Cloud-based audit management system

Reimagine engagement management with Guided Assurance

This assurance advisor offers a guided audit-tracking technology and the tools you need to perform efficient and profitable audits that comply with professional standards and pass peer review

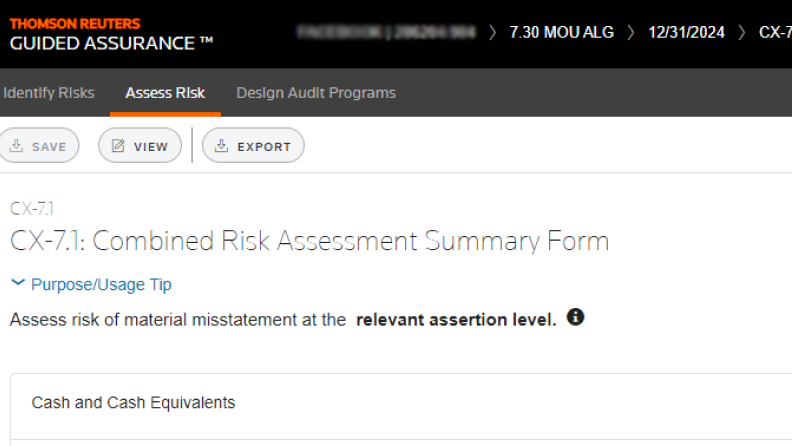

Design a risk-based audit approach for engagements of all sizes

Access leading audit methodology backed by experienced editors and authors

Boost your expertise with PPC audit guides overflowing with practical considerations, real-life examples, time-saving checklists, and practice aids. Discover why more than 90% of the market relies on content and audit methodology from Thomson Reuters to consistently pass peer review.

Explore more features

Have questions?

Contact a representative

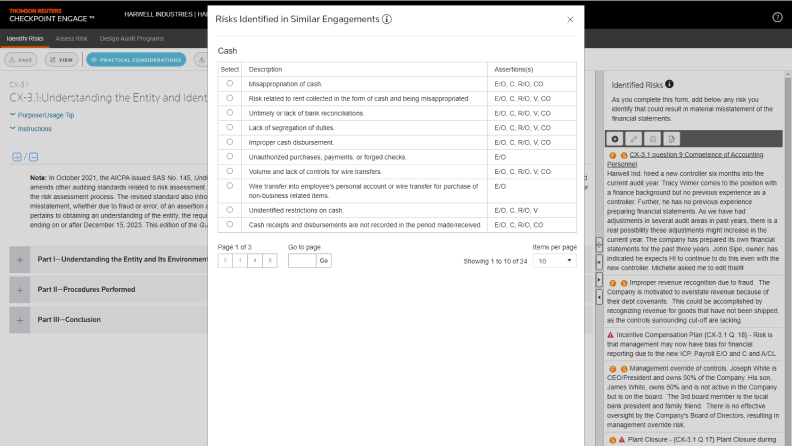

Avoid inefficient auditing with a customized risk-identification solution

Leave over- and under-auditing behind. Harness the power of AI to create a customized audit program based on documented risks and assertions and see a clear picture of how your firm's identified risks stack up with similar industry engagements.

Explore more features

Have questions?

Contact a representative

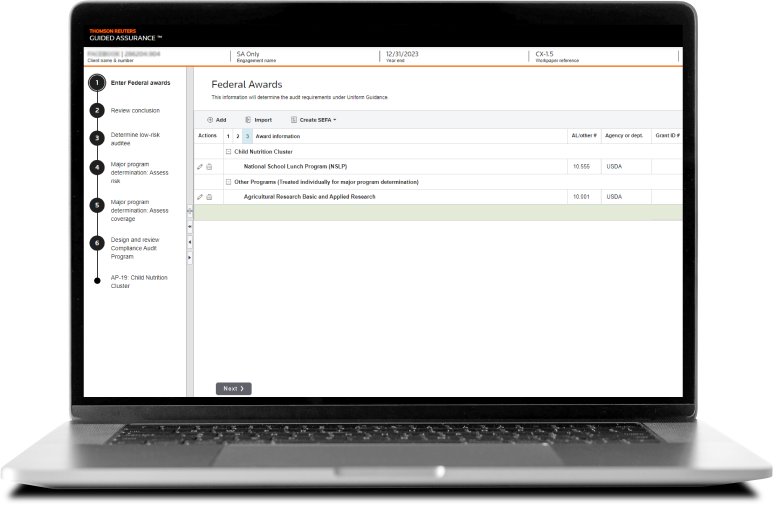

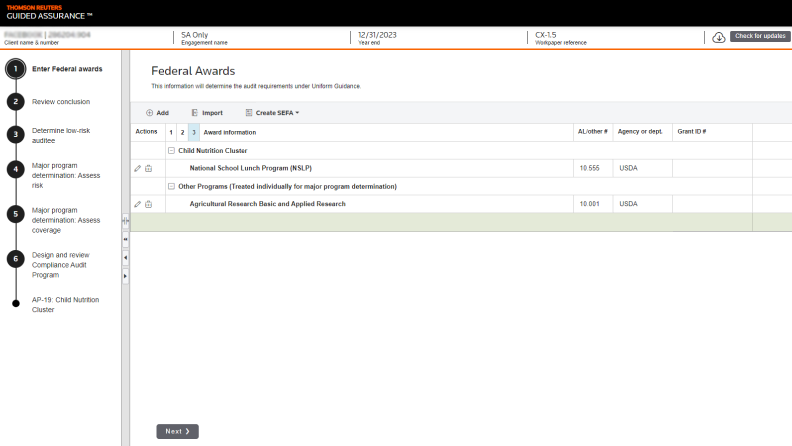

Keep your single audits efficient and compliant with a guided, automated process

Access a cloud-based solution for the automated guidance you need to overcome complex, challenging, and ever-changing audit requirements. Save time by relying on Guided Assurance Single Audit to automatically generate compliance programs from the Office of Management and Budget (OMB) Compliance Supplement.

Explore more features

Have questions?

Contact a representative

As a cloud-based solution, Guided Assurance offers the flexibility you need

Universal compatibility

Bring together the gold standard in audit methodology with the engagement manager of your choice. Guided Assurance offers a PPC file format to gain the benefits of our cloud-based methodology with automatic updates and the flexibility to work from any engagement manager.

Real-time, multi-location collaboration

Easily access data, coordinate fieldwork, collaborate on engagements, and review processes simultaneously from anywhere without version control issues.

Dynamic setup

Tailor engagements, removing unnecessary forms and programs based on your answers to a few quick questions.

Questions about Guided Assurance? We're here to support you.

800-968-8900

Call us or submit your email and a sales representative will contact you within one business day.

Contact us