Tax and accounting software and research solutions

Explore our tax, accounting, and research solutions to help manage both day-to-day tasks and future growth

Tax, audit and accounting

Expand your team’s capabilities with premier tax and accounting software and research solutions.

Explore tax and accounting

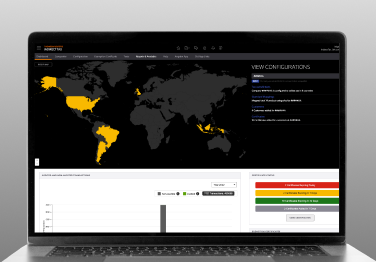

International trade and supply chain

Communicate, manage, and track your partners within the global supply chain to identify any risks to remaining compliant.

Explore international trade and supply chain

Tax, audit, accounting and trade solutions

Take advantage of our groundbreaking software to help make your business a one-stop, full-service resource.

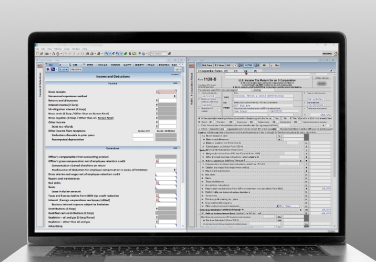

UltraTax CS

Professional tax software for tax preparers and accountants, including a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

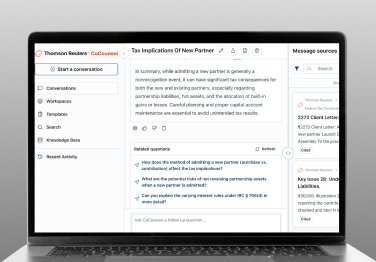

CoCounsel Tax

Transform your tax practice with CoCounsel Tax, an AI-powered assistant that combines trustworthy answers, automation, and firm knowledge into one seamless platform. Enhance efficiency, reduce risk, and improve client confidence with CoCounsel Tax.

ONESOURCE Determination

Market-leading global tax determination software that automates tax calculations. Report on sales and use tax, GST, VAT, and excise tax using the latest rates and rules.

Tax and trade insights

Stay updated with our regularly published tax and trade tips and advice.

AI

Challenges of adopting AI in accounting firms

Identify barriers to AI adoption for your firm

TRADE

How integrated global trade content systems transform compliance into strategic advantage

Turn oversight into actionable global advantage

Tax

How accounting firms are overcoming challenges with AI

Discover how AI can help your firm

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us