Know the differences and benefits of primary and secondary sources for the tax code, tips on how to apply the code, tools to help master the tax code, and more.

Varying interpretations, frequent updates, and appropriate applicability. These are just a few of the issues that newer tax professionals can face when learning the U.S. tax code. To say it is complex is an understatement.

Given the difficulties, it comes as little surprise that keeping up with tax law and government regulations ranked number three among the top accounting challenges in 2024, according to Thomson Reuters research.

Unfortunately, the ever-evolving landscape of intricate tax provisions and new regulations shows no signs of slowing. Now, throw into the mix the pressures of the busy tax season and rise in client demands and expectations. In today’s environment, the need for precise and timely tax information is critical.

Inaccurate information can not only damage a firm’s reputation and result in a loss of clientele, it can also lead to costly penalties and fines.

Keep reading for actionable tips on how to learn the U.S. tax code system, stay up to date on changes, and effectively communicate those tax law changes to clients.

Jump to ↓

| A refresher on tax code sources |

| Interpreting and applying the tax code |

| Staying on top of tax law changes |

| Tools to help master the U.S. tax code |

| Communicating tax law changes to clients |

A refresher on tax code sources

There are different sources that provide the authority for tax rules and procedures. Congress typically enacts federal tax law in the Internal Revenue Code (IRC), which is the definitive source of all U.S. tax laws. The U.S. Department of the Treasury and the federal court system provide the official interpretation.

The IRC — initially compiled in 1939 and revamped in 1954 and 1986 — is the body of law that codifies all federal tax laws such as income, employment, estate, and excise taxes. The laws constitute Title 26 of the U.S. Code, which is published by the U.S. House of Representatives’ Office of the Law Revision Counsel.

The IRC is complex. As explained by the IRS, the sections of the IRC must be read in the context of the entire Code, the Treasury (tax) regulations, and the court decisions that interpret it.

The U.S. Department of the Treasury provides the official interpretation of the IRC and gives directions on how taxpayers comply with the IRC’s requirements. Treasury regulations are also known as federal tax regulations.

As stated in a document recently issued by the Congressional Research Service (CRS), “Treasury regulations are the most important type of tax guidance issued by the Treasury and the IRS. Treasury regulations can provide guidance on newly enacted legislation and tax issues that arise with respect to preexisting laws. Taxpayers may rely on final and temporary Treasury regulations, but may not rely on proposed Treasury regulations unless they contain an express statement permitting reliance.”

|

|

Interpreting and applying the tax code

Interpreting and appropriately applying the U.S. tax code to a client’s specific situation is one of the biggest challenges for tax professionals.

Tax attorneys or professionals who have attended law school and are accustomed to statutory language may find it easier; however, for most tax professionals, deciphering the legalese and navigating the thousands of pages packed with cross-references, detailed rules, and exceptions is no small feat. As Shaun Hunley, Thomson Reuters Executive Editor, explains, it can quickly become a bit of a “puzzle.”

“It is very difficult because they write the Code in a way that is a lot different than how we speak or how we write. We don’t use that kind of language and that can be very frustrating, especially for a new associate, to translate what they are reading in the Code,” Hunley said.

Hunley continued, “The other thing that is really hard about the Code is a particular Code section will often reference another Code section. So, that leads you down this trail of having to jump around to all of these different Code sections. And often they will use another Code section to define a term. When you read a Code section, sometimes you cannot use what you think is the definition of a term, so you have to go to the Code and see how Congress defined that term. It can be a puzzle going to all these different sections.”

Primary and secondary sources

When interpreting and applying the U.S. tax code, it is important to keep in mind the importance and purpose of both primary and secondary sources.

Primary sources include:

- The tax code and other federal laws

- IRS revenue rulings

- IRS revenue procedures

- IRS notices

- Court case rulings, which can shed more light on a Code section and its intent

Hunley noted, “When a new Code section is passed, you can read the legislative intent. You can read the legislative history behind the Code section. Many times, when Congress is passing a bill, they will have an explanation of what they are trying to do, or you will see committee reports, or maybe there was some debate on the floor of Congress. Those are also really good to figure out what was the intent of the Code section.”

