Tax client portal

Simplify taxpayer collaboration with TaxCaddy

Eliminate the traditional organizer and increase client satisfaction during the 1040 client experience with a consolidated, user-friendly app available for iOS, Android, or desktop

Increase client satisfaction and decrease stress on your staff

Streamline the tax process with gathering and delivery tools that simplify tasks

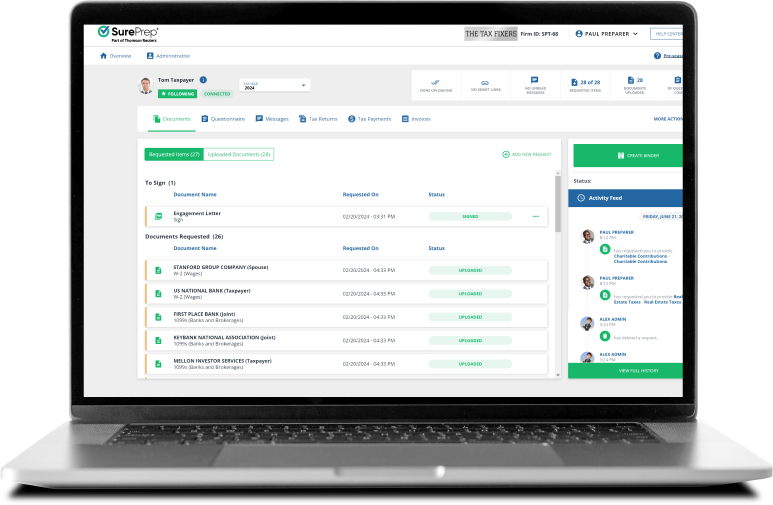

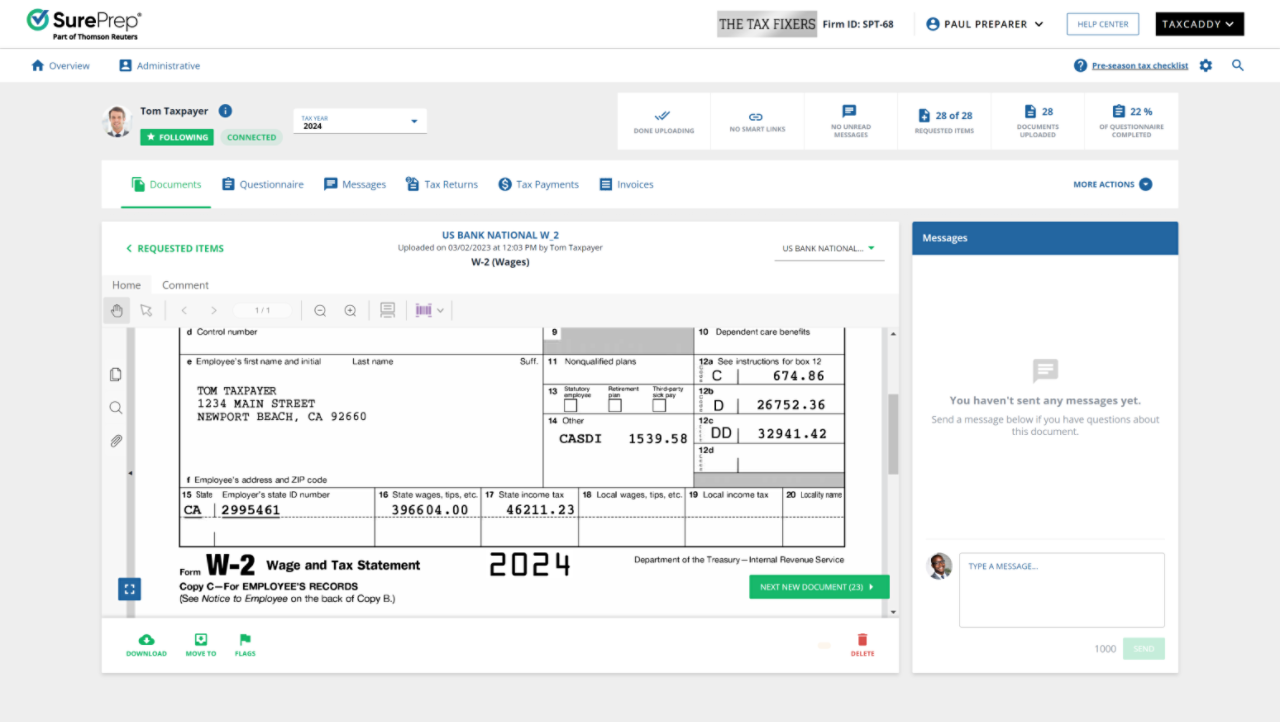

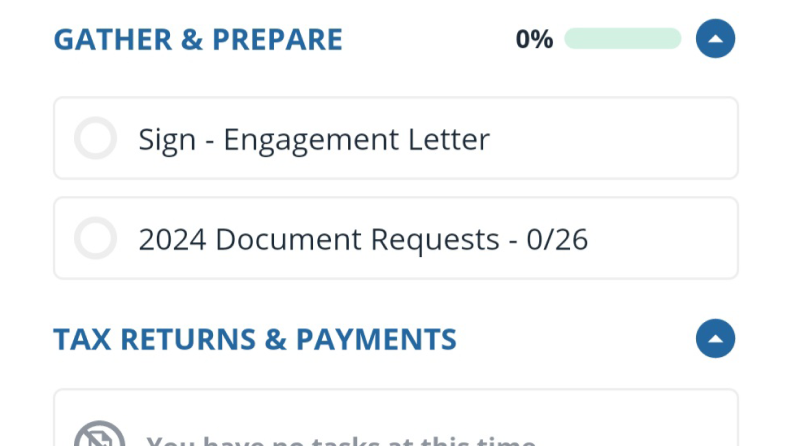

Remove manual, time-consuming tasks by creating an automated document request list for each client based on data in your tax software. Easily view which documents have already been uploaded and which are still outstanding. Once the return is complete, clients can review, sign, and make payments with just a few taps.

