Answers to commonly asked questions about claiming children on taxes.

Jump to:

| Child and dependent care credit FAQs |

| What is kiddie tax? |

| What is the adoption tax credit? |

| Claiming children on taxes |

| Choosing the best tax preparation software |

As all working parents know, the cost of child and dependent care can be a significant financial burden. To help offset these expenses, the IRS offers the child and dependent care tax credit. This credit allows eligible taxpayers to reduce their tax liability by a certain percentage of the qualified expenses incurred for the care of their children or dependents.

From an accountant’s perspective, you likely have heard these questions: How do dependents affect taxes? How do I go about claiming children on taxes? To effectively answer these questions, an understanding of the child and dependent tax credit and how to apply it is essential. In addition, it is important to keep up to date with other dependent and child tax legislation in order to maximize your clients’ tax benefits while ensuring compliance with the latest IRS regulations.

However, navigating ever-changing child and dependent tax credits and encouraging clients to keep track of relevant documentation throughout the year can be a complicated process, to say the least. To keep up, more and more accountants are streamlining data entry with scan-and-populate solutions that automate the tax prep process and create a seamless client experience.

To better understand the intricacies of tax credits related to children and dependents, let’s take a look at the basics and discuss how automated workpaper preparation can help your clients claim their eligible expenses faster.

What is the child and dependent care tax credit?

The child and dependent care tax credit provides financial relief for families who pay for child or dependent care expenses. To claim the child and dependent care tax credit, taxpayers must file their Form 1040 federal income tax return using Form 2441. The form requires the taxpayer to provide information about the qualifying individual, the expenses incurred, and any dependent care benefits received.

To qualify for this tax credit, the child or dependent care must be necessary in order to allow the taxpayer and their spouse (if married) to work or look for work. These expenses must be incurred for children under the age of 13 or for a dependent who is physically or mentally incapable of self-care.

Eligible expenses include daycare, babysitters, nannies, day camps, and similar care services. However, expenses related to education or overnight camps generally do not qualify. This credit is calculated based on a percentage of your eligible expenses, which are subject to certain limits. These limits include a maximum dollar amount per dependent and a maximum overall limit on expenses. Review the IRS guidelines for a comprehensive list of eligible expenses.

Depending on your client’s adjusted gross income, there may be a limit to the tax credit percentage. The higher the income, the lower the percentage.

The Interactive Tax Assistant on IRS.gov is helpful in determining if your client is eligible to claim this credit.

What is a qualifying child vs dependent?

A qualifying child must meet certain criteria as defined by the IRS.

- The child must be under the age of 13.

- The child must be a dependent of the taxpayer (usually a parent or guardian) for tax purposes.

- The child must live with the taxpayer for more than half of the year.

- The child must not provide more than half of their own financial support.

- The child cannot be claimed as a qualifying child by more than one taxpayer.

A dependent is defined as an individual, which could be a child or other relative, who relies on the taxpayer for financial support. The criteria for a dependent is broader than a qualifying child and can include adult children, parents, and other relatives. Dependents do not necessarily have to be children, and they can be of any age. The rules for claiming someone as a dependent include considerations like the individual’s relationship to the taxpayer, their income, and the amount of support provided by the taxpayer.

It is important to note that not all dependents qualify as qualifying children. Only certain criteria apply to determine if a child meets the qualifications to be considered a qualifying child, and only those who meet these criteria can contribute to the taxpayer’s eligibility for the child and dependent care tax credit.

As an accountant, you should refer to the most current IRS guidelines related to qualifying children and dependents. The child and dependent care tax credit FAQs are a helpful resource.

How many dependents can I claim for the child and dependent care tax credit?

The child and dependent care tax credit is typically limited to expenses incurred for the care of one or more qualifying dependents. There isn’t a strict limit on the number of dependents you can claim, but the expenses you incur must be directly related to their care and meet the other eligibility requirements.

Publication 503: Child and dependent care expenses explains the tests your client must meet to claim the credit for their child and dependent care expenses.

Is the child and dependent care tax credit refundable?

The child and dependent care tax credit is only partially refundable. This means that if the credit exceeded the amount of taxes owed, taxpayers can receive a refund for a portion of the excess credit, but not necessarily the full amount.

Some employers offer dependent care assistance programs as a benefit to their employees. These programs allow employees to set aside pre-tax dollars from their salary into an account specifically designated for dependent care expenses. Money contributed to these programs is not subject to federal income tax, Social Security tax, or Medicare tax.

However, if a taxpayer utilizes a dependent care assistance program, the expenses covered by that program cannot be used to claim the child and dependent care tax credit. Generally, it is more advantageous to use a dependent care assistance program for dependent care expenses as it provides tax savings at the time of contribution.

