Tax Workflow

2022 tax season review: Turning challenges into opportunities

Join our roundtable to review key insights, pain points, and takeaways from the 2022 tax season

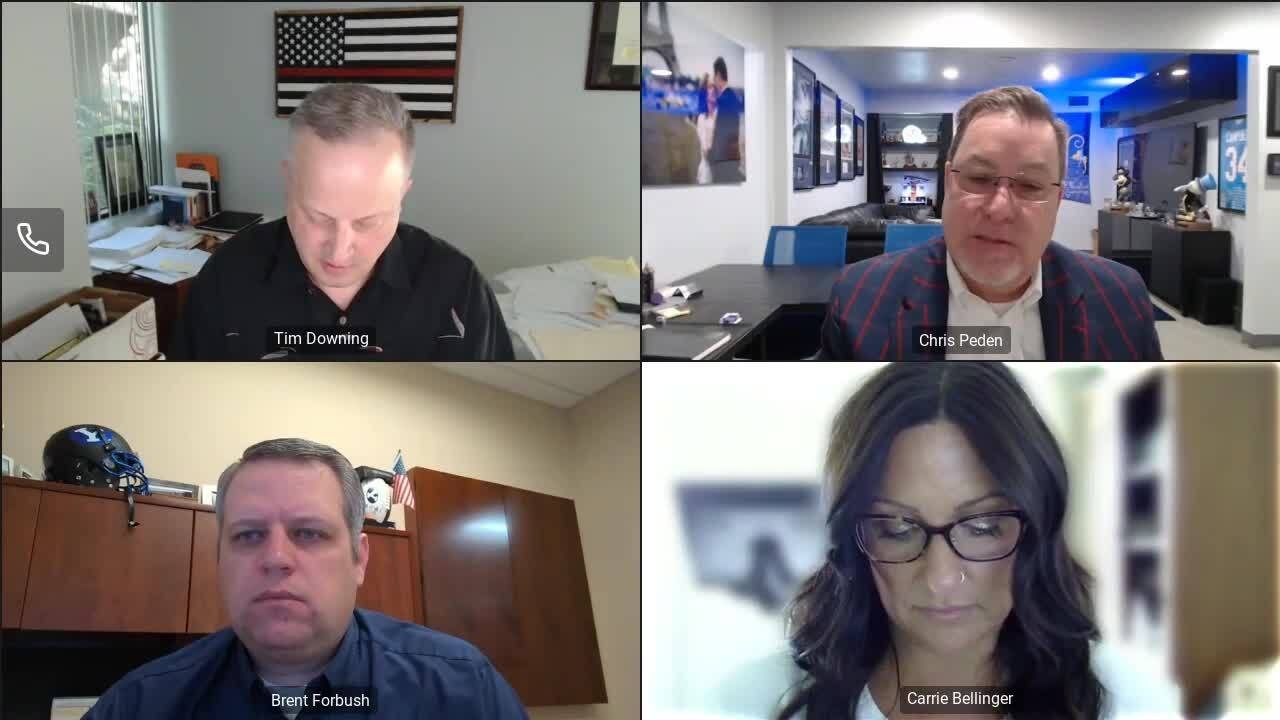

Speakers

Tim Downing

Brent Forbush

Chris Peden

Carrie Bellinger

What you will take away

Tax season comes along faster every year — and with it, a new set of challenges. Tax season can be difficult for many, whether from the rise in client demands or the pressures of a constant stream of tax law changes and legislative updates. During these difficult times, remember that with challenges also come significant growth opportunities. So, what can you do now to be more prepared, efficient, and profitable in 2023?

Join our engaging roundtable for a retrospective look at the 2022 tax season. Our expert panel will share actionable insights and key takeaways on how your firm can turn challenges and learnings into growth-oriented action.

Additional details

Better tax software with UltraTax CS

Professional tax software for tax preparers and accountants