Tax data hub

Gain control over tax data complexity with ONESOURCE Data Hub

Rapidly process and store tax information for use, reuse, and audits with a centralized tax data solution

Save time, reduce risk, and make data more accessible

Spend less time manually processing tax data

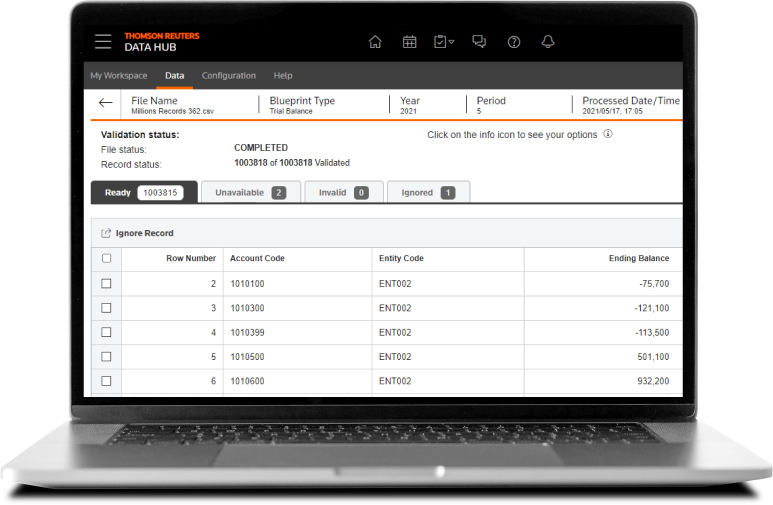

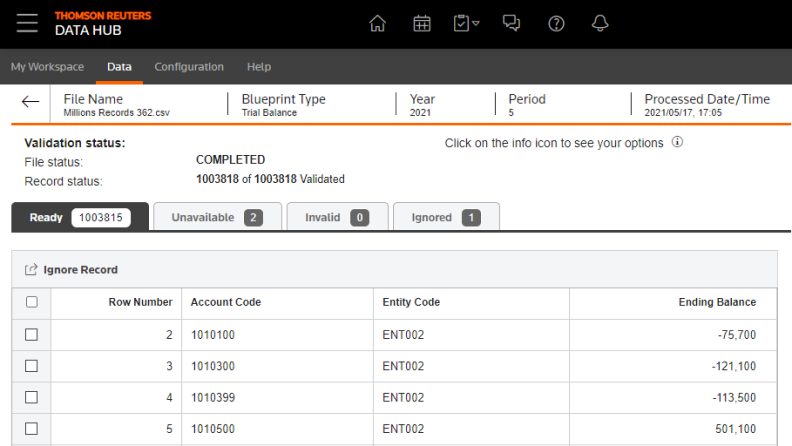

Regulatory changes, data volumes, and reporting complexity make it more challenging to prepare data for tax. Data processing and preparation can be a painful, repetitive process. Reduce errors at every touchpoint with Data Hub, a tax data solution that automatically loads, consistently processes, and prepares data based on defined criteria.

Have questions?

Contact a representative

Quickly prepare data for tax use

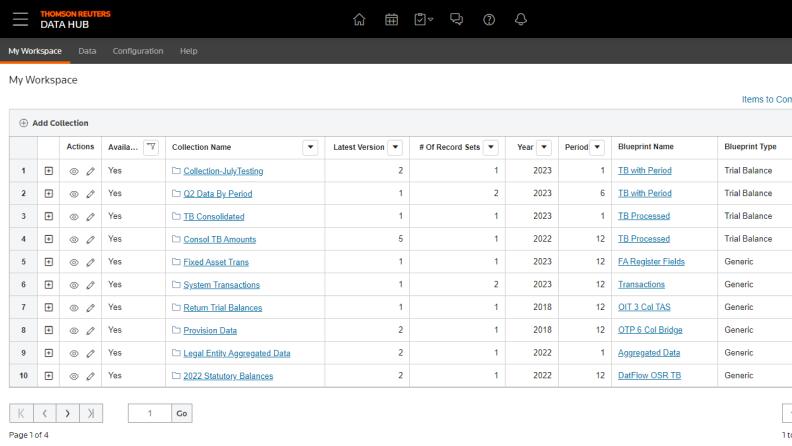

In-house tax uses data from multiple disparate sources, including enterprise resource planning and other business systems. Data comes in varying formats that require hours to process and prepare for use, including layering in missing details tax needs. Data Hub automatically layers in relevant details such as geographies and converts currencies, enriching and strengthening the data for use by tax.

