TaxCaddy features

Transform client service with streamlined tools and resources from TaxCaddy

Get everything you and your 1040 taxpayers need for fast, seamless collaboration in one cloud-based application

Tap into this 1040 taxpayer collaboration software that gives clients and tax professionals the resources needed to get through tax season.

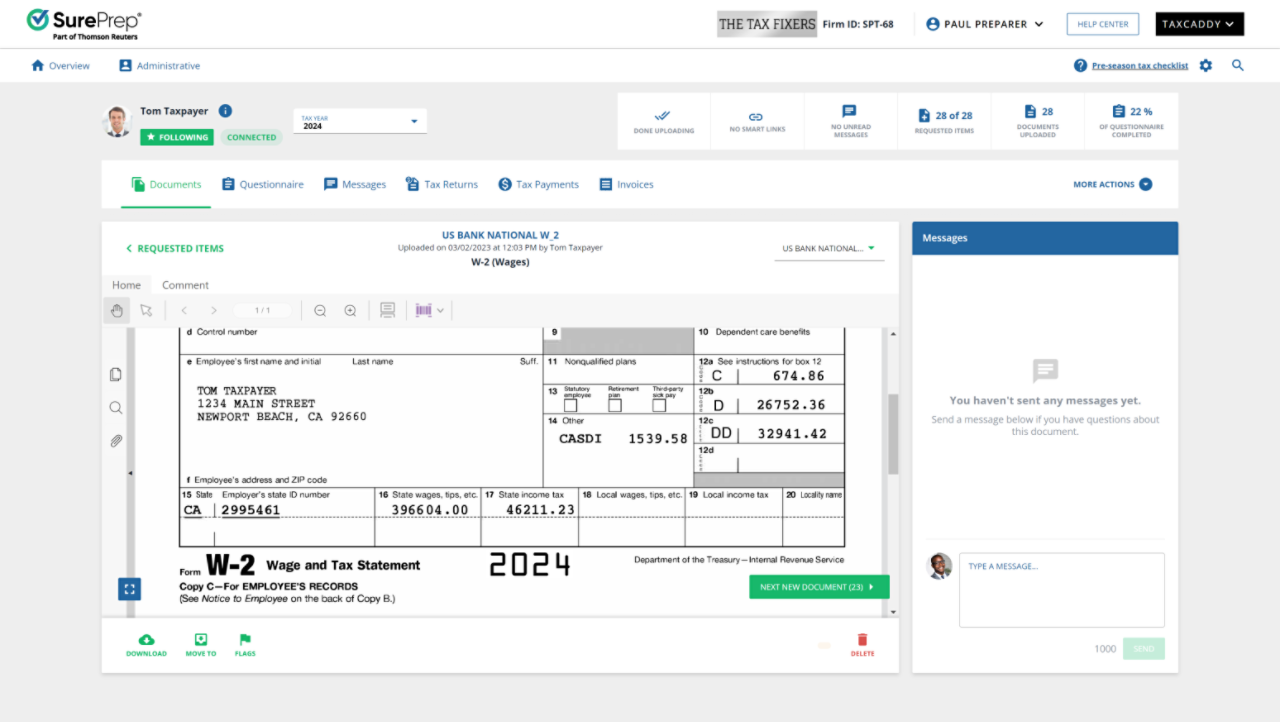