Child and dependent care tax planning strategies

As an accountant, your job is to guide your clients through various tax planning strategies to optimize their child and dependent care tax credit. As such, it is important to evaluate your client’s tax filing status. Depending on their situation, it may be beneficial to explore different filing statuses, such as head of household or married filing jointly, to maximize their credit.

In addition, it may also be beneficial to utilize pre-tax accounts by encouraging clients to contribute to dependent care assistance programs or health savings accounts, if available. These contributions reduce taxable income, potentially increasing the credit percentage.

Depending on their circumstances, it may be wise to advise clients to consider timing their dependent care expenses strategically to ensure maximum credit eligibility and assessing whether it’s beneficial for both spouses to work, as the credit is typically tied to earned income.

At the end of the day, the child and dependent care tax credit is a valuable tool that can help your clients alleviate the financial burden of caring for children or dependents. By understanding the eligibility criteria, calculating the credit accurately, and considering related tax implications, you can guide your clients and unlock potential tax savings.

Taking advantage of the latest advances in tax preparation software can help you better advise your clients on advantageous tax strategies while saving time and reducing the risk of errors.

Child tax credit vs child and dependent care tax credit

The child tax credit and the child and dependent care tax credit are different, however, both provide financial relief to families with children.

The child tax credit is designed to provide financial assistance to families with qualifying children under the age of 17 to help with the costs of raising children, while the child and dependent care tax credit is intended to help families cover the costs of child care or dependent care expenses, allowing parents to work or actively seek employment.

What is kiddie tax?

Kiddie tax refers to a special IRS tax provision designed to prevent parents from transferring investment income to their children to take advantage of lower tax rates. It applies to unearned income (income from investments) of certain children, typically those who are under the age of 18 or who are full-time students under the age of 24.

Prior to the introduction of the kiddie tax, parents could shift income-producing assets or investments to their children, who were subject to lower tax rates due to their lower income and tax brackets. This practice allowed families to reduce their overall tax liability.

To curtail this tax avoidance strategy, the kiddie tax rules are designed to tax the unearned income of a child at the parents’ tax rate as opposed to the child’s tax rate.

Kiddie tax rules

The kiddie tax includes a special set of income tax rules that apply to individuals under 18 years and full-time students under 24 years. If the child’s unearned income (i.e., investment income) is more than the kiddie tax threshold for the tax year, then the child’s unearned income over the threshold is subject to the kiddie tax and gets taxed at the parents’ marginal tax rate rather than the child’s tax rate. The kiddie tax threshold is adjusted for inflation each year.

Kiddie tax does not apply if the child earned any salary or wages from working, that income is then taxed at the child’s rate. However, kiddie tax will still apply to the child’s unearned income if the requirements are met.

What is kiddie tax unearned income?

According to kiddie tax rules, unearned income refers to:

- Taxable interest

- Dividends

- Capital gains (including capital gain distributions)

- Rents

- Royalties

- Similar investment income

The taxable part of social security or pension benefits paid to the child are also unearned income. IRA distributions received by a child subject to kiddie tax are considered unearned income.

Earned income includes income attributable to wages, salaries, or other amounts received as compensation for personal services. Distributions from certain qualified disability trusts are treated as earned income.

What is the adoption tax credit?

The adoption tax credit is a tax benefit provided by the U.S. government to help offset qualified expenses associated with adopting a child. It is intended to ease the financial burden for adoptive families for costs associated with adoption agency fees, legal fees, travel expenses, and other necessary adoption-related expenses.

The adoption tax credit is a non-refundable credit, which means it can reduce your federal income tax liability dollar-for-dollar. If the credit exceeds your tax liability, you won’t receive a refund for the difference. However, any unused credit can be carried forward to future tax years.

There are income limits that may affect your eligibility for the full adoption tax credit. If your modified adjusted gross income exceeds a certain threshold, the credit amount may be reduced or phased out entirely.

In addition to the adoption tax credit, some employers offer adoption assistance programs, which provide financial assistance or reimbursements for adoption-related expenses. These employer-provided benefits may also be tax-exempt up to a certain limit. Additionally, state governments may offer their own adoption-related tax credits or benefits, which may vary from state to state.

How many years can you claim the adoption tax credit?

There isn’t a specific limit on the number of years one could claim the adoption tax credit, as long as you had eligible adoption expenses to claim for each year.

Failed adoption tax credit

The adoption tax credit may still be available to taxpayers even if the adoption process does not result in the legal adoption of a child. This credit allows individuals who incurred qualified adoption expenses during an unsuccessful adoption attempt to still receive some financial relief.

