By standardizing your firm’s advisory services delivery, you can empower junior staff, develop long-lasting client relationships, and boost your bottom line.

Jump to:

| The opportunity of advisory |

| How do Advisory Maps work? |

| Empower your staff — and your firm |

| A powerful advisory combination |

It’s no secret that more and more accounting firms are making the shift towards advisory engagements. But how do you empower your staff — particularly junior staff — to deliver advisory services confidently and effectively?

The answer lies in an AI-powered solution that provides step-by-step guidance on how to deliver tax planning and advisory engagements to your clients. Enter Advisory Maps from Checkpoint Edge — an indispensable tool for accounting firms interested in capitalizing on the opportunity of advisory services.

Not only do Checkpoint Edge Advisory Maps focus on streamlining tasks and boosting efficiencies to free up your time for higher value services, but they are also uniquely tailored to support the transition to advisory. With expert-authored content and implementation resources on hundreds of different types of advisory engagements, accountants of all skill levels can advise clients with ease.

And, by standardizing your firm’s advisory services delivery, you can empower junior staff, develop long-lasting client relationships, and boost your bottom line.

The opportunity of advisory

Most tax and accounting firms build their business model on the number of tax returns completed. However, they are often answering tax-related questions and providing guidance for clients throughout the year — all without being compensated for it.

This fact, along with the dawn of AI-powered tax software, has resulted in many accounting firms extending their practices beyond traditional tax preparation and into the world of advisory services.

From analyzing financial information to providing forward-looking guidance, tax advisors help their clients understand the impacts of their financial decisions and offer advice on how to maximize their tax position, all while taking into account business or personal financial goals.

As traditional compliance work is increasingly commoditized, tools that support the transition to advisory services can be a game-changer for accounting firms looking to get a leg up on the competition. In fact, studies show that accounting firms can increase their monthly revenue by 50% by providing strategic advisory services.

However, if your accounting firm is like most, you may face challenges in offering comprehensive advisory services due to a lack of expertise in various service areas. Checkpoint Edge Advisory Maps remove this barrier by providing a step-by-step process for delivering advisory services across numerous types of engagements.

With 50 tax advisory maps and 25 financial management/accounting advisory maps, even entry-level accountants are empowered to deliver advisory services with confidence. And with continuous updates, Advisory Maps foster knowledge transfer from senior to junior staff, all while ensuring clients stay informed.

How do Advisory Maps work?

