In the ever-changing landscape of the tax industry, embracing automation has become essential for tax firms seeking to elevate their client services.

Jump to ↓

| Optimize your strategy with client service automation |

| Leveraging AI for predictive analytics |

| Effective client communication |

| Enhancing data accuracy and compliance for clients |

| Navigating the future of tax automation |

By leveraging technology, tax firms can streamline their processes, enhance accuracy, and provide clients with a more personalized and efficient experience.

In this blog, we’ll look at how artificial intelligence and automation can change your client service strategy. When used correctly, they can change your customer service strategy in a new way. This transformative approach can reshape and elevate your practice to meet the evolving needs of both your firm and clients.

Optimize your strategy with client service automation

In today’s competitive tax industry, firms that fail to leverage technology risk falling behind. By using cloud-based solutions, automation tools, and AI-powered software, tax firms can improve their customer service and compete better.

Cloud-based solutions enable seamless data access and collaboration, allowing tax professionals to work efficiently from anywhere, at any time. This flexibility makes it easier for team members to work together in real-time. This means that clients get fast and accurate service.

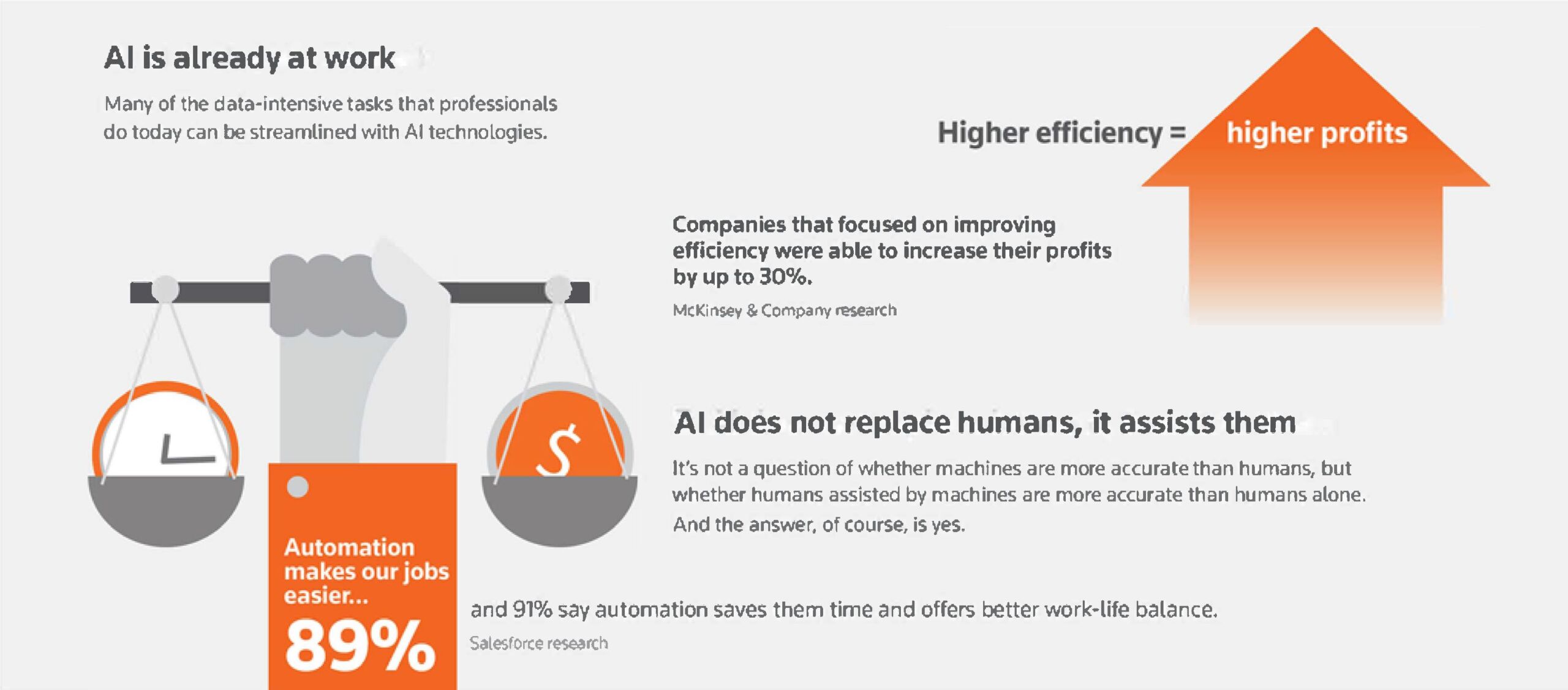

Incorporating automation tools streamlines routine tasks, freeing up valuable time for tax professionals to focus on higher-value activities.