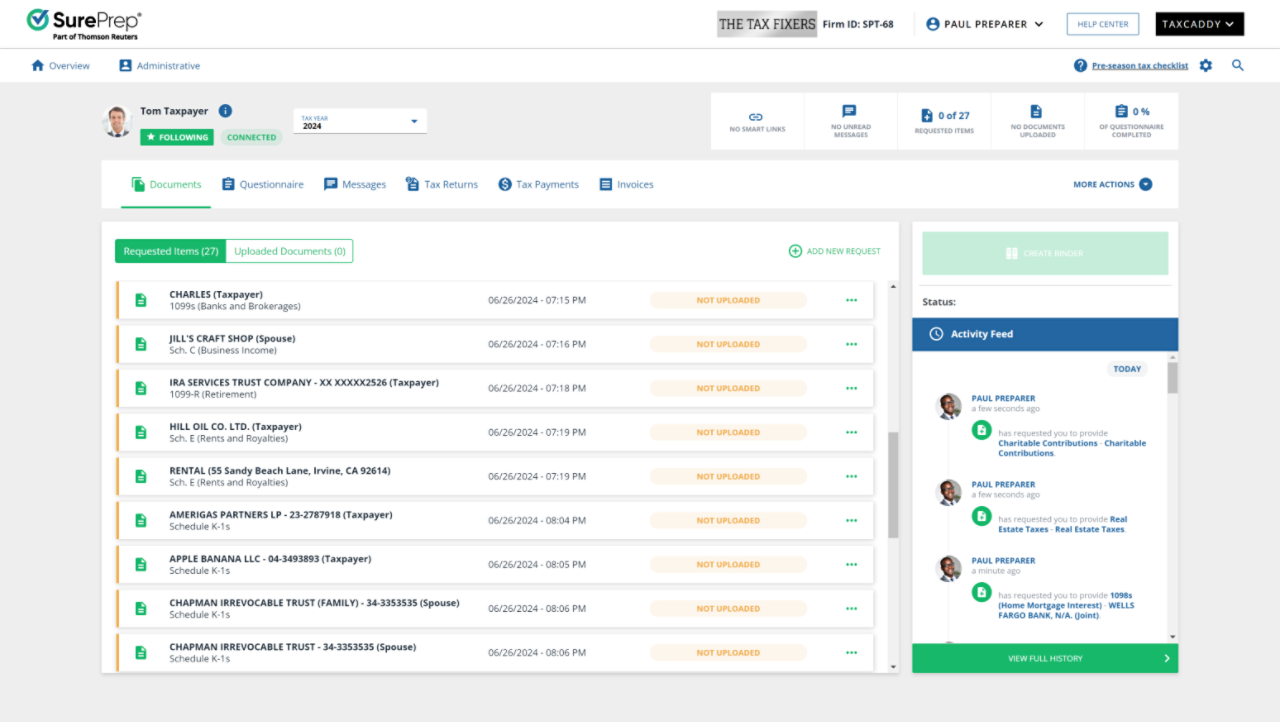

Document gathering

Improve productivity with convenient document-gathering TaxCaddy tools. Use data from your tax software to automatically generate a custom Document Request List for each client. Then, allow clients to tap into fillable forms and use Smart Links to fill out any documents on their apps, seamlessly connecting their financial institutions to their TaxCaddy account.