Explore more features

Have questions?

Contact a representative

Reduce workload compression by simply tapping into Client Profiles in the TaxCaddy dashboard

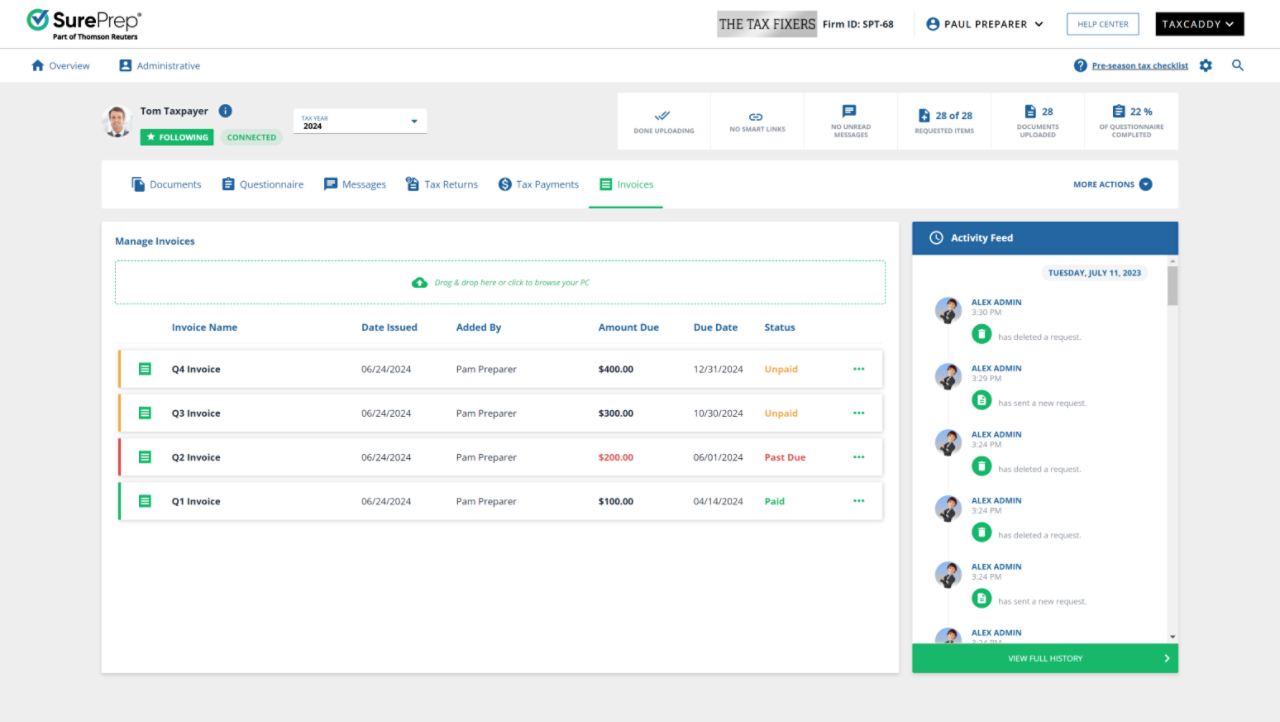

Easily manage invoices under Client Profile in TaxCaddy with effortless PDF uploads, automatically updated payment statuses, and the facilitation of payments via Stripe. You can also handle delivery within the Client Profile by simply dragging and dropping the final return to a specific tab. Clients will own their accounts to retain access to all their prior returns indefinitely.

Explore more features

Have questions?

Contact a representative

Improve client service through this modern convenience

Impress your staff and clients with the ability to efficiently address taxpayers' needs using the advanced technology of our native iOS and Android mobile apps, mobile photo scanning, e-signatures, and automated document retrieval.

Explore more features

Have questions?

Contact a representative

How TaxCaddy serves both tax professionals and taxpayers

Tax professionals

Firms and other tax professionals will have access to clients and their questions, a storage place for necessary tax materials, and a single portal to deliver tax returns and invoices in a unique app.

Taxpayers

Clients experience the benefits of digital workflow by having control over document uploads, access to prior tax returns, and open communication with tax professionals through one innovative platform.

Tax professionals and taxpayers

Tax professionals and their clients benefit from the automated, tailored document request lists, which are updated as information is uploaded so that both can see what is still outstanding.

The future of taxpayer collaboration

See how TaxCaddy works

TaxCaddy integrates with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, or Lacerte to streamline document gathering and tax return delivery for 1040s and 1041s. Discover how you can simplify collaboration for your clients and staff.

Hear what tax professionals are saying about TaxCaddy

"It’s what the clients want. More and more clients are becoming less enthusiastic about paper organizers. The benefit is faster responses from clients and not having to worry about unorganized emails and blurry photos of documents."

Lindsay Park

Perkins & Co.

"A lot of other options were designed for the tax professional and had very little adoption for that client. TaxCaddy is designed around the convenience of the client which saw much better adoption."

Susan Theissen

Forvis

"From a professional support perspective, you're able to send your TaxCaddy clients all of their documents at once. It's just a couple of clicks and you're sending it all out. We're finding that wonderful."

Cindy Owens

Rehmann

Questions about TaxCaddy?

We’re here to support you.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us