How automation and collaboration enhance indirect tax compliance strategies and help streamline e-invoice processes.

In 2025, Germany, France, Portugal and Spain are implementing electronic invoicing (e-invoicing) mandates that demand more tax data in real-time. They are not alone in this trend: More than 30 jurisdictions have enforced some form of e-invoicing mandates. Countries such as Belgium and China, among others, have announced mandates to begin within a two-year period amidst a global surge in continuous transaction control (CTC) systems.

Although the United States does not currently require e-invoices or real-time reporting, adopting these practices elsewhere has led to increased tax revenues. As a result, it is likely only a matter of time before the U.S. or individual states implement similar laws.

If your company lacks the proper systems and processes for collecting, consolidating, and validating the data required to meet various compliance obligations, you may experience a process that is costly, time-consuming, and prone to errors. This not only places undue strain on your tax department but also increases the risk of significant penalties that could adversely affect the company. Additionally, staying abreast of evolving legislation across different countries will pose considerable challenges

Any indirect tax compliance strategies for e-invoicing will require automation and teamwork across the company. Isolation of systems and people will not work in this new world of e-invoicing.

Jump to ↓

| Indirect tax strategies to ensure compliance and data governance |

| The benefits of indirect tax automation |

| The circular process of e-invoicing compliance |

| People are essential to any indirect tax transformation |

| Facing your fear |

Indirect tax strategies to ensure compliance and data governance

Previously, you could determine the tax amount at the time of invoice creation and make corrections before submitting your tax payment. With these new regulations, you need accurate calculations immediately, said Giuseppe Ciampa, Indirect Tax Technology Director with Deloitte, during a webcast hosted by Thomson Reuters.

Getting tax calculations sorted upfront is essential so that what goes into e-invoicing or your submissions for transactions is correct without the need for manual alterations later.

“That time to correct it after no longer exists,” Ciampa said.

Ensuring accurate information from the start is complicated by the need to consider various jurisdictions and whether the sale occurs online or in person. Additionally, the volume or variation of the product can affect tax requirements in some jurisdictions.

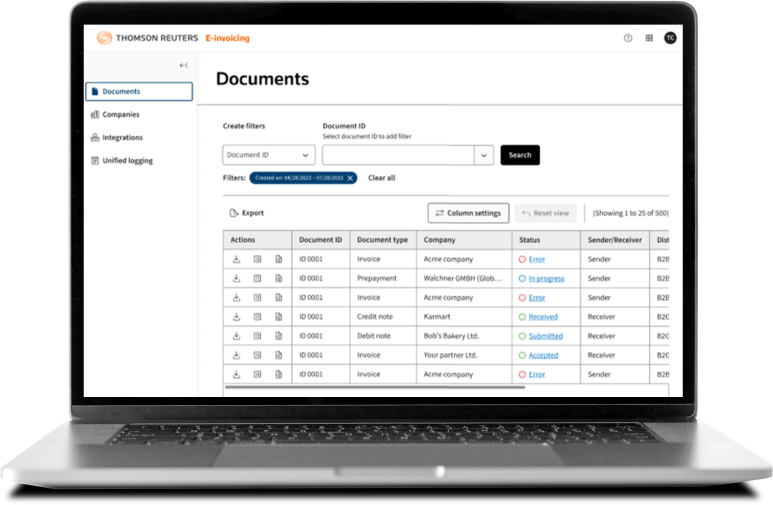

To deal with this complexity, you must establish a system that integrates all stakeholders involved in indirect taxes, streamlines the calculation process, and offers high-quality data and visibility across all information. You need a system that enhances your understanding of when and how to integrate e-invoicing into your billing process. When an invoice is rejected for not meeting all the validation rules, a change management system should be in place to fix it quickly and automatically.

Finally, creating a system that ensures companywide indirect tax and e-invoicing compliance requires data management practices that facilitate a smooth transition to e-invoicing. This involves reviewing data points, ensuring data quality and accuracy, and focusing on integration methods and timing.

Download the white paper

E-invoicing compliance: A world of complex challenges for global organizations

Read now ↗The benefits of indirect tax automation

Setting up your systems and processes for e-invoicing isn’t just about being compliant and checking a box. It’s about becoming more efficient, improving cash flow, and getting deeper data analytics.

Manual processes are often too slow to meet these data demands, so automated solutions are the only practical way to keep pace and lower costs. Automation can help:

- Contain compliance costs

- Eliminate unexpected cash-flow issues

- Avoid penalties and fees

- Reduce overall risk

- Remain current on changing tax laws

- Prevent the disruption of normal business operations

Furthermore, digitizing and automating key aspects of the tax process streamlines workflows, allowing your tax team to focus more on activities and analyses that add value to the enterprise in other ways.

The circular process of e-invoicing compliance

With e-invoicing mandates in place, tax management has become a broader concern, extending beyond tax departments—if it ever truly was confined to them. Meeting these new obligations requires teams across the company to work together to ensure that your organization accurately maintains data quality, understands current regulations and tax codes, reports taxes correctly, and meets all invoice obligations. That also means sharing data and regulation updates in near real-time, which automation can facilitate.

Other departments should be more active in transforming your systems and processes to meet these demands. They, too, will benefit from shorter payment times, standardization, and automation.

|

Guiseppe Ciampa

Indirect Tax Technology Director, Deloitte

People are essential to any indirect tax transformation

Don’t underestimate the importance of people, said Nazar Paradivskyy, VP of Regulatory Affairs with Pagero, a global leader in e-invoicing and indirect tax solutions and a Thomson Reuters company, during that webcast.

“We can talk about the technology as much as possible, but at the end of the day, we all agree it’s about the people. People either use the technology improperly, use it for the wrong purposes, or fail to use it at all. So, you must have the right people involved,” Paradivskyy says.

Facing your fear

Change can be difficult, and there’s naturally a fair amount of fear around these mandates.

When it comes to e-invoicing, change can be good, something that offers many businesses benefits beyond meeting tax entities’ requirements and avoiding business disruption.

Learn more about ONESOURCE Pagero.

|

|