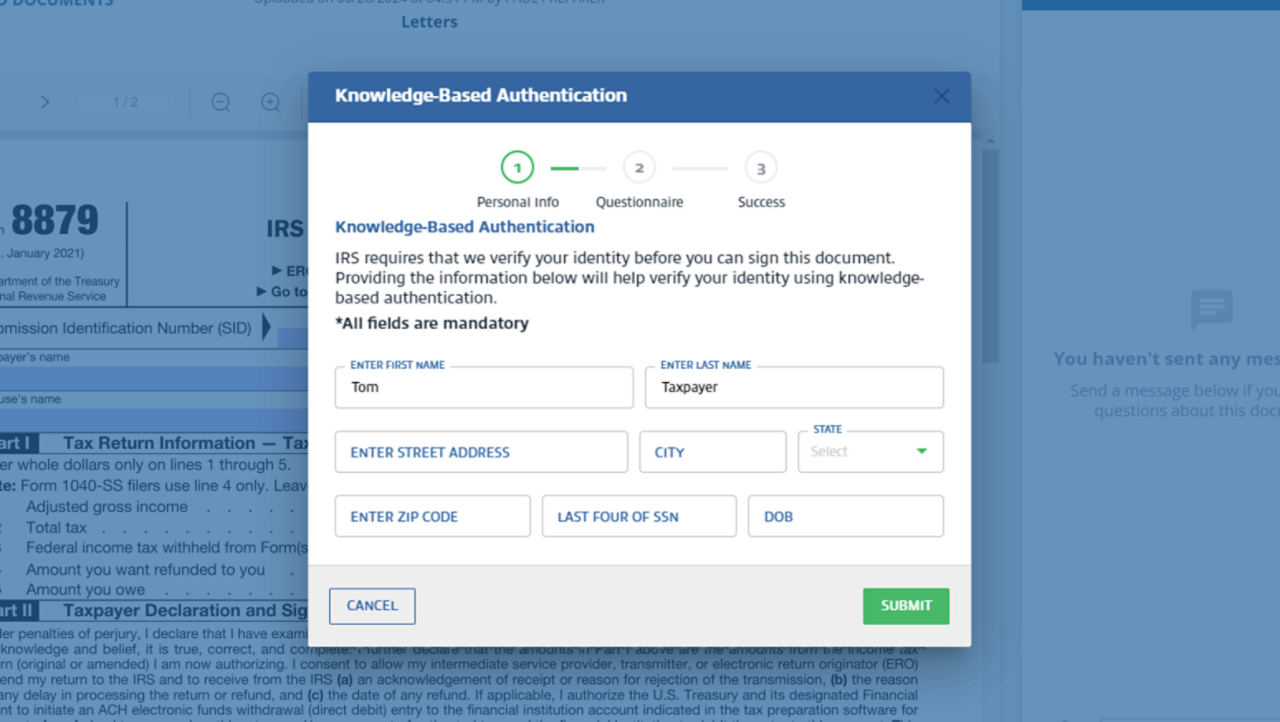

E-signatures and review

Avoid waiting on signatures and quickly obtain a valid e-signature for any document, including engagement letters and statements of work, through TaxCaddy. Ensure security for certain forms with dynamic knowledge-based authentication. If a document does not require a formal signature, firms can upload it for review and clients can simply click "mark reviewed" whenever they complete it.

