ONESOURCE Determination for sales tax

Get transaction taxes right the first time, every time, for growing companies.

Give your tax team a single source of truth, and enable stronger collaboration and visibility across your business systems with the ONESOURCE Determination intelligent tax engine. Built on native cloud technology, ONESOURCE Determination allows you to automatically calculate sales tax on transactions, no matter how often rates change. Backed by trusted content, you have access to the tax information you need at your fingertips, without having to worry about manually researching tax law changes or paying large fees.

Determination can take manual, repetitive sales tax work out of the equation, giving your team time to focus on more strategic activities and deliver value to your growing business.

Spend less time manually researching rates and pushing or pulling data and more time focusing on where your company can go next. In a growing company, it can sometimes feel like you’re constantly playing catch-up when it comes to keeping up with new tax regulations. And if you’re expanding into new markets, that complexity only grows, as does the time it takes to address it. ONESOURCE Determination has the most up-to-date content with real-time updates as regulations change, across a broad range of product categories. And it connects to your existing business systems to make calculating tax seamless.

ONESOURCE Determination has the broad content coverage, flexible technology, and seamless business system integrations you need to create efficiencies in your sales tax processes and automate formerly manual work.

We wanted a reliable, accurate tax solution that was flexible enough to grow with our company and would give us confidence that our tax activities were accurate.

How Determination can be a part of your business’s technology transformation.

When you’re a growing company, it’s usually a time of technological transformation – moving from manual processes to automated ones as your business expands. But if that transformation is done piecemeal, or if tax isn’t brought to the table, you can be left with disparate systems that don’t talk to each other, creating more work for your team. If your company is looking at new technologies to support run-the-business activities – whether that be a new ERP, ecommerce, or finance system – it’s usually the best time to also talk about your tax needs. ONESOURCE Determination seamlessly integrates with many systems on the market today, allowing regulatory updates, jurisdictional changes, and other tax policy data to be added and applied throughout your organization from a centralized, cloud-based hub.

By integrating ONESOURCE Determination with your business systems, you can reduce time, effort, and risk posed by manual processes or disconnected solutions. Plus, you can easily apply your tax policy consistently across your business and collaborate across regions with our cloud-native solution.

When we expand, the tax system will already be in place. To have that essentially done effectively and correctly already is a huge bonus.

How Determination can support your business as it expands into new markets.

It’s exciting to be part of a growing company, watching as it expands into new opportunities and reaches new customers. But from a tax perspective, expansion can also be challenging, especially if you have a small team. Individual states, counties, and cities have their own ever-changing rates for taxable transactions, and as you grow, it can quickly become overwhelming to keep up with these changes and filing requirements. ONESOURCE Determination has content coverage of thousands of jurisdictions, both in the US and internationally, to support you wherever you go. And our cloud technology means that no matter where you do business, ONESOURCE remains a central source of truth, accessible wherever you need it.

ONESOURCE Determination has the widest coverage of product taxability categories, the centralized cloud structure, and the seamless integration to support any new additions to your tech stack.

When we expand, the tax system will already be in place. To have that essentially done effectively and correctly already is a huge bonus.

How Determination can help you reduce risk & limit tax audit exposure.

ONESOURCE Determination ensures you get sales and use tax right the first time, every time, while keeping track of shifting regulations, so that you can reduce the risk of costly penalties and reputational damage. Because calculating taxes correctly isn’t just a matter of getting the math right - it's vital to the health of your organization. Inaccurate tax calculations can be costly, and can inhibit your organization’s ability to plan, grow, and adapt to changing market dynamics. Tax errors can also result in penalties that impact your bottom line and can even affect public perceptions and customer loyalty.

ONESOURCE Determination has the trusted content, reporting, and data connections you need to reduce risk and ensure that your sales tax calculations are accurate.

We wanted a reliable, accurate tax solution that was flexible enough to grow with our company and would give us confidence that our tax activities were accurate.

Are you interested in finding out more about how we can help with the following?

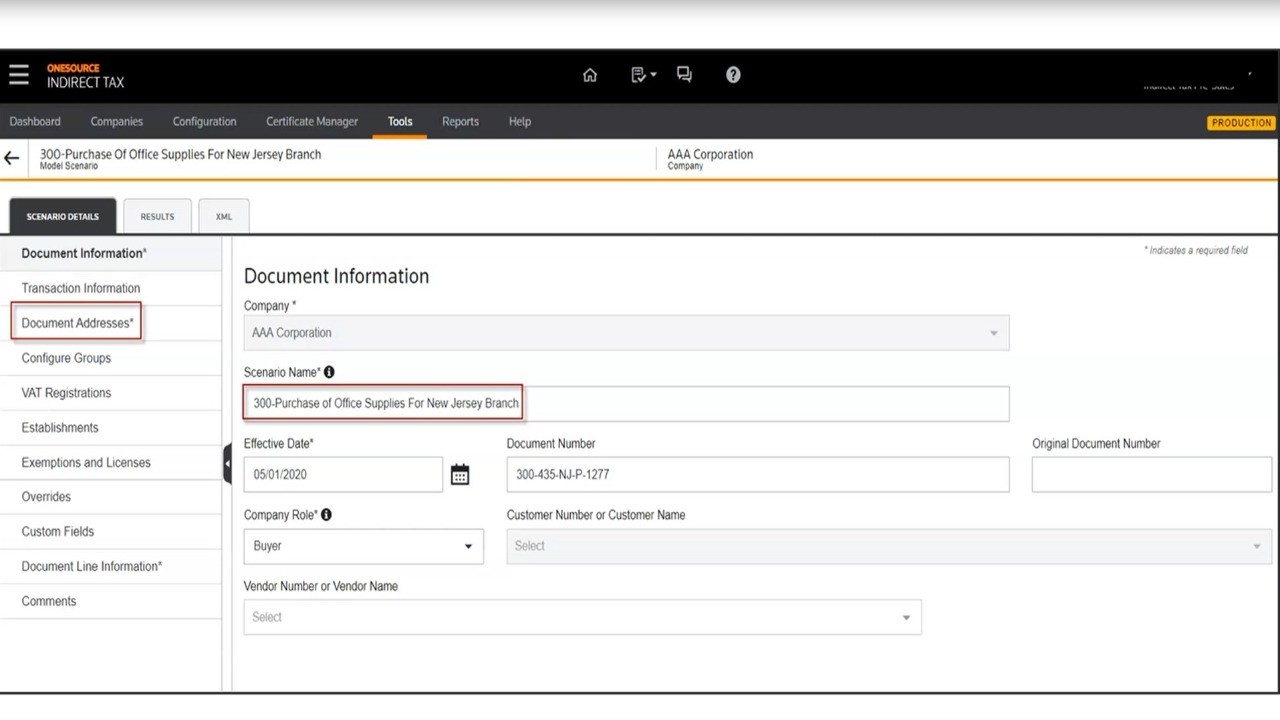

See how it works

Have questions about sales tax automation? ONESOURCE Determination has answers. Learn how to configure your company structure, set up tax calculation for multiple jurisdictions, streamline tax returns, and more.