1040SCAN features

Eliminate data entry with an industry-leading scan-and-populate solution

Drastically reduce repetitive and manual tasks by scanning more documents in less time and exporting the data directly to your tax software

Workflow automation

Save time by instantly ingesting source documentation. Use 1040SCAN's document automation coverage to eliminate manual data entry and verification.

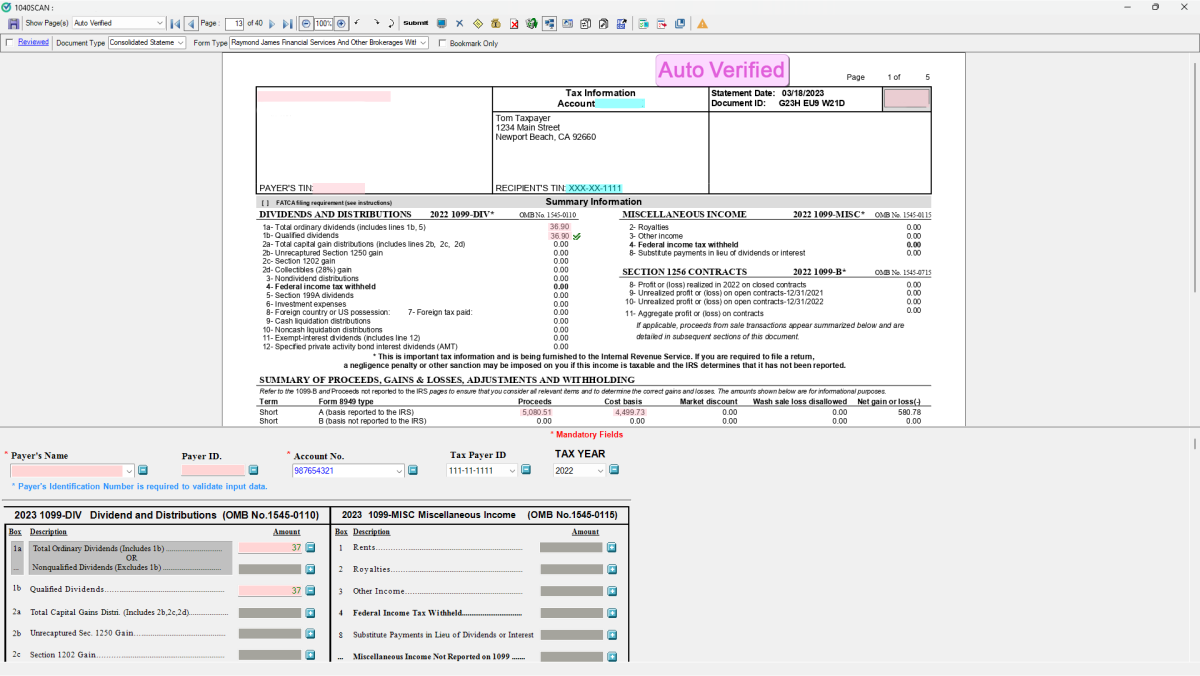

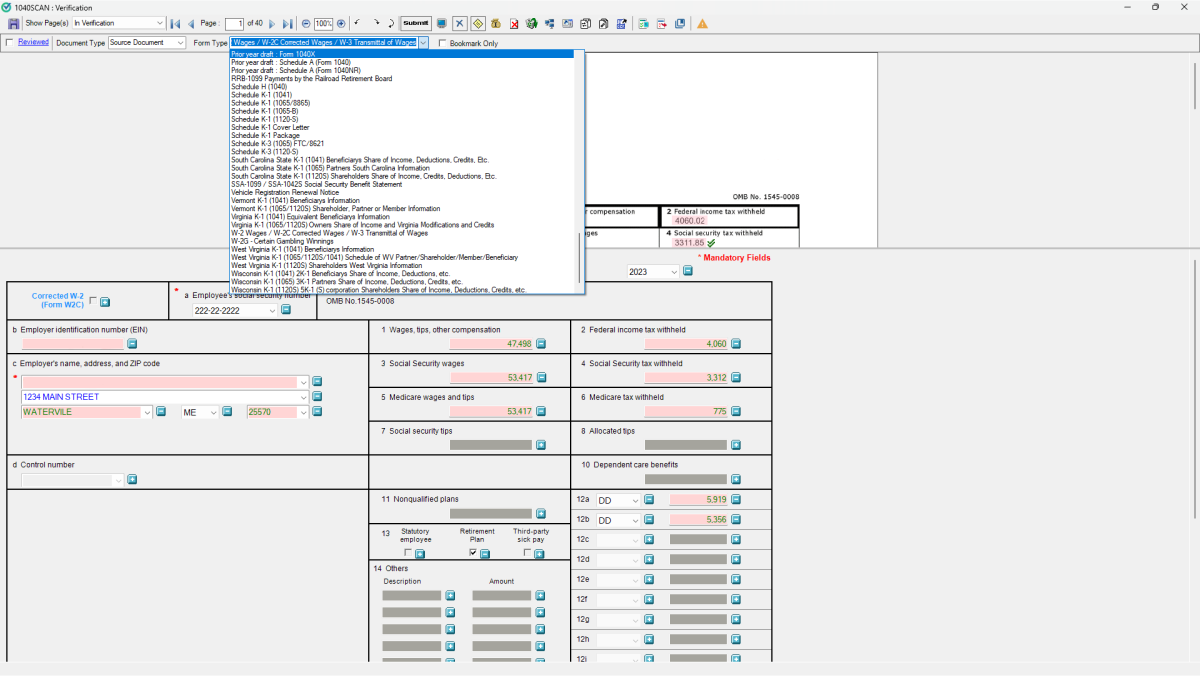

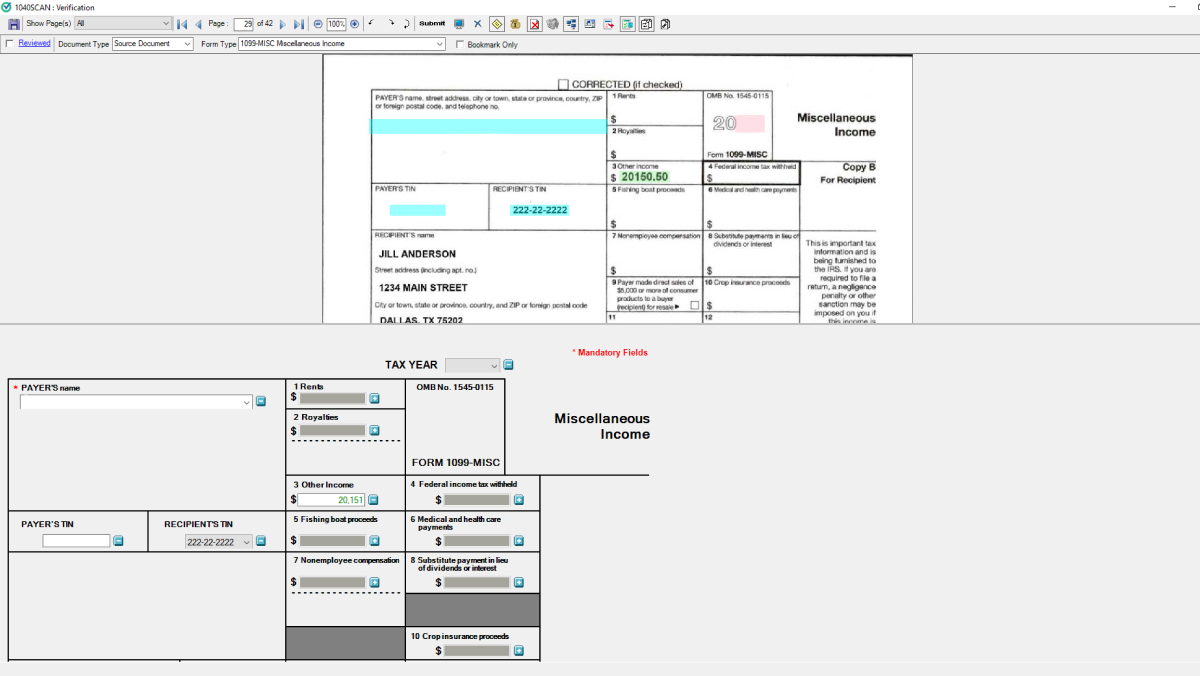

Optical character recognition (OCR)