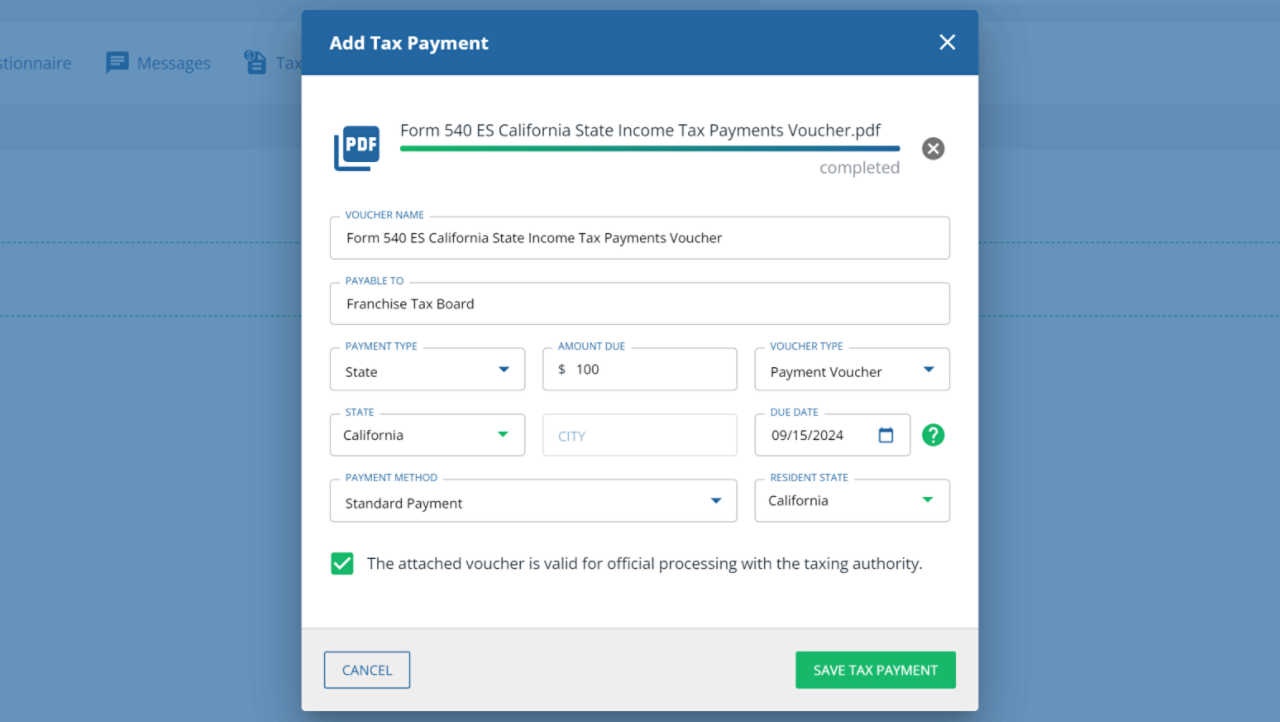

Tax payment vouchers

Centralize all your tax payment needs with TaxCaddy's intuitive platform. Deliver tax payment vouchers to your clients, track when payments are due, and update payment status. Then, clients can pay state and federal taxes directly from the app, making the process easier for staff and clients.

Mobile apps

Bring all of TaxCaddy's features on the go with a taxpayer mobile app, available on Google Play and Apple's App Store. Experience modern convenience where clients complete tasks and access all their materials on their phones while firms manage client relationships.

