With AI-powered tax technology automating most traditional tax compliance work, forward-thinking accounting firms are increasingly shifting their business model and engaging clients in a new (and more profitable) way: advisory services.

Making this transition, however, requires a change in mindset. Advisory engagements are centered around your client’s business goals and strategy (in addition to traditional tax compliance, of course) and are built into your client relationships from the get-go.

Jump to:

| Recognizing the value of advisory services |

| Renew your love for helping clients |

| Are you ready to start your advisory journey? |

Recognizing the value of advisory services

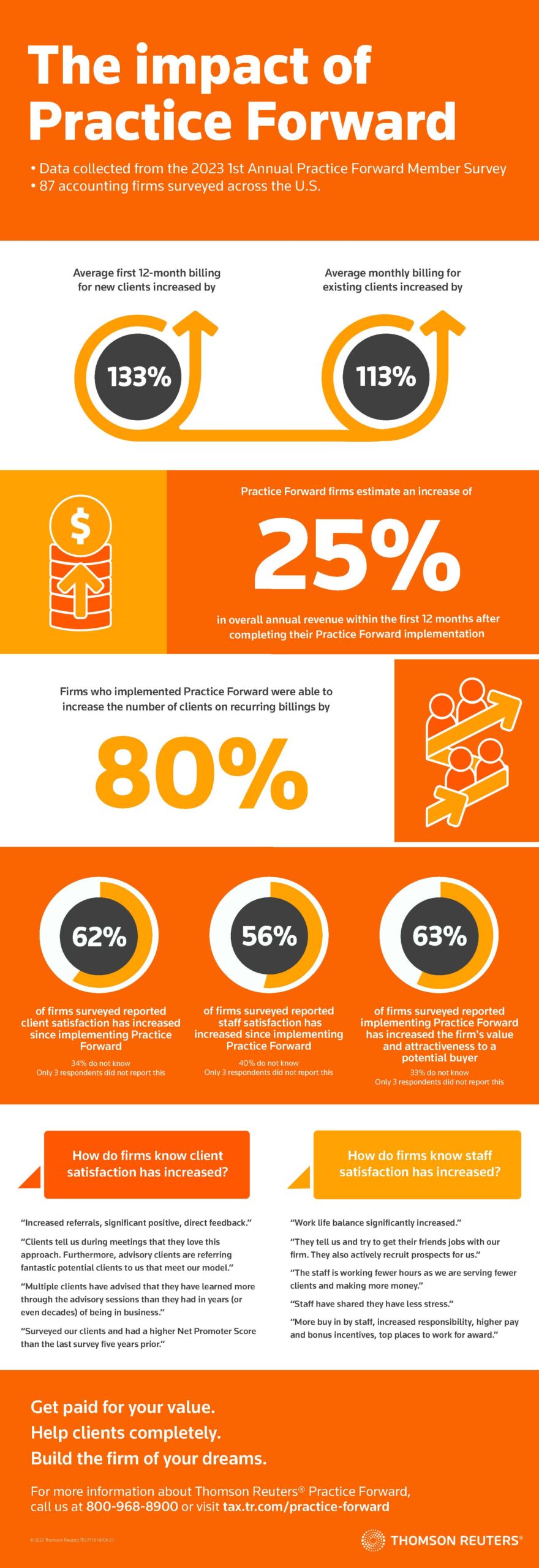

From providing clients with financial insights to helping them navigate the complexities of tax law, accounting firms who have made the move to an advisory services business model are realizing significant gains, including:

- A 133% increase in average first 12-month billing for new clients

- A 113% increase in average monthly billing for existing clients

Fundamental to this shift in mindset is recognizing that your knowledge and experience is valuable — and it shouldn’t be given away for free. Not only do client advisory services open up additional revenue streams, but they also enable more meaningful relationships with clients and a deeper sense of purpose in the services your accounting firm provides.

By shifting from billable hours to a value pricing model, you can strengthen your accounting firm’s value proposition and open the door to year-round client relationships (instead of just once-a-year tax return preparation).

In fact, accounting firms who’ve made this shift estimate:

- A 25% increase in overall annual revenue within the first 12 months

- An 80% increase the number of clients on recurring billings

In much the same way, AI-enabled tax technology can streamline tax prep workflow and supercharge tax research, it can also open the data-driven insight, assisted decision making capabilities, predictive analytics, and much more. These capabilities take your firm beyond the tax return and into the world of becoming a year-round strategic partner to the clients you serve.

Renew your love for helping clients

Perhaps most importantly, an advisory mindset revives those accountants once overloaded with tedious work or who’ve lost the spark that once drew them into the profession. The power of shifting to an advisory-based model is that it can enable you to do what you started out in this profession to do — help clients in a meaningful and satisfying way.

And there is evidence of a significant boost of engagement and satisfaction for those accounting firms who’ve shifted to an advisory services business model, including:

- 62% of firms reporting an increase in client satisfaction

- 56% of firms reporting an increase in staff satisfaction

- 63% of firms reporting an increase in the firm’s value and attractiveness to a potential buyer

*All results based on 87 Practice Forward member accounting firms who completed the Annual Practice Forward Member Survey.

| Download our infographic, The impact of Practice Forward, for a visual of the information from this blog. |

|

Are you ready to start your advisory journey?

With trusted methodology, guidance, and content solutions, Practice Forward can help your firm shift from a compliance-focused model to a lucrative advisory services approach that engages and sustains clients.

Through your Practice Forward implementation, you have access to over 160 tools, including proposal templates, pricing calculators, and checklists, paired with personalized consulting to help you:

- Implement and execute a proven sales process

- Identify and package your firm’s services

- Develop a pricing strategy

- Standardize business best practice advisory delivery

- Transition existing clients to advisory relationships

- Uncover client advisory opportunities

For more information, join us for a virtual Advisory Bootcamp and our in-person Partner Summit where you’ll learn the steps you need to take to redefine your business model and distinguish between value-added advisory services and compliance services — and how you can monetize the value of that difference.