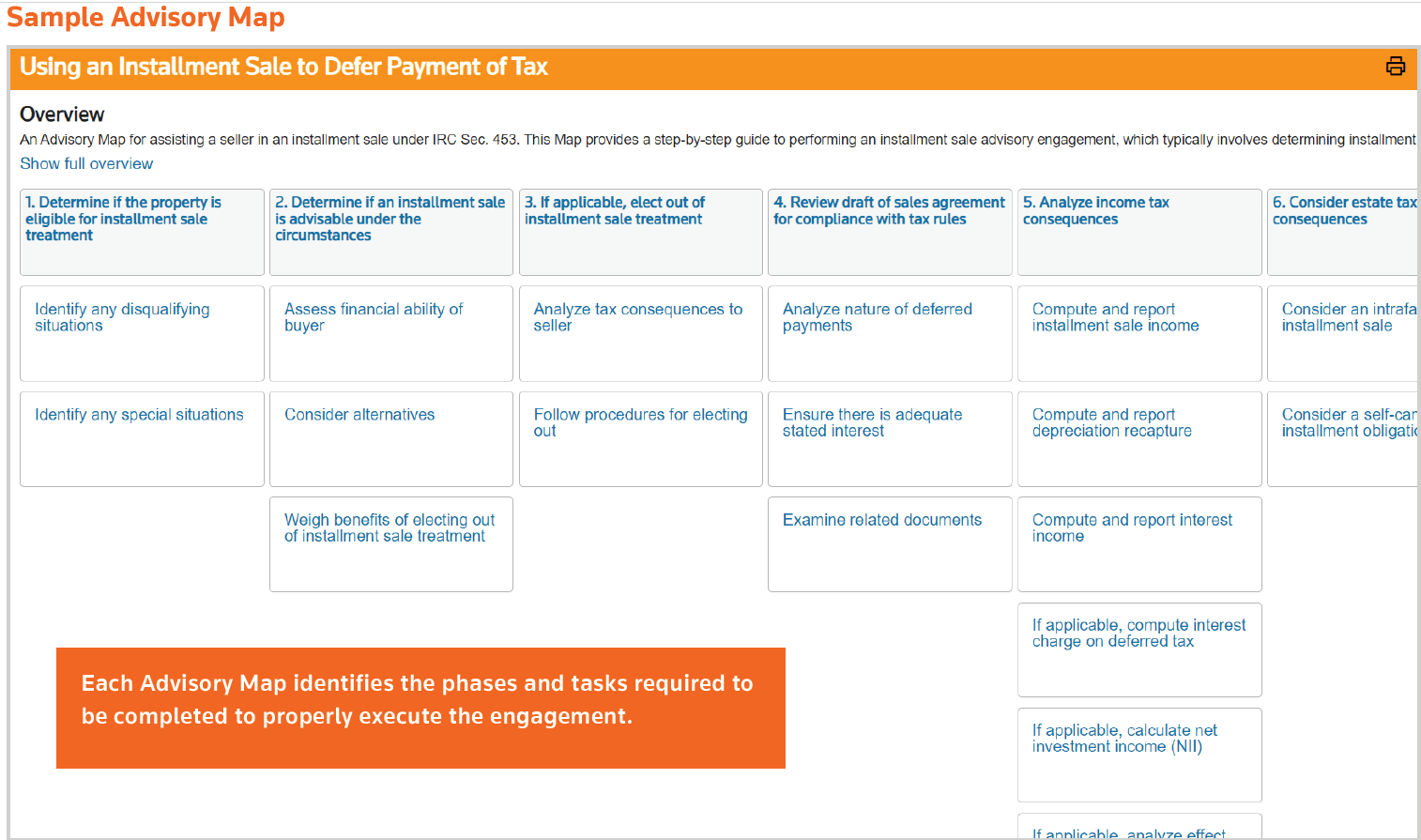

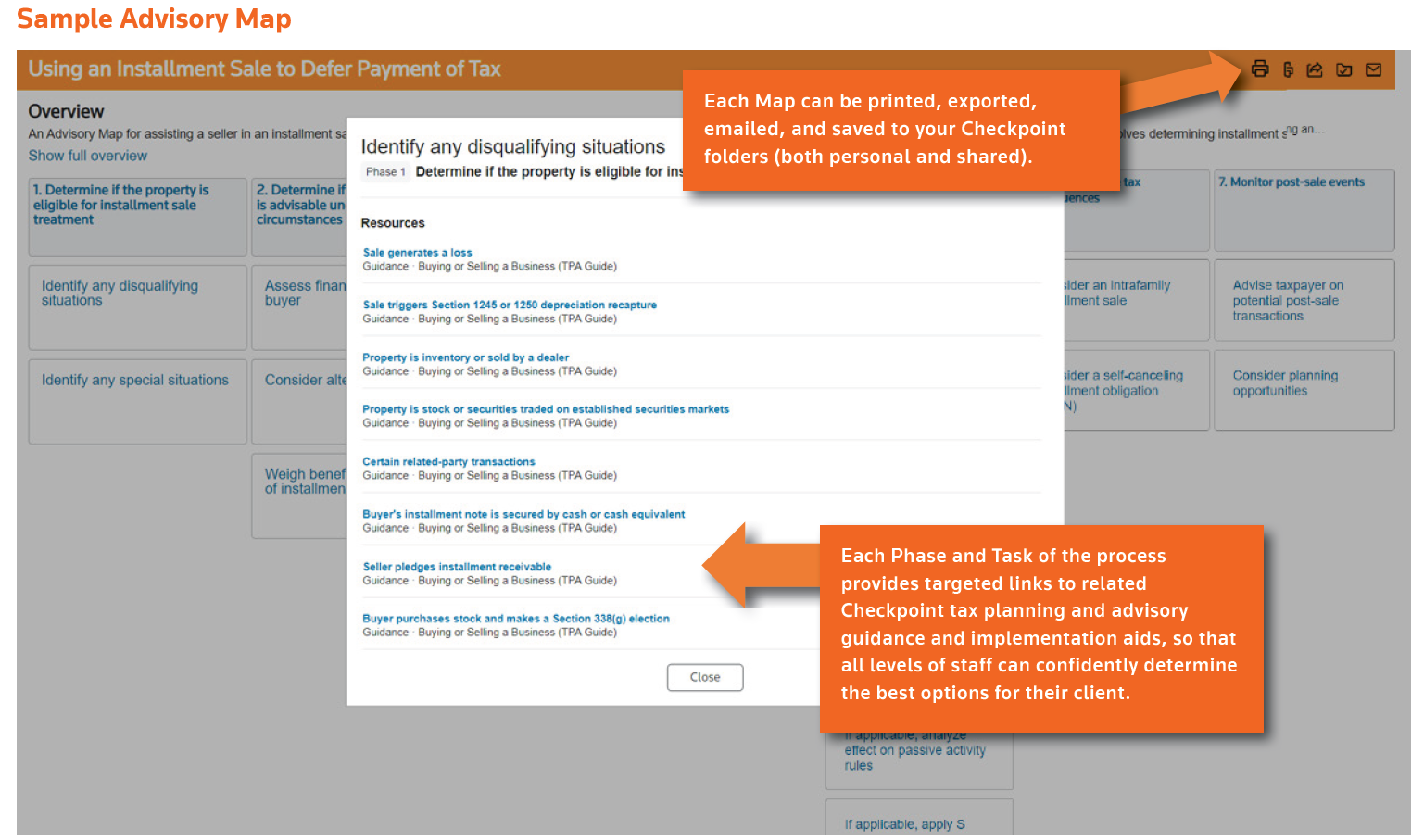

Imagine you have a client who is interested in using an installment sale to defer the payment of tax. As you’ll see below, Advisory Maps lays out each step in the advisory process, backed by the expert knowledge and guidance found on Checkpoint Edge.

With targeted links to related guidance and implementation aids, you and your staff can confidently evaluate and determine the best options for your clients on any number of tax planning and advisory topics.

As proof of its transformative influence, Checkpoint Edge Advisory Maps was named winner of the 2024 Accounting Today Top New Products.

Empower your staff — and your firm

Remember: Your knowledge and experience are unique. Clients are willing to pay a premium when they understand the value being provided. Meaningful year-round client relationships reinforce that you are not just a transactional expense, but a committed partner.

Shifting to an advisory services model provides your clients with the guidance and support they are looking for, while enabling you and your staff to use your knowledge and experience to your advantage.

A powerful advisory combination

With more than 280 tools, including proposal templates, client deliverables, pricing calculators, checklists, videos, and more, Thomson Reuters Practice Forward provides firms with resources and customized coaching to help firms achieve advisory-focused client relationships and a healthier bottom line.

Together, Practice Forward and Checkpoint Edge Advisory Maps empower your firm to cultivate and nurture client relationships that are both profitable and mutually beneficial. While these relationships will continue to include traditional tax preparation and compliance, you will primarily approach them from an advisory standpoint, focusing on your clients’ overall financial objectives.

With Checkpoint Edge, you gain access to swift, precise responses through a seamless and intuitive user interface designed to integrate the latest advancements in artificial intelligence, cognitive computing, and machine learning. This tax and accounting research tool accelerates your quest for information, offering enhanced efficiency and effectiveness with every use.

Alongside Practice Forward, you’ll have a true roadmap for shifting your business to advisory-centered client relationships and getting paid for the valuable knowledge, advice, and strategies you provide your clients.

If you’re ready to open new revenue opportunities and empower your staff to deliver on them, learn more about Checkpoint Edge or take advantage of a free Practice Forward demo today.

|

AI solutions for advisory firms of the future |

|