Indirect tax automation

Harness the power of automation with ONESOURCE Indirect Tax Determination

Take the risk out of the equation and automate processes that drive greater efficiency with numbers you can count on with ONESOURCE Indirect Tax Determination.

What can ONESOURCE Indirect Tax Determination do for you?

Automate and simplify your indirect tax calculations

Calculate your indirect taxes with an automated solution for global sales tax, use tax, GST, VAT, and excise tax.

Explore more features

Have questions?

Contact a representative

Seamlessly connect all your business systems

Connect to ERP, financial, billing, e-commerce, POS, or payment systems through pre-built and custom integrations with ONESOURCE Indirect Tax Determination.

Explore more features

Have questions?

Contact a representative

Avoid errors and minimize risk with confidence

Reduce the risk of audit-triggering mistakes using our in-house expertise, backed by SSAE 18 and ISAE 3402 certified processes.

Explore more features

Have questions?

Contact a representative

Oil and gas

Our single tax engine has everything to support oil and gas tax calculations, from sales and use, motor fuels excise, and value-added taxes to volumetric-based taxes like Superfund.

Retail

Tax management for retailers to ensure compliance, even during peak sales periods, without compromising customer experience.

Manufacturing

Accurately validate and reconcile vendor-charged tax on equipment, drop shipments, materials, and other goods and services.

Technology

Modernize tax processes and give your business the competitive edge with the latest solutions for every tech industry challenge.

The value of ONESOURCE Indirect Tax Determination

See how it works

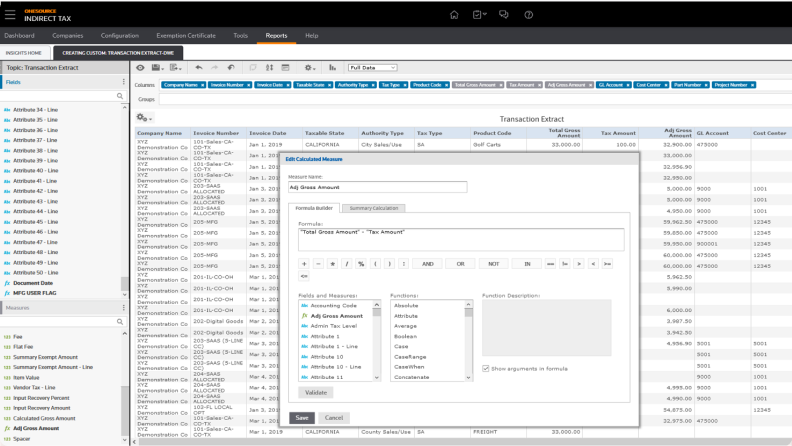

Watch the video and learn how ONESOURCE Determination simplifies configuring a company structure, setting up tax calculations for global jurisdictions, streamlining tax returns, and more.

Tour ONESOURCE Determination

Manage product and service-specific taxability.

Tailor an integration to a specific workflow or process without disrupting the business.

Use standard APIs to connect ONESOURCE Determination to business workflows, applications, or platforms without a complex software implementation.

Take advantage of edge computing with ONESOURCE Determination Anywhere

Enhance security and performance

Maintain business-specific security and data residency requirements with our market-leading tax engine, which automatically delivers global tax rates, rules, and calculations in real-time.

Maximize the efficiency of tax calculations

Eliminate downtime from system and content updates with automatic synchronization between Determination Anywhere and the ONESOURCE Indirect Tax engine that sits in the cloud, even with high transaction volumes.

Stay current with tax changes with ease

Receive current, global tax content that touches on even the most specialized jurisdictions and industries. Your team does not need to spend time researching rates and taxability rules.

Questions about ONESOURCE Tax Determination? We're here to support you.

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us