Tax breaks for foster parents

In the U.S., foster care reimbursements provided by state or local agencies are generally not considered taxable income. This means that the money you receive to cover the expenses of caring for foster children is not subject to federal income tax.

In the past, foster parents could claim a dependency exemption for each foster child in their care. However, due to tax law changes, dependency exemptions were suspended for tax years 2018 through 2025. This means foster parents cannot claim a tax exemption for their foster children during this period.

Foster parents may be eligible to claim the child tax credit for qualifying children in their care, which can help reduce their tax liability. In addition, if they have qualifying earned income and meet certain income requirements, they may be eligible for the earned income tax credit, which can provide significant tax savings for low to moderate income families, including foster families.

If a foster family decides to adopt a child who was previously in their foster care, they may be eligible for the adoption tax credit to offset the adoption-related expenses.

Lastly, some expenses related to foster care, such as unreimbursed out-of-pocket expenses, may be deductible. Some states even offer tax benefits for foster parents who incur education-related expenses for their foster children. Be sure to advise your clients to keep accurate records of these expenses throughout the year.

Claiming children on taxes

To claim the child and dependent care tax credit, taxpayers must file their Form 1040 federal income tax return using Form 2441. This form requires the taxpayer to provide information about the qualifying individual, the expenses incurred, and any dependent care benefits received.

In addition, Schedule 8812 is a tax form used to calculate the additional child tax credit. Schedule 8812 is attached to Form 1040. The additional child tax credit is a refundable credit designed to provide additional assistance to families with children who qualify for the child tax credit but have a tax liability that is lower than the credit amount. In other words, if the child tax credit exceeds the amount of taxes owed, some or all of the excess can be claimed as the additional child tax credit.

Helping clients with Form 2441

Using 1040 tax software to streamline the tax preparation process can save accountants time and reduce the risk of errors. Most tax software platforms provide a step-by-step process which typically includes the following:

- Enter the necessary information about the care provider, including their name, address, and taxpayer identification number into Form 2441.

- Input the details of the qualifying individuals, including their names, ages, and taxpayer identification numbers.

- Input the total amount paid for child and dependent care expenses throughout the tax year. The software will guide you through this process.

- Calculate the credit based on the information provided. The software will apply the appropriate credit percentage and income limitations.

- Review all information entered to ensure accuracy. The tax software should provide an option to review the form before finalizing.

- Transfer the credit amount from Form 2441 to the appropriate line on Form 1040. With the right tax software, this process is automated.

- Electronically file the tax return or generate a printable version for mailing, depending on your client’s preferences.

- Advise your client to keep any relevant documentation in case of an audit, even if they’re using tax software.

Remember that the exact steps and options may vary depending on the tax software you’re using. It’s important to be familiar with your specific software’s interface and capabilities.

Choosing the best tax preparation software

If you’re starting your own accounting practice or considering a software switch, look for tax preparation software that enables remote work, automates manual tasks, and improves the client experience. Today’s tax preparation software solutions include everything from practice management to trial balance engagement, and much more.

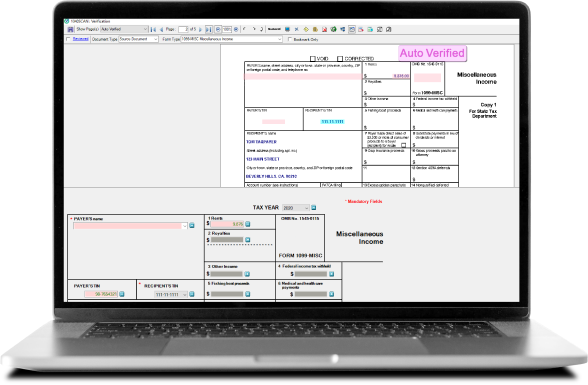

SurePrep products can integrate with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, and Lacerte and can help make your tax practice more productive and profitable. The AI-powered combination of 1040SCAN, SPbinder, and TaxCaddy integrate with your existing tax software to automate each phase of the tax prep process.

When it comes to helping your clients claim child and dependent care tax credits, 1040SCAN can streamline the process, reduce errors, and ensure maximum tax benefit.

So how does it work? By eliminating data entry with a scan-and-populate solution, accountants can bookmark and organize source documents into a standardized workpaper index that follows the order of the tax return. You no longer have to painstakingly assemble tax workpapers thanks to 1040SCAN’s automated scan-and-organize functionality which automates 4–7x as many documents as the alternatives and exports data directly to your tax software.

The unmatched document coverage eliminates more data entry than any other solution on the market. Plus, the patented, AI-powered technology auto-verifies OCR data for 65% of standard documents.

Scan-and-populate tax software

Maximize efficiency and automate tax work paper preparation with 1040SCAN

Learn more ↗