Scan documents and convert them into usable data with OCR software. 1040SCAN is purpose-built to use OCR with tax returns. It extracts information from tax documents and exports the data directly to your tax software, emphasizing convenience and efficiency. Process more tax documents than any competitor and implement unique verification options with our leading scan-and-populate solution.

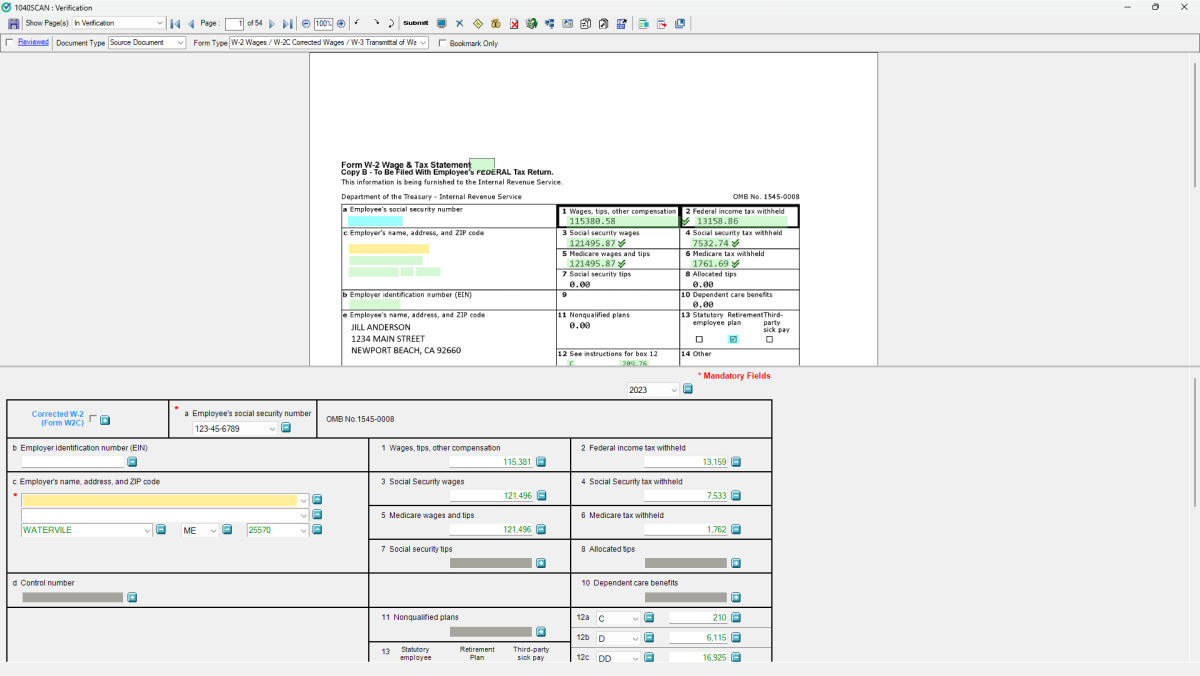

Intelligent data verification

All data captured by OCR needs verification, and 1040SCAN eliminates the need to verify OCR data for 65% of standard documents by combining patented text-layer matching and AI. For text-layer matching, our tax software compares native PDFs to OCR-extracted data, eliminating the need for manual checks when they match. The AI engine will automatically verify data using machine learning to set rational thresholds that help the system catch mistakes.

