Help clients navigate credits and FSAs.

From an accountant’s perspective, helping your clients navigate the various aspects of claiming dependents on taxes can be complicated. To better understand the intricacies of claiming dependents, let’s take a look at the basics and discuss how automated workpaper preparation can help your clients claim their eligible expenses faster.

Jump to ↓

Qualifying for the dependent care credit

When does a dependent have to file their own taxes?

Helping clients with claiming dependents

Tax software for claiming dependents on taxes

Qualifying for the dependent care credit

The child and dependent care tax credit provides financial relief for families who pay for child or dependent care expenses.

To claim the child and dependent care tax credit, taxpayers must file their Form 1040 federal income tax return using Form 2441. This form requires the taxpayer to provide information about the qualifying individual, the expenses incurred, and any dependent care benefits received.

To qualify for this tax credit, the taxpayer must prove child or dependent care is necessary to enable the taxpayer and their spouse (if married) to work or look for work. These expenses must be incurred for children under the age of 13 or for a dependent who is physically or mentally incapable of caring for themselves.

Together with other tax benefits for families like the child tax credit and Schedule 8812, an IRS form designed to help taxpayers take advantage of the additional child tax credit, accountants can maximize tax savings in a meaningful way for their clients.

What are eligible expenses for the dependent care credit?

Eligible expenses for the dependent care tax credit include daycare, babysitters, nannies, day camps, and similar care services. Expenses related to education or overnight camps generally do not qualify.

This credit is calculated based on a percentage of eligible expenses, which are subject to certain limits. These limits include a maximum dollar amount per dependent and a maximum overall limit on expenses. Review the IRS guidelines for a comprehensive list of eligible expenses.

Depending on your client’s adjusted gross income, there may be a limit to the tax credit percentage. The higher the income, the lower the percentage.

The Interactive Tax Assistant on IRS.gov is helpful in determining if you or your client is eligible to claim this credit.

Who can be claimed as a dependent on taxes?

Generally, dependents are children, relatives, or even non-relatives who rely on the taxpayer for financial support.

Children must meet specific criteria to qualify. Other dependents, such as relatives, must meet various tests related to relationship, income, and support. These tests determine whether a taxpayer can claim them on their tax return.

To keep up with the latest information of claiming dependents on taxes, it is important to refer to the most current IRS guidelines. The child and dependent care tax credit FAQs are a helpful resource.

How much does claiming a dependent save on taxes?

Each dependent you claim can lead to a reduction in taxable income and potentially increase your tax refund. The exact amount saved varies depending on your tax bracket and the number of dependents claimed.

In addition to lowering taxable income, claiming dependents may also enable you or your clients to be eligible for tax credits specifically designed to support families, such as the child tax credit and the earned income tax credit.

How long can you claim a dependent on your taxes?

The duration for which you can claim a dependent on your taxes depends on the type of dependent.

For qualifying children, you can claim them as long as they meet the age and residency criteria. However, for other dependents, such as relatives, they must continue to meet the relationship, income, and support tests each year you intend to claim them.

Visit www.irs.gov/taxtopics/tc602 to learn more.

Is after school care tax deductible?

While the cost of sending your child to an after school program isn’t directly tax deductible, there are other ways to save on taxes related to childcare.

One option is the child and dependent care tax credit, which can provide tax relief for a percentage of qualifying childcare expenses, including after school care. This credit is subject to certain income limits and percentage caps based on your total expenses.

Another option is a dependent care Flexible Spending Account (FSA) which is a pre-tax benefit account used to pay for eligible dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult daycare.

What is a dependent care FSA?

A dependent care FSA allows you to set aside pre-tax dollars from your paycheck to cover eligible dependent care expenses. This can include expenses related to childcare, preschool, and even after-school programs.

Unlike the child and dependent care tax credit, which provides a reduction in your tax liability, the FSA reduces your taxable income, effectively lowering the amount of income subject to taxation.

Dependent care tax credit vs FSA

The dependent care tax credit and Flexible Spending Account (FSA) are two distinct tax strategies that assist individuals with dependent care expenses, but they differ in key ways.

The dependent care tax credit enables taxpayers to claim a percentage of eligible care expenses as a tax credit. However, it has income limits and can be complex to navigate.