Have questions?

Contact a representative

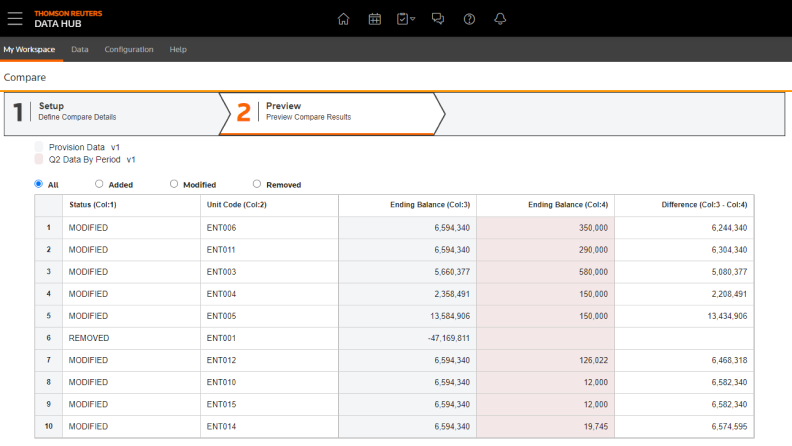

Centrally store data in a single tax solution

Limited access to tax data leads to repeated processing, which wastes time and creates the risk of inconsistency. By centrally storing data in a tax data solution like Data Hub, you can rely on consistency and accuracy for the short and long term. Confidently know that the data is precise and you can use it for audits, historical reporting, and other compliance needs.

Have questions?

Contact a representative

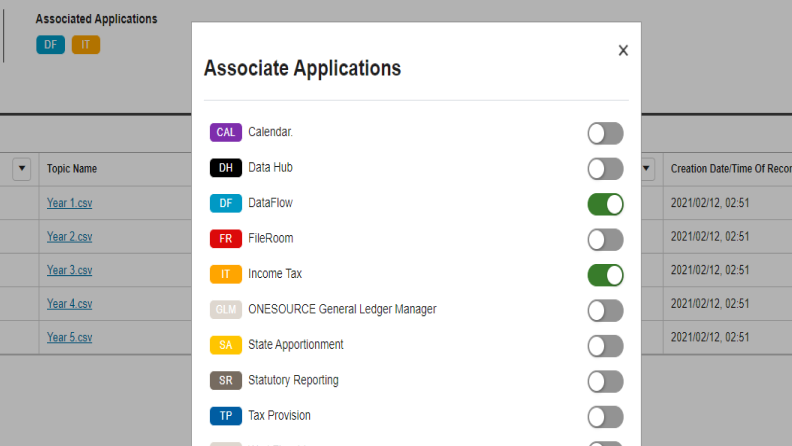

Integrate across third-party data visualization and analytic tools

Getting data in and out of tax systems can be difficult. Data Hub integrates with any system to push and pull data. This connectivity and flexibility make it easy to expand the use of data across third-party visualization and analytics tools, including Alteryx.

Have questions?

Contact a representative

Access tax data easily in one centralized repository

How in-house tax benefits from automated and centralized data management designed for tax

In-house tax teams need to prepare disparate, complex tax data for compliance faster than ever. Data Hub allows seamless data connectivity to quickly and accurately prepare data for use and reuse.

Comply confidently

Meet frequently changing tax compliance requirements using consistent and accurate data that accelerates the financial close, tax reporting, and other requests for tax data.

Mitigate risk

Gain governance and control over tax data with standardized, no-touch processes, removing the risk of errors. Detect data irregularities and certify data meets expectations for process requirements.

Free up time for strategic analysis

Consistently use enhanced and accurate data in visualization and tools for analysis, dashboards, and building “what-if” scenarios.

Questions about Data Hub? We're here to support you.

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us