Document coverage

Recognize 4 to 7 times as many tax documents as competing scan-and-populate solutions. 1040SCAN is the only software that can verify data from Federal Organizer pages, grantor letters, and Schedules K-1. It can also identify several fields other tax software ignores, including margin interest, investment fees, and foreign income.

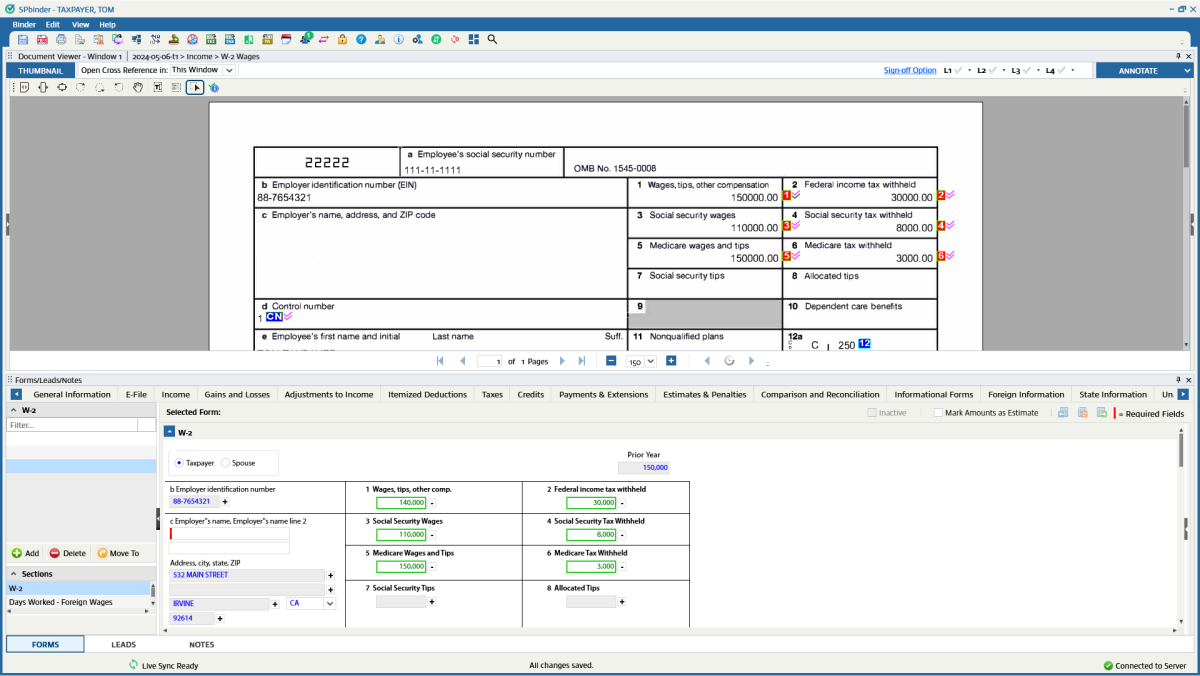

Review Wizard

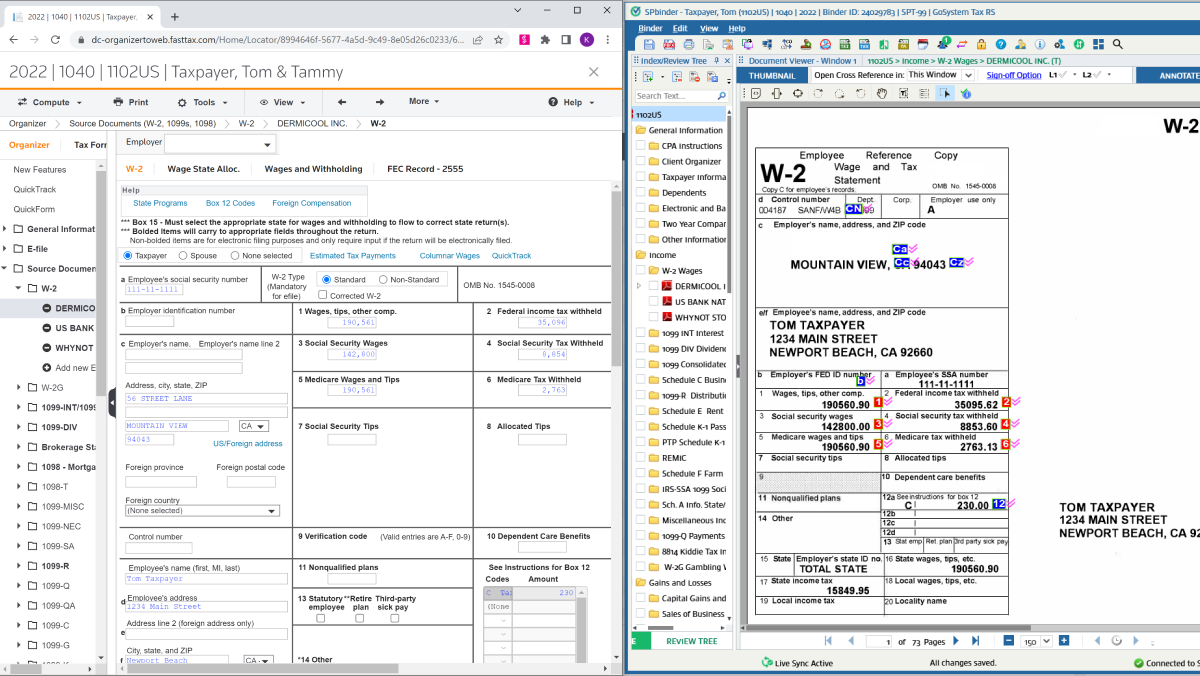

Use this verification tool to guide your staff through a standardized verification workflow. The system displays the original document and the captured data in adjacent panels for easy comparison. From there, your staff can correct any mistakes or manually capture missed fields.

Optimize your tax return process with 1040SCAN

Work paper organization

Avoid spending hours on binder assembly and focus on your firm's productivity with these tools that help with document standardization.

Bookmarking and indexing

Automatically bookmark and organize tax documents into a standardized index tree. 1040SCAN sorts files into the tax work-paper index individually, even when there are multiple workpapers per file. Your firm can even create a binder by uploading documentation or integrating with TaxCaddy to bring client documents into this cloud-based automated software.

Expedite the assembly process for tax returns with 1040SCAN

Software integration

1040SCAN integrates seamlessly with other tax solutions to create ease and automation for all tax professionals.

