Take back control of tax season.

Jump to ↓

| How to manage work-life balance during tax season |

| 1. Tapping into a full suite |

| 2. Access to in-context answers |

| 3. Truly paperless processes |

| Take back tax season |

Did your last few months consist of late nights, long weekends, and little time for family or friends? If you are like most tax professionals, then you let tax season dictate your schedule and keep you from doing the things you enjoy most for months every year.

How to manage work-life balance during tax season

Fortunately, it does not have to be this way. One key realization from turning to technology is putting an end to the seemingly endless amount of redundant data entry and manual processes throughout your tax workflow.

As technology continuously advances, you should continue evaluating the options available to improve your practice. More often than not, you will find that your problems can be solved using technology that exists today. Here are the areas on which the most progressive firms are focusing:

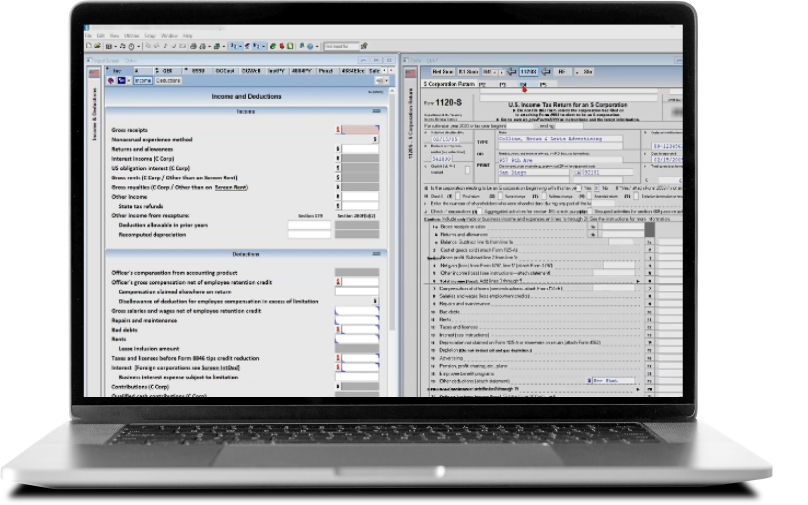

1. Tapping into a full suite

If you are tired of redundant data entry such as updating an address in multiple databases or applications every time one of your clients move, then it is time to evaluate tax software that seamlessly and automatically integrates with a full suite of applications. How much time would you save if client demographic information such as addresses and contact information was automatically transferred between returns and even between applications? How much time would you save if K-1 data was automatically transferred from the S Corporation, Partnership, or Trust return to the applicable recipient return? This is all possible today when using tax software that is part of a full suite of applications.

2. Access to in-context answers

When someone asks us what we dislike most about finding answers to questions that arise when preparing or reviewing tax returns, most of us answer the same way – searching. Having to manually search for information not only disrupts workflow, but it also takes far too much time. Whether you find yourself searching through each tax authority’s website or struggling with how to best utilize the search functionality within your tax research, time is unnecessarily being spent searching for answers. Turning to research and guidance solutions that provide in-context answers alleviates this pain. Firms using these solutions can link out from their tax software input and forms screens to line-by-line explanations using real-life examples and worksheets without disrupting their workflow, effectively circumventing the need to manually search for this information.

3. Truly paperless processes

We can all agree that managing paper is a pain, but most are still using paper documents in many of our processes today. Some of the most common processes include data collection, managing workpapers, and signature documents.

- Data collection – How do you currently gather information from your clients? If you are using traditional organizers or requesting that your clients come into the office to provide this information, then you are making it difficult for them to provide you with this information. Instead of using those outdated methods that result in lackluster completion rates and a lot of back-and-forth, progressive firms are using tax questionnaires that are event driven and mobile-friendly in order to do business with their clients the way they want it to be done. Their clients appreciate the flexibility of completing online or on their mobile device and that they are only answering questions relevant to them. Using data collection tools that integrate with your tax software also eliminates the need to re-key or manually transfer any of this information.

- Managing workpapers – How do you currently manage your workpapers? If you are using paper documents or files stored locally on your workstation, then I would highly recommend evaluating a workpapers solution. Your workpapers solution should put the information you need at your fingertips and effortlessly integrate with your tax software. However, the ideal solution will go a step further and include data extraction capabilities. These capabilities will label and organize client documents, deliver these documents to the correct folder in your workpapers solution, and transfer amounts from source documents to the applicable tax return within your tax software.

- Signature documents – If you are not using an electronic signature solution, then how long does it for your client to sign and return documents you send to them? If you are using an electronic signature solution, then how easy is it for you to monitor and track these requests and does it integrate with your tax software? Finding the right electronic signature solution will allow you to send these requests with automatic reminders and track the statuses of these requests all from directly within your tax software. No more waiting days or even weeks for client signatures or having to manually send reminders and track the statuses of these signatures.

Take back tax season

These are the three areas on which many of the most successful firms are focusing. Successfully implementing the right technology has enabled them to take back control of tax season, allowing them to spend time doing the things they enjoy most no matter the time of year. It is more important than ever to evaluate the solutions available today that could help you streamline your workflow and eliminate time wasted on redundant data entry, manually searching for information, and managing paper-based processes.

|

|

|

|

|

|