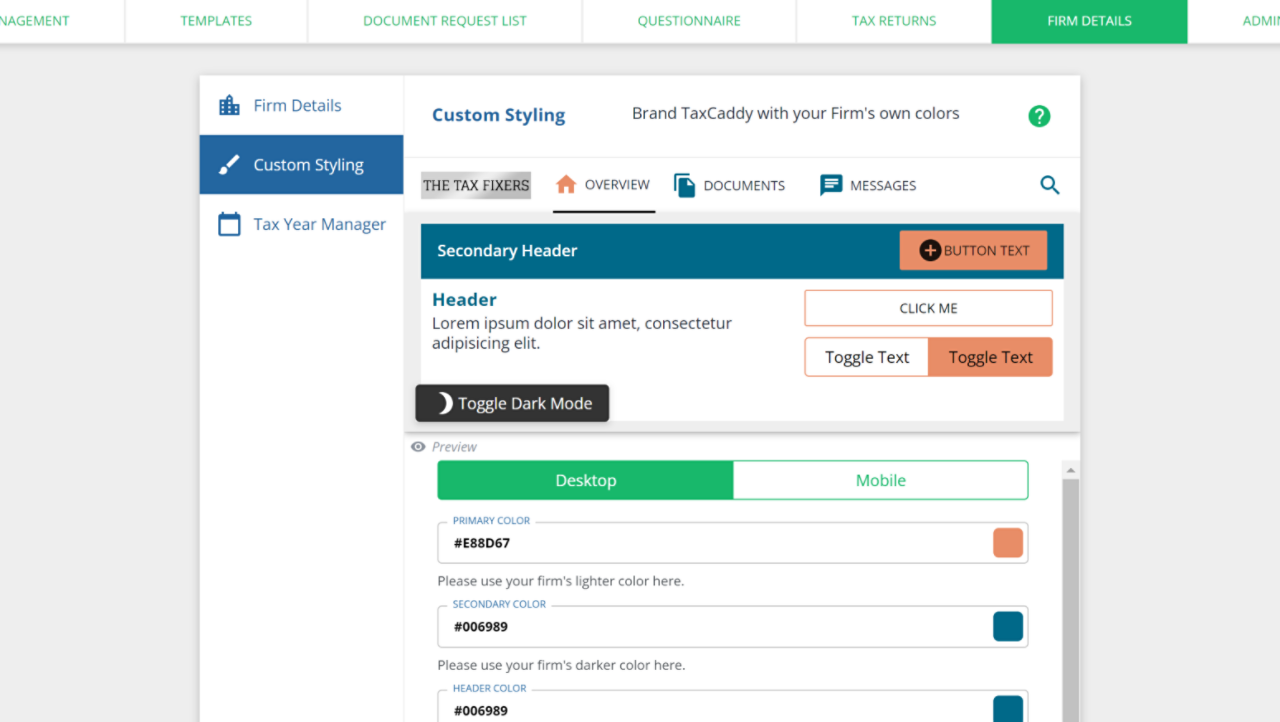

Custom branding

Express your firm's specific branding by redesigning the TaxCaddy interface — for desktop and mobile layouts — with your firm's logo and brand colors so taxpayers view it as a cohesive experience rather than an external service.

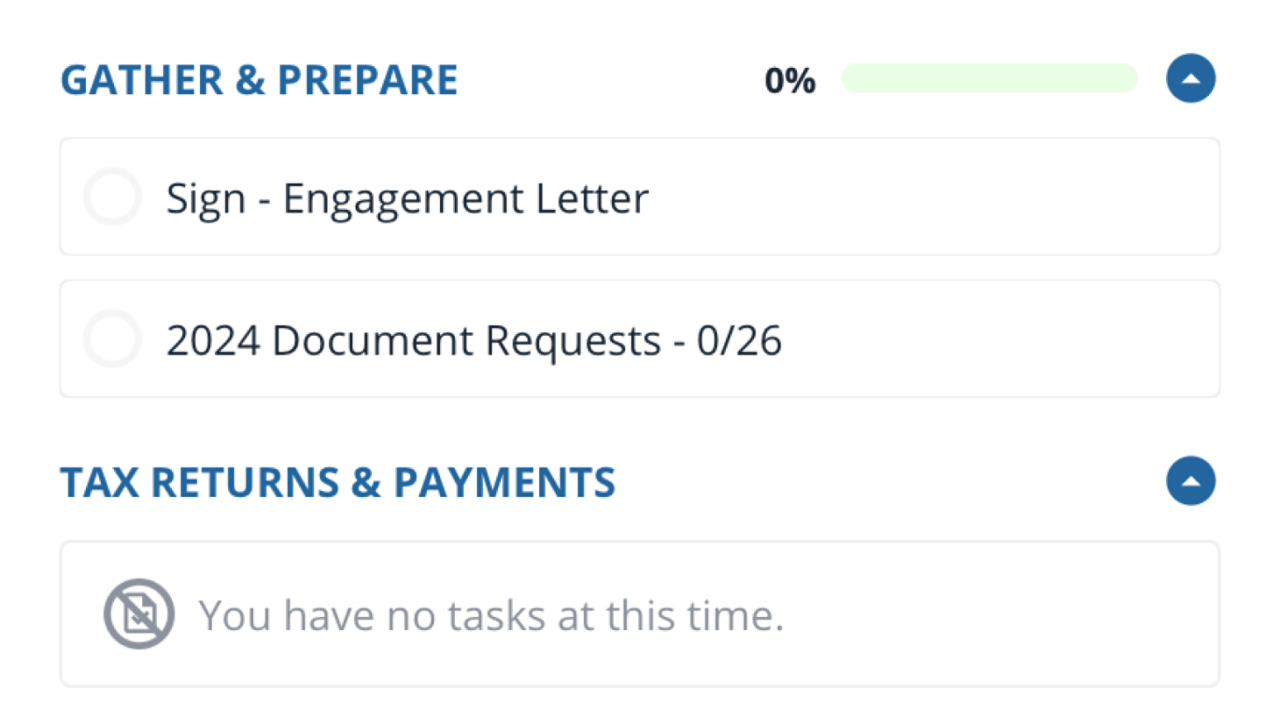

Leverage these comprehensive tax resources on TaxCaddy

Upgrade the tax process for clients by putting the power into their hands. Let them upload documents, access past returns, and contact their tax professional whenever necessary.