Secondary sources, which can further summarize, analyze, interpret, or comment on the information, include:

- Current news

- Tax treatises

- Articles

- Editorial materials like tax news alerts and tax handbooks

“I tell people that the Code section is the starting point,” said Hunley. “That is what you do at a minimum, but then you need to go into other sources.”

Staying on top of tax law changes

As previously stated, intricate tax provisions and new regulations continue to evolve and, without the right tools and resources, keeping pace with the changes can be daunting.

Take for instance, the many tax-related changes enacted under The Tax Cuts and Jobs Act in 2017; the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020; the Coronavirus Response and Consolidated Appropriations Act in 2021; and the Inflation Reduction Act of 2022.

“Apart from any really significant tax reform, which was in 2017, the tax code is usually modified in reaction to some sort of event—whether it is a major pandemic, or inflation, or the economy is not doing well. That is when Congress steps in and thinks, ‘Should we modify the Code in some way?’” Hunley said.

Hunley added, “The next significant modification is going to happen this year, in 2025, because a lot of the provisions from the Tax Cuts and Jobs Act are scheduled to expire at the end of this year. Trump is talking about tax reform, and he wants to do no tax on tips, no tax on Social Security, and no tax on overtime pay. So [if passed], that would be another significant modification to the Code.”

The good news is that, with the proper tools and resources in place, tax professionals can find it easier to stay aware of emerging tax-related events and help clients remain in compliance as changes happen. Consider taking the following measures:

- Subscribe to the IRS E-News for Tax Professionals and Quick Alerts for timely tax updates and e-file information delivered directly to your email.

- Subscribe to a reputable tax news service such as Thomson Reuters Checkpoint newsstand to receive the latest tax and accounting news.

- Subscribe to industry publications like Accounting Today to receive news articles that discuss topics in a conversational, easier-to-understand manner.

- Leverage your firm’s internal expertise and resources to track tax developments.

“My suggestion, especially to new associates, and I know this can be hard during busy season, but just take ten to fifteen minutes out of your day and look at those tax subscriptions and the news you are getting,” said Hunley.

“Always look at those, even if it’s just for a few minutes, because that way you will get all those updates. Any time we have major legislation or tax reform, you are going to get those updates because the House will release a version of a Code section and then the Senate will release their version. It is good to stay up to date because when they pass the final bill, you probably already know what is going to happen.”

If your firm uses Checkpoint Edge or Checkpoint Classic, Hunley offered another tip: Use the history button. If a practitioner is within a Code section in Checkpoint and presses the “History” button, Checkpoint will then list all the amendments that happened to that specific Code section and the date on which each amendment took place.

Tools to help master the U.S. tax code

Mastering the U.S. tax code is becoming easier, thanks in large part to advancements in technology.

Tax professionals can more efficiently navigate the U.S. tax code using advanced search options on the U.S. House of Representatives’ Office of the Law Revision Counsel web site.

