See how both the Big 4 and smaller firms are utilizing AI in their workflows.

In today’s fast-paced business world, ignoring AI technology is not an option, and the field of accounting is no exception.

Artificial Intelligence (AI) has become a game-changer, helping accounting firms streamline processes, improve accuracy, and deliver more value to their clients. Firm owners are shifting their perspective. The 2025 Generative AI in Professional Services Report from Thomson Reuters Institute found that 68% of tax and accounting professionals are excited and/or hopeful about the future of GenAI in the industry.

“Current and emerging generations of GenAI tools could be transformative,” said one US director of tax. “For example, deep research capabilities, software application development, and using GenAI to help with business storytelling would have significant impacts on the future of professional work.”

How are industry-leading firms actively implementing GenAI technology? This article explores how different accounting firms use AI in their operations to drive efficiency and excellence in their services.

Jump to ↓

| How many accounting firms use AI? |

| How do the Big 4 use artificial intelligence? |

| How do smaller accounting firms use AI? |

| Approaching AI with curiosity |

2025 GenAI in Professional Services Report

Explore how GenAI will impact the future of legal, tax, accounting, audit, government, and risk & fraud professionals work

Read special report ↗How many accounting firms use AI?

According to survey respondents, 21% of tax firms identified as already using GenAI technology, with 53% either planning to use the technology or considering it. A quarter of firms (25%) still have no current plans to use GenAI, but this percentage is down from 49% in 2024. The AI trade winds are changing.

The adoption of AI in the accounting industry in recent years has been on the rise. Accounting firms of all sizes, from global giants to local boutiques, are increasingly turning to AI solutions to enhance their services. This shift is driven by the realization that AI can automate mundane tasks, reduce errors, and free up accountants to focus on higher-value advisory work.

Interestingly, accountants seem to be implementing GenAI tech through personal, open-source tools for their work over industry-specific tools. 52% of tax firm survey respondents who already use a GenAI tool are using open-source technology, such as ChatGPT; only 17% are using an industry-specific tool.

This trend could soon shift as more industry-specific technology providers introduce their own GenAI solutions within the coming years.

How do the Big 4 use artificial intelligence?

The “Big 4” accounting firms—Deloitte, Ernst & Young (EY), PwC, and KPMG—have led the way with AI adoption. They have heavily invested in AI-powered tools and solutions to provide clients with more advanced and insightful services. Here’s a glimpse of how they use AI:

- Audit document review: Deloitte has developed GenAI and agentic capabilities in its audit platform. The AI-powered tool can perform initial reviews of audit documentation and suggest enhancements for clarity and consistency.

- Unifying tech stack: In 2023, EY launched an AI platform that combines leading EY technology platforms and the power of AI with strategy, transactions, transformation, risk, insurance and tax. EY also recently announced new AI capabilities supporting the organization’s 160,000+ global audit engagements.

- IT: In-house teams at PwC have developed customized software applications for employees that synthesize data, complete and review code, conduct granular troubleshooting, and more. They have seen 20% to 50% productivity gains in their development processes because of GenAI. Additionally, PwC estimates that a new end-to-end AI-driven audit solution will be complete in 2026.

- Client solutions: KPMG’s Trusted AI framework helps their member firms’ clients design, build, deploy, and use AI tech solutions in a responsible and ethical manner, building loyalty and partnerships.

How do smaller accounting firms use AI?

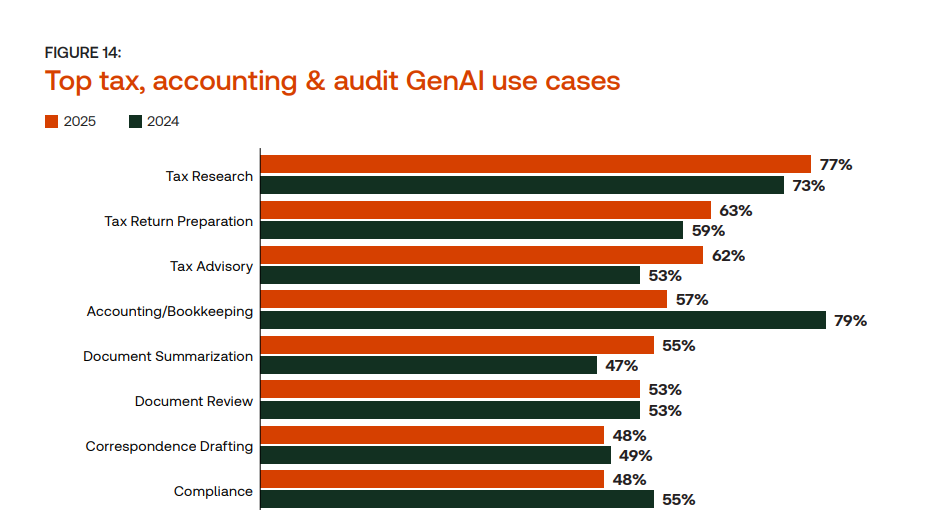

Smaller accounting firms might not have the same resources as the Big 4, but they are also embracing AI to stay competitive and offer better services. According to the GenAI report, the top five use cases for tax firms using or planning to use GenAI were:

- Tax research: Firms use AI-powered algorithms in tax research tools to return data from human-edited, tax-specific content. This provides authoritative answers from trusted sources quickly and accurately.

- Tax return preparation: Firms are using AI to automate the extraction and analysis of data from various financial documents, significantly reducing the time and effort required to prepare accurate tax returns. GenAI also assists in identifying applicable deductions and credits tailored to individual or corporate financial scenarios, ensuring compliance and optimization of tax liabilities.

- Tax advisory: Firms are using AI tools to generate predictive insights, helping clients plan for future tax implications based on their financial decisions. This provides a more strategic role for tax professionals, allowing them to offer value-added services.

- Accounting/bookkeeping automation: Firms are using AI-powered software to automatically categorize expenses, reconcile accounts, and generate financial reports. This saves time and reduces the risk of manual errors for firms.

- Document summarization: Firms use AI to summarize key points from contracts, invoices, and receipts and can quickly identify anomalies that require further investigation. This capability not only speeds up the review process but also enhances the accuracy and reliability of financial audits and compliance checks.

Among the firms actively using or planning to use GenAI, 44% said they use the technology daily, if not multiple times a day. An additional 29% said they are using it weekly.

Approaching AI with curiosity

In the accounting world, AI is not a threat but an opportunity. It can empower firms of all sizes to offer better services, improve efficiency, and thrive in an ever-changing industry. As AI continues to advance, those who approach it with curiosity and a willingness to embrace new technology will likely stay ahead of this trend.

If you’re looking to explore the world of AI in accounting, join the AI @ Thomson Reuters community. Here, you can connect with experts, learn about the latest AI trends, and unlock the full potential of AI in your accounting practice. For next steps on how to incorporate AI tools in your firm, read our white paper: “Harnessing AI and automation: How to elevate your tech stack.”

CoCounsel: Your trusted AI partner

One agentic AI assistant for tax, audit, and accounting professionals.

Learn more ↗