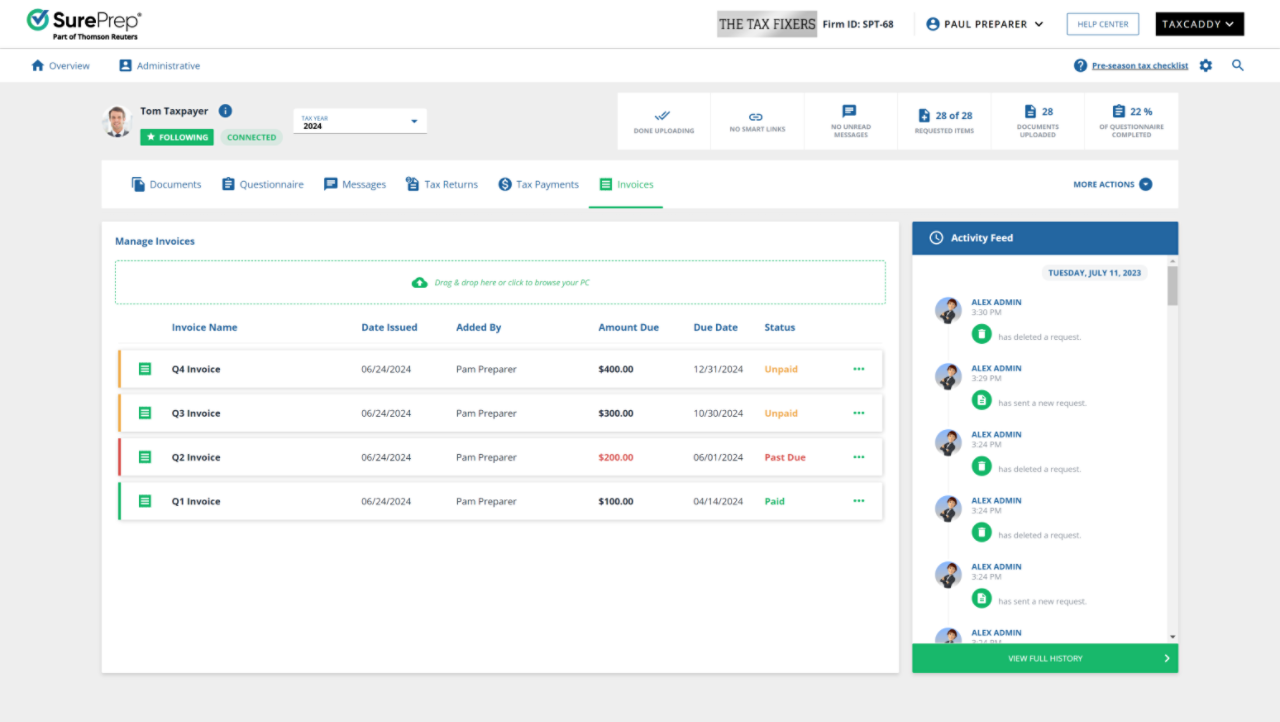

Invoicing and delivery

Experience tax season with integrated invoicing that allows firms to manage taxpayers' billing while clients view and pay any pending invoices. Similarly, manage tax return delivery through a simple drag-and-drop process. Taxpayers will be able to view the final return and store prior returns under their specific profile.