On the other hand, an FSA is funded with pre-tax dollars, thus reducing taxable income. This option accommodates various dependent care costs, such as childcare or eldercare. However, it usually requires a “use it or lose it” policy, meaning unused funds may not roll over to the next year.

Using one or both of these tax saving strategies depends on your income, tax situation, and preferences for fund management. From an accountant’s perspective, tax advice should be tailored to the individual needs and preferences of each client, taking into account their financial situation, eligibility, and dependent care costs.

What is the dependent care FSA income limit?

The dependent care FSA income limit is subject to change based on evolving IRS rules. Taxpayers are encouraged to verify the current limits with the IRS or a tax professional.

It is also important to note that dependent care FSAs typically have a “use-it-or-lose-it” policy. This means that funds not used within the plan year may be forfeited, although there might be a grace period or carry-over option depending on current rules.

In terms of dependent care FSA contribution limits, the maximum amount that can be excluded from an employee’s income through a dependent care assistance program is $5,000 ($2,500 if married filing separately) for 2022.

Newsletter

Stay up to date with the latest changes in tax legislation with Checkpoint newsstand.

Checkpoint newsstand ↗When does a dependent have to file their own taxes?

Generally, if a dependent’s earned income exceeds a certain threshold (which can change annually), they are required to file their own tax return. This threshold includes not only wages from a job but also other forms of income, such as investment income.

However, if a dependent has unearned income above a certain limit, they might be subject to the “kiddie tax,” which can impact how their investment income is taxed. Additionally, some dependents may choose to file a return even if not required to do so in order to claim refunds for taxes withheld from their paychecks or to receive certain tax credits.

Helping clients with claiming dependents

Assisting clients with claiming dependents is a crucial aspect of tax advising. Understanding the nuances of tax rules and regulations related to dependents can help you provide accurate and effective guidance to your clients.

With tax legislation evolving from year to year, it’s essential to keep up with the changing rules. From determining who qualifies as a dependent to understanding the various tax credits available, a clear understanding of claiming dependents is essential.

Here are five steps to helping your clients claim dependents on their taxes:

- Begin by understanding your client’s family dynamics, including the number of potential dependents, their relationships, ages, and residency situations.

- Assess dependency eligibility by reviewing IRS guidelines for claiming dependents to determine if dependents meet eligibility criteria, including relationship, residency, support, and income thresholds.

- Help clients understand how claiming or not claiming dependents can impact their overall tax liability, including potential tax refunds or amounts owed.

- Advise clients on the importance of maintaining accurate records and documentation to support their claim for dependents. This includes birth certificates, Social Security numbers, and residency records.

- If the client is eligible to claim dependents, strategize on how to maximize current tax benefits and help them plan for future tax years.

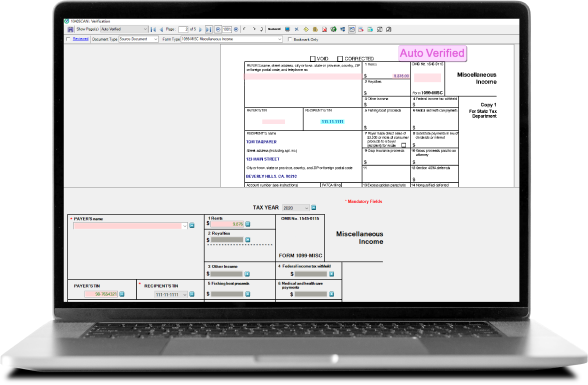

With shifting IRS regulations and the need for error-free documentation, more and more accountants are turning to scan-and-populate solutions that automate the tax preparation process and integrate with AI-powered tax research tools.

By staying informed and keeping accurate documentation, you can ensure that your clients maximize their tax benefits while staying in compliance with the latest tax laws.

Tax software for claiming dependents on taxes

If you’re an accountant looking to help your clients accurately claim dependents on their taxes, SurePrep software can integrate with UltraTax CS, GoSystem Tax RS, CCH Axcess Tax, and Lacerte and can help you reduce manual data entry and maximize child and dependent care tax credits.

The AI-powered combination of 1040SCAN, SPbinder, and TaxCaddy integrate with your existing tax software to automate each phase of the tax prep process. Together with Checkpoint Edge, you can be sure you are properly interpreting IRS tax legislation in an ever-changing landscape.

Scan-and-populate tax software

Eliminate data entry with our industry-leading scan-and-populate solution.

1040SCAN overview ↗