Jump to:

| Concerns around GenAI |

| Why you still need GenAI |

| What to look for in an AI assistant |

|

2024 GenAI in Professional ServicesDiscover perceptions, usage, and impact on the future of work

|

The potential benefits of AI for the tax and accounting profession are real. In April, the professionals surveyed in the Thomson Reuters Institute’s 2024 Generative AI in Professional Services report demonstrated an overall sentiment surrounding GenAI remains hesitant, but that is quickly followed by optimism and excitement. They expressed positive perceptions of GenAI and its benefits. Focusing specifically on tax and accounting practices, leveraging AI could provide opportunities for tax firms and departments to serve their clients and companies in new ways—from increasing productivity, streamlining workflows, and staying up to date to complicated regulations.

But these professionals also believe that tax AI risks and accounting AI risks are also important. They are worthy concerns. While these risks don’t negate the benefits of AI, they do require tax and accounting practitioners to choose their AI tools carefully. What they need to mitigate these risks is an AI solution designed and developed specifically for their field. As they conduct due diligence on potential AI tools, professionals also should include in their considerations the distinction between public AI and private AI.

Concerns around GenAI

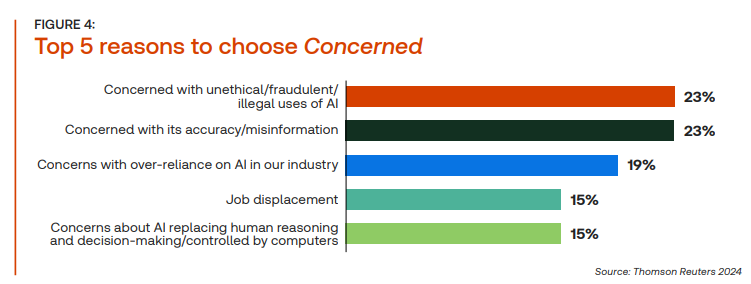

The tax and accounting experts surveyed in the 2024 GenAI in Professional Services report shared worries about this emerging technology. Over 23% of respondents state there are GenAI concerns toward illegal uses and misinformation of AI, since “outsiders” could use AI to access that information. Tax and accounting users of AI want to be sure that that information is safe.

One of GenAI’s main strengths is its ability to pour through large amounts of data in seconds. That leads to another worry: How can the professional be sure that the data being accessed is accurate? Some AI tools can create what are called “hallucinations”—seemingly believable but inaccurate results. That’s an unacceptable risk for tax and accounting professionals, for whom accuracy and reliability are sacrosanct.

Though GenAI has made tremendous strides in a very short time, the technology is still relatively new and it’s continuing to evolve. While many of the risks we’ve discussed will be mitigated over time thanks to GenAI’s ability to continuously “learn” and regulation changes, tax and accounting professionals will still need to be vigilant as they incorporate this technology into their work.

CoCounsel: The GenAI for professionalsTrained by industry experts, ours is the only GenAI assistant built on 150 years of authoritative content

|

|

Why you still need GenAI

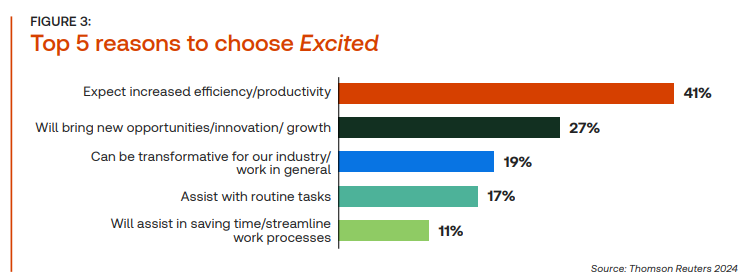

Still, there’s plenty of evidence that the benefits of GenAI outweigh the risks. An average of 56% of tax firm and corporate tax respondents stated that GenAI should be applied to industry work, with a major reason that GenAI can help increase efficiency and productivity. With top use cases in bookkeeping, research, and compliance, there are many notable reasons for tax and accounting professionals to be excited about GenAI.

Expect increased efficiency and productivity

One of the main benefits of AI for tax and accounting professionals is increased productivity and efficiency. For instance, identifying and extracting data from widely scattered sources can be difficult, let alone categorizing and analyzing it. GenAI can rapidly gather data from a wide range of sources and collate it into accessible, useful information for a specific tax report or audit. GenAI also can automate repetitive tasks such as entering information from various documents (invoices and receipts, to name two), thus reducing the human error that can result from manual data entry.

By streamlining day-to-day workflows, the right AI technology can help professionals add more value to their work.

Can be transformative for industry work

GenAI can provide instant access to tax law guidance. Its capacity for predictive analysis based on historical financial data can help tax and accounting professionals identify future trends for their clients or companies. These professionals can plot out plausible future scenarios and anticipate potential risks that their clients might need to plan for.

“I have already used [GenAI] for VAT compliance and have found it useful, particularly with international transactions where information and guidance from tax authorities based overseas can be difficult to find,” a corporate tax accountant said.

Will assist in streamlining work processes

Though professionals need to be diligent regarding tax and accounting AI risks, artificial intelligence can actually protect against certain risks. For instance, a well-designed GenAI tool can monitor and identify new tax legislation and regulations both domestically and internationally. It can even keep professionals up to date on regulations specific to AI.

Most respondents in the 2023 Future of Professionals Report survey cited “keeping abreast of regulation” as one of the top five areas where AI could be helpful. GenAI can assist in keeping track of changing regulatory requirements and ensuring that financial practices meet the most current standards, which can reduce the risk of non-compliance.

In addition, GenAI can help auditors and accountants identify patterns and anomalies in financial data that may indicate fraudulent activity. It also can boost auditors’ capabilities to assess other types of risk, such as cybersecurity and business continuity.

What to look for in an AI assistant

In determining the most beneficial GenAI tool, they’ll want to ensure that the AI assistant’s developer has experience in or at least demonstrable knowledge of the professional’s field. A truly valuable AI assistant should access reliable information when the professional’s needs involve trends, data, and other types of research.

An AI assistant, and the company providing it, should also be able to prove that the tool will become even more helpful, accurate, and efficient in the future, evolving as one’s profession evolves. A question any professional should ask should be, will this tool help me uncover insights and meet challenges for situations that have yet to arise?

Public vs private AI

All this noted, there is a distinction between public AI and private AI. The main difference is that public AI scrapes the entire internet for research and data. As a result, a public GenAI tool may inadvertently access and make use of false information, private data, or material under copyright—major risks for any profession. By contrast, private AI uses “proprietary” databases that have been developed to access specific and trusted sources of data and research.

Choosing the right solution

Not all AI tools are created equal. Tax and audit professionals must conduct thorough research to minimize their exposure to potential tax and accounting AI risks. With Thomson Reuters’ CoCounsel, tax and accounting professionals can do just that and more.

- Improve the speed of the research phase by finding the summarized answers you need quickly.

- Increase confidence in AI-assisted answers with links to relevant editorial content and source materials from a broad collection of data sets and expert knowledge of Checkpoint Edge.

- Enable senior staff to redirect their efforts toward higher-value work while junior staff learn and develop good question techniques with AI-assisted research.

This tax-specific private GenAI assistant can perform sophisticated research and analyze dense, voluminous information — and then deliver reliable, accurate, and thorough answers as quickly as you need them. It has been trained by industry experts to handle essential but repetitive tasks so that professionals can focus on more profitable uses of their time. With the latest technology, you should be able to clarify the complex.

|

2024 GenAI in Professional ServicesDiscover perceptions, usage, and impact on the future of work

|