UltraTax CS features

Elevate your firm with increased automation and seamless integration tools to simplify tax workflows

Find out what makes UltraTax CS a premium tax and compliance solution that manages the process from start to finish

Complete timely and accurate tax compliance engagements with resources and tools that serve a wide range of client opportunities.

Returns and forms availability

Address all possible client requirements with ease when your firm is provided with broad programs for federal, state, and local tax filings. UltraTax CS manages multistate returns as well as specific offerings for individual tax returns such as the 1040, corporate returns like the 1120, partnership returns on form 1065, and estates and trusts filings with form 1041.

Intelligent calculations

Anticipate potential issues and make informed decisions using meticulous calculations to manage an array of client tax scenarios in a real-time data preview during the initial input. Instantly see the implications of each entry on the spot and assure the client that you are handling their returns with precision and care.

Data sharing

Streamline the data management process with seamless transfer and information exchange in UltraTax CS. The software's intuitive design ensures that entering data into a client's tax return automatically populates all pertinent areas within other related tax returns. This feature eliminates the need for repetitive data entry, reduces the chance of errors, and saves valuable time.

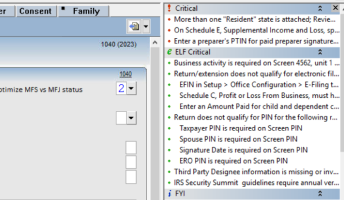

Advanced diagnostics

Receive alerts about outstanding issues with an instant checklist detailing all the fields where you had entries last year but haven't entered data for this year. Additionally, you can create a client email to note missing information.

Data mining

Easily identify advisory opportunities and manage client services more effectively with this powerful search tool. UltraTax CS allows you to quickly spot clients affected by new tax laws or changes in your service.

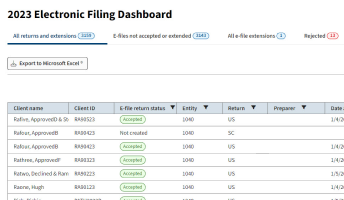

E-filing and online dashboard

Save time by monitoring each step of the e-file process with thorough error checking to ensure that returns are complete and accurate before transmission. Access an online dashboard anywhere on any device to track e-file status.

Get all the returns, forms, and capabilities essential to execute a comprehensive tax workflow

Have questions? Contact a representative.

Enhance the value of client engagements with supporting products and partners that work in sync with UltraTax CS.

Product integration

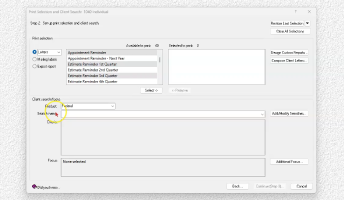

Increase firm workflow and eliminate repetitive data entry to help transfer and share information by integrating UltraTax and other CS Professional Suite products, as well as Checkpoint, Onvio Firm Management, and SurePrep.

Developed partnerships

Correctly report cryptocurrency transactions, rely on tax audit defense, and automate the assembly and delivery of returns with Ledgible, Protection Plus, and SafeSend Returns, solutions that are engineered to integrate with UltraTax CS.

The value of eSignature

Use eSignature with UltraTax CS to set up engagement letters, manage your clients' 8879 forms, and more. Feel assured that your firm will have an added layer of security to identify clients and capture signatures with knowledge-based authentication (KBA).

Expand the power of UltraTax CS with integrated products and partnerships that help to streamline your tax workflow

Have questions? Contact a representative.

Maximize the value of your tax software with features built to complete returns with ease and confidence that produce a trusted, profitable client relationship.

Depreciation and asset management

Guarantee the most accurate applications with mid-quarter, prior-year, and other depreciation calculation capabilities. Select from various asset types that automatically insert the correct asset method and life for federal and state purposes through UltraTax CS.

Multistate capabilities

Experience the convenience of a single screen in UltraTax CS for entering all apportionment data across all states in business returns. Benefit from a multistate allocation grid for individuals designed to expedite both the preparation and review stages.

Multimonitor flexibility

Easily display client information, form details, current-year and prior-year returns, and other diagnostic tools with independent views synchronized with one another on up to four separate monitors.

System updates

Avoid system interruptions and enjoy worry-free maintenance with streamlined updates through UltraTax CS. The system automatically applies updates without requiring users to log off, which is especially important during the busy season.

Customer service

Ensure you get the best solutions from UltraTax CS with free onboarding assistance, customer service, a Help and Support Center, and a private community to network with other professionals.

Equip yourself with a complete suite of tools and options to confidently tackle tax compliance engagements

Have questions? Contact a representative.

Questions about UltraTax CS?

We’re here to help.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us