By automating repetitive processes such as data entry, document management, and appointment scheduling, tax firms can enhance efficiency and reduce the risk of human error.

This not only improves the overall client experience but also allows tax professionals to provide more personalized and tailored services. Furthermore, utilizing AI-powered software empowers tax firms with advanced data analysis capabilities. By leveraging AI, tax professionals can gain deeper insights into client data, identify trends, and make informed decisions. This enables them to provide proactive and strategic advice, helping clients optimize their tax positions and achieve their financial goals.

By embracing technology, tax firms can automate their client service, streamline operations, and gain a competitive advantage in the ever-evolving tax landscape.

Leveraging AI for predictive analytics

Artificial intelligence is rapidly transforming the tax industry, and firms that embrace AI-powered solutions are poised to gain a significant competitive advantage. By leveraging AI for predictive analytics, tax firms can anticipate client needs and preferences, enhance decision-making processes, identify potential risks and opportunities, streamline tax preparation and filing, and ensure accuracy and compliance.

One of the key benefits of AI in tax automation is its ability to analyze vast amounts of data and identify patterns and insights that would be difficult or impossible for humans to detect. This enables tax firms to make more informed decisions, optimize their processes, and provide tailored services to their clients.

For example, AI can be used to analyze historical client data to identify trends and patterns in their tax liabilities, helping firms to better anticipate their clients’ needs and provide proactive advice.

AI can also be used to develop predictive models that can help tax firms identify potential risks and opportunities. For example, AI can be used to analyze financial data to identify clients who are at risk of tax audits or who may be eligible for certain tax credits or deductions. This information can then be used to develop targeted strategies to mitigate risks and maximize opportunities.

In addition to its use in predictive analytics, AI can also be used to automate various tax-related tasks, such as data entry, document preparation, and tax calculations. This can free up tax professionals to focus on higher-value activities, such as providing strategic advice to clients.

Overall, AI has the potential to revolutionize the tax industry and provide significant benefits to tax firms and their clients. By embracing AI-powered solutions, tax firms can improve their efficiency, accuracy, and compliance, and provide a more personalized and valuable service to their clients.

Effective client communication

Client communication is essential for providing a positive client experience and building long-term relationships. In the past, tax firms have relied on traditional methods of communication, such as phone calls and emails, which can be time-consuming and inefficient.

However, with the advent of automation, tax firms can now streamline communication channels, implement real-time messaging platforms, and utilize mobile apps to allow for faster and more efficient communication with clients.

By leveraging automation tools, tax firms can provide clients with a more personalized and efficient experience. For example, automation can be used to send personalized emails or text messages to clients with updates on their tax returns or to remind them of upcoming deadlines. Additionally, automation can be used to create self-service portals where clients can access their tax documents and information at any time. This not only saves tax firms time and resources but also provides clients with greater convenience and control over their tax matters.

Automation offers numerous benefits for tax firms, including improved client service, communication, and compliance. By embracing cloud-based solutions, incorporating automation tools, and utilizing AI-powered software, tax firms can streamline processes, reduce errors, and provide clients with a more personalized and efficient experience.

Enhancing data accuracy and compliance for clients

Tax automation offers significant potential for enhancing data accuracy and compliance within tax firms. By automating data entry processes, firms can minimize manual errors and ensure the integrity of their data. Automation tools can also implement robust data validation mechanisms to ensure that data is accurate, complete, and consistent before it is processed or stored.

Additionally, embracing cloud-based solutions allows for centralized data storage and real-time data updates, ensuring that everyone within the firm has access to the most up-to-date and accurate information. Automation can also facilitate the generation of real-time reports and analytics, enabling firms to identify and address compliance issues promptly.

Navigating the future of tax automation

As you navigate the evolving landscape of tax automation, the adoption of technology represents not just a strategic move but a fundamental shift that can redefine your firm’s trajectory. Incorporating automation, cloud-based solutions, and artificial intelligence (AI) goes beyond mere process streamlining; it positions your practice at the forefront of industry progress.

Venturing into the realm of automation requires more than embracing new tools—it’s about implementing a practical approach centered on efficiency, accuracy, and client satisfaction. The future of tax automation isn’t solely about streamlined operations; it possesses the potential to enhance your practice, providing a client experience that aligns seamlessly with the demands of the modern era.

To learn more about client service automation, watch our on-demand webcast below:

On-Demand WebcastThe Future of Tax Automation: How to Elevate Your Firm’s Client Service

|

Product PageWhy choose TaxCaddy? TaxCaddy is the ultimate 1040 client collaboration software and provides the most taxpayer-focused tax client portal available while integrating with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, or Lacerte. |

|