Uncertain Tax Positions module

Analyze and report on open positions under ASC 740-10 (formerly FIN 48)

Why choose Uncertain Tax Positions module

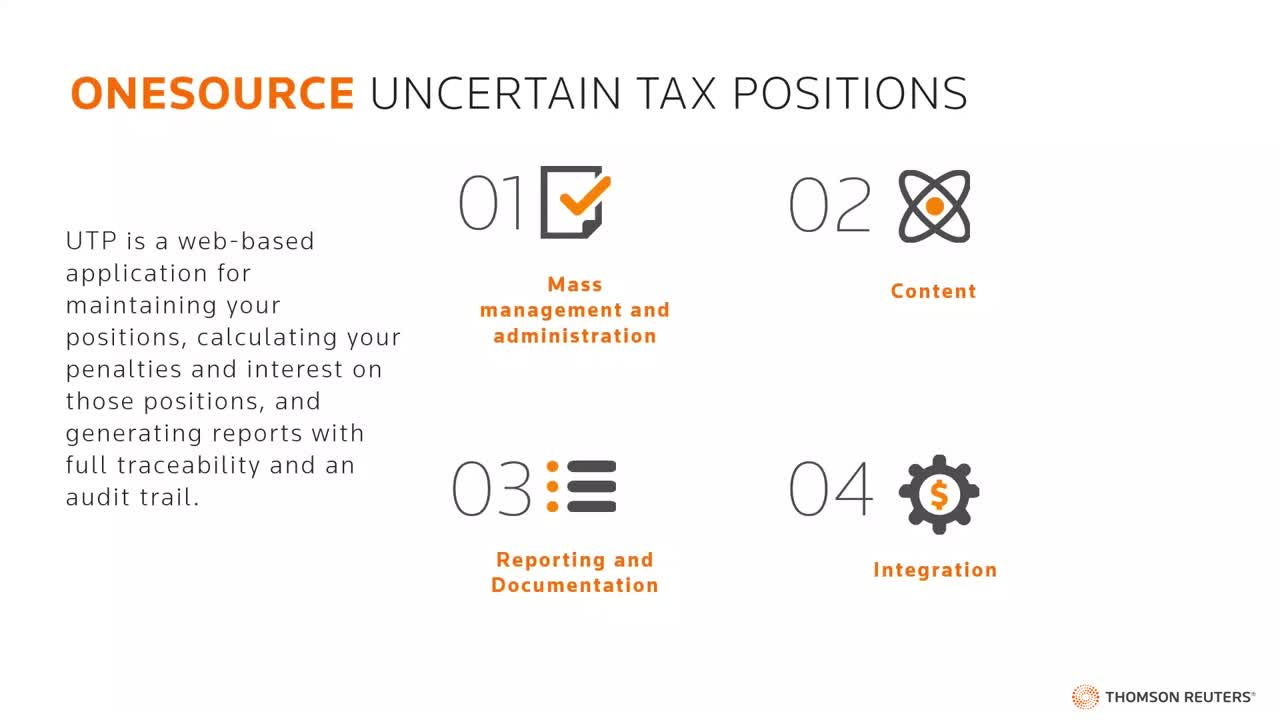

Changing IRS requirements are putting pressure on businesses to report on their uncertain tax positions. Thomson Reuters ONESOURCE Uncertain Tax Positions module (formerly TaxStream FIN 48) gives you the tools to analyze and report tax treatment of open positions under ASC 740-10-50 and IAS 37. Use this flexible, web-based software, which integrates with ONESOURCE Tax Provision, to give more complete descriptions of the issues related to your tax uncertainties, while managing your tax reserves effectively. Keep an organized inventory of all your positions, calculate tax and interest for each one, and report on them with a full audit trail — all while getting the information you need to make decisions about what to disclose.

Useful links

What you get with our tax reserves management

Manage your uncertain tax positions more effectively so you can more accurately report to the IRS and other auditors.

No need to manually update interest and tax calculations — the software does it for you as your inventory of positions changes.

Track domestic, state, foreign, and other uncertain positions over time with all relevant documentation.

Watch Uncertain Tax Positions in action

Leveraging technology to navigate UTP changes

Find out how ONESOURCE can help transform your Uncertain Tax Positions processes.

Uncertain Tax Positions at Electronic Arts

Learn how Electronic Arts uses ONESOURCE Uncertain Tax Positions.

Tax provision customers also buy these solutions

Get everything you need to automate and streamline your corporate income tax process, from planning and provisioning to filing and reporting.

Ready to start a conversation?

Need more information about how our solutions can work for you? Drop us a line and someone from our sales team will get back to you.

Or call a representative in your region at

888-885-0206