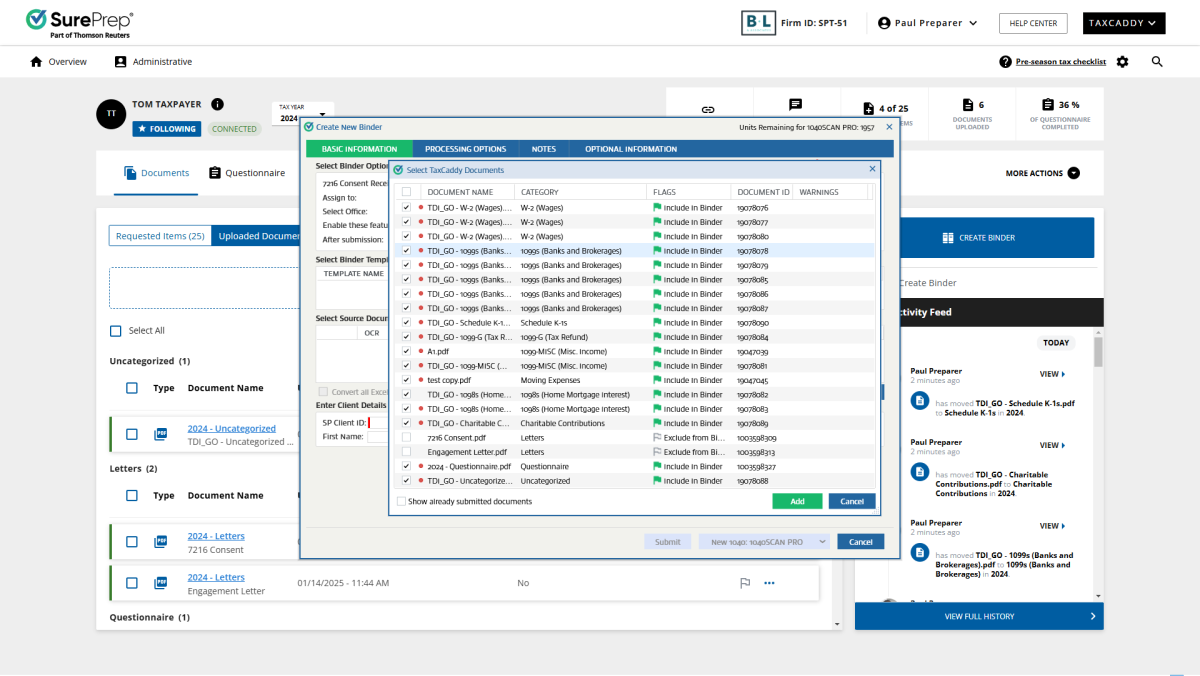

TaxCaddy

Easily integrate with TaxCaddy, a 1040 taxpayer collaboration platform that gathers documents and delivers finished returns. Create a binder for clients in TaxCaddy's dashboard, and then the binder will send the client's documents to 1040SCAN, where it will organize, scan, and export source documents into a standardized work paper index.

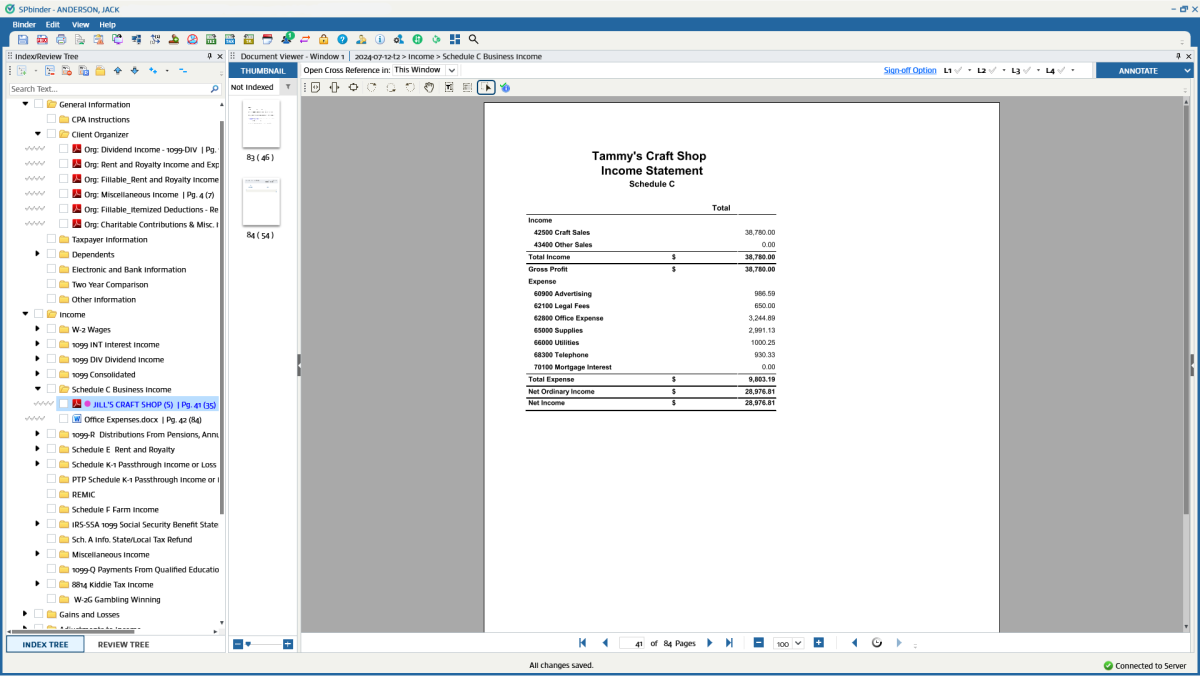

SPbinder

After bookmarking and indexing data in 1040SCAN, find your workpapers neatly organized in the index tree in SPbinder. With work paper organization and data entry already complete, your staff has more time for preparation. Also, use SPbinder's suite of tools, including Review Tree and Digital Leadsheets, to make the binder easier to navigate and review.