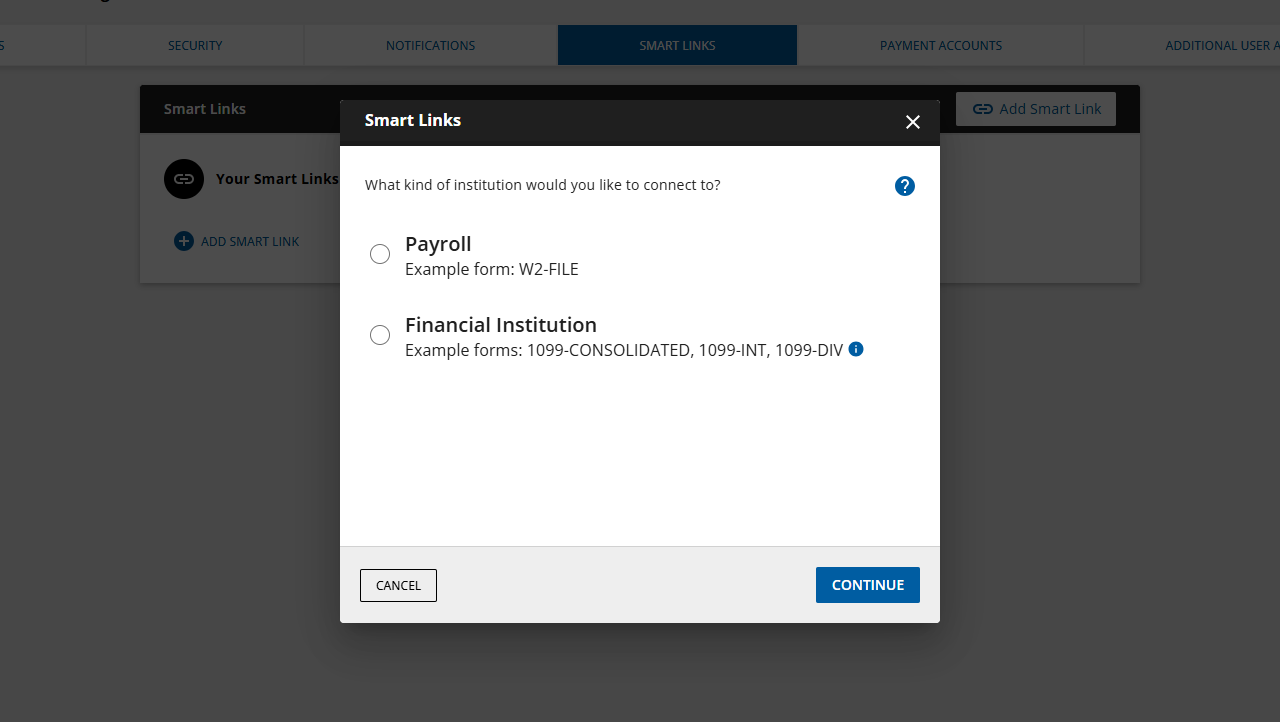

Smart Links

Automatically retrieve tax documents from the taxpayers' financial institutions on their behalf. Once connected, Smart Links automatically imports tax documents as soon as they become available.

Messages

Initiate communication through message threads in TaxCaddy. Attach documents with messages or send out general queries. Firms may export any message thread to the client's work paper binder as a tax document.

Photo scan

Transform your client’s smartphone camera into a trusty scanner, allowing taxpayers to capture photos of paper documents and upload them as legible, correctly cropped PDFs.

Questionnaire

Customize the questionnaire process so clients see only relevant questions. You can even sync progress between desktop and mobile while automatically saving it.

Develop stronger client connections with TaxCaddy

Enhance the benefits of TaxCaddy by integrating with these solutions to make your workflow even more efficient.

UltraTax CS and GoSystem Tax RS integration

TaxCaddy utilizes the data in UltraTax CS and GoSystem Tax RS, professional tax software for tax preparers and accountants, to generate tailored Document Request Lists for each client. Once information has been gathered, it can be seamlessly transferred into UltraTax CS and GoSystem Tax RS, eliminating the need for manual entry.

Learn more about how TaxCaddy integrates with other tax solutions

Questions about TaxCaddy?

We’re here to support you.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us