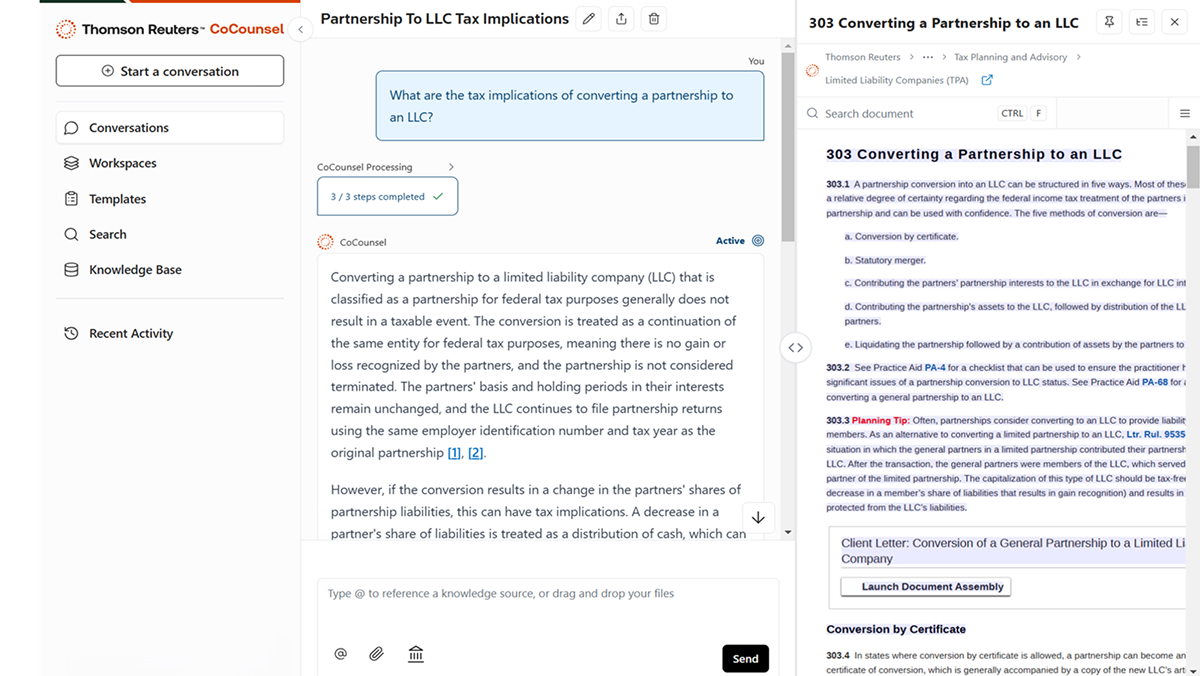

There’s also AI-powered innovation like Thomson Reuters CoCounsel Tax, which can take staff productivity and research capabilities to new heights. CoCounsel Tax is a next generation agentic AI assistant that can deliver the following benefits:

- Streamlines the tax workflow, as CoCounsel Tax is designed to automate complex tasks, analyze documents, and standardize processes across a firm.

- Accelerates research by integrating multiple knowledge sources—including trusted Checkpoint content—eliminating time-consuming manual searches.

- Validates answer formation with citations and links to specific Checkpoint editorial content and source materials, showing a clear and defensible audit trail.

- Enables junior staff to work more independently and effectively. This means senior staff has more time to concentrate on critical, higher-value projects.

CoCounsel Tax combines agentic AI with trusted expertise to transform complex tax research into clear, actionable insights

“You can have a conversation with it, but what is really good about that tool is it takes its information from Checkpoint itself. So, it is taking information from up-to-date data, content that has been updated for current law changes,” Hunley said.

Communicating tax law changes to clients

In today’s competitive business environment, it is important to strengthen client loyalty and provide the proactive tax guidance clients have come to expect. This involves using solutions, including AI-powered tools, to research and communicate tax code changes more effectively.

Sending a mass email or video to clients can be an easy way to quickly reach a broad audience with tax-related news and developments.

On the other hand, data mining capabilities can be a highly effective way to pinpoint existing clients who could be impacted by a specific tax development. This can help strengthen client relationships and unlock more higher-value, higher-margin advisory services.

Regardless of the communication channel and method used to inform clients, Hunley stressed the importance of translating the statutory language for clients so it is easy for them to understand. In other words, do not cite Code sections to clients.

“What clients care about is how it affects them. For some clients, the Code section won’t affect them at all, but when we have major legislation, like we will this year, there probably will be some that are going to affect a large number of clients. So, getting that message out to them in everyday language is what you have to do,” Hunley said. “It is just being proactive, anticipating what could happen, how it could affect the clients, and then translating all of that.”

Take steps today to master the U.S. tax code with greater precision. Turn to a trusted provider like Thomson Reuters to stay up-to-date on the latest tax news and transform the way you work with the power of AI.

CoCounsel Tax

CoCounsel: One agentic AI assistant for tax, audit, and accounting professionals

Learn more ↗