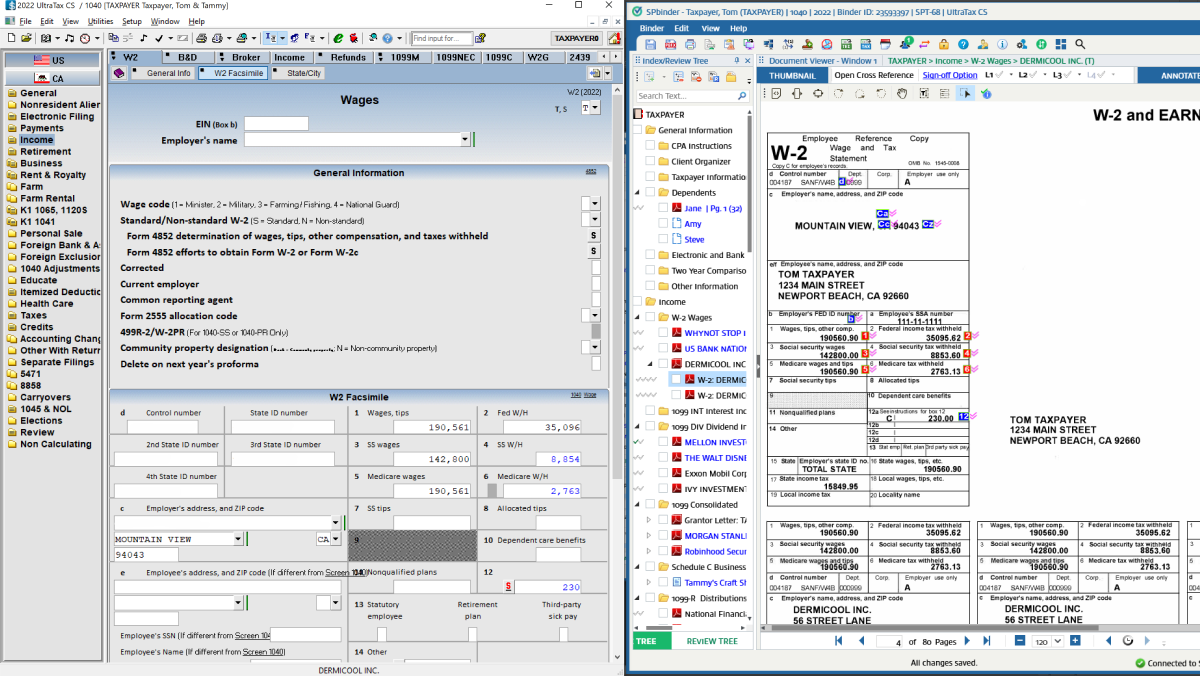

Ultratax CS

Automatically ingest source document data from 1040SCAN into Ultratax CS, a tax preparation software that helps professionals complete more income tax returns in less time. Preparers won't have to painstakingly assemble workpapers manually due to 1040SCAN's scan-and-organize functionality.

GoSystem Tax RS

1040SCAN works with GoSystem Tax RS, a cloud-based professional income tax software that files different tax return types. Save time by organizing data in 1040SCAN; then prep returns in GoSystem Tax RS, including multitiered consolidated corporate returns, life insurance returns, and tax equalization returns.

Maximize the potential of 1040SCAN today

Questions about 1040SCAN? We're here to support you.

800-968-8900

Call us or submit your email and a sales representative will contact you within one business day.

Contact us