ONESOURCE Determination for indirect tax

Get sales and use tax, VAT, and GST right the first time, every time, for large corporations.

Automatically calculate sales and use tax, VAT and GST on any transaction, no matter how often rates change with our intelligent tax engine, ONESOURCE Determination. Access the tax automation you need at your fingertips, all backed by trusted content covering thousands of jurisdictions across the globe. Handle large amounts of transactions in milliseconds, all while giving your tax team a single source of truth, enabling stronger collaboration and visibility. This is all made possible through Determination’s native cloud technology and with seamless integrations to existing business systems.

Streamline your indirect tax processes and get seamless data connections, giving your team visibility and a single source of truth across all the regions you operate in, all in the cloud.

For corporations operating in multiple jurisdictions, it can sometimes feel like you’re constantly playing catch-up when it comes to keeping up with new global tax regulations. And with the international move toward digitizing tax and real-time reporting, your team has more pressure than ever to get the right answers quickly. ONESOURCE Determination has the most up-to-date content and built-in tax logic with real-time updates as regulations change, across a broad range of product categories. The solution also has zero downtime for updates and system maintenance. It connects to your existing business systems to make calculating indirect tax seamless. That means less time spent on consolidating data from multiple systems and more time spent on value-added activities to drive your business growth.

Create efficiencies in your indirect tax processes and bring together data from disparate sources with ONESOURCE Determination’s broad content coverage, latest cloud technology, and seamless business system integrations to save you time.

We chose ONESOURCE over the other suppliers because of the global reach of the product. We were looking for something that would give that global reach, and other suppliers didn’t offer it.

How ONESOURCE Determination can be a part of your business’s technology transformation.

Technological transformation projects can seem daunting, especially for large corporations looking to make a big move like upgrading ERP systems or moving to the cloud. But if that transformation is done without bringing tax to the table early, you can be left with disparate systems that don’t talk to each other, creating more work for your tax team. If your company is looking at new technologies to support run-the-business activities – whether that be a new ERP, ecommerce, or finance system – it’s usually the best time to also talk about your tax needs. ONESOURCE Determination seamlessly integrates with numerous systems on the market today, allowing regulatory updates, jurisdictional changes, and other tax policy data to be added and applied throughout your organization from a centralized, cloud-based hub.

By integrating ONESOURCE Determination with your business systems, you can reduce time, effort, and risk posed by manual processes or disconnected solutions. Plus you can easily apply your tax policy consistently across your business and collaborate across regions with our cloud-native solution.

It was a perfect storm of tax challenges. Instead of being swept up in it, we decided to use it as a basis for transformation. With indirect tax becoming more and more important to governments around the world from a revenue perspective, we knew we needed a single, global solution with a local focus.

How ONESOURCE Determination can support your business as it expands into new markets.

It’s exciting to watch as your company expands into new opportunities, acquires or merges with other corporations, and widens its reach to new customers. But from a tax perspective, expansion can also be challenging. Individual countries, provinces, states, counties, and cities have their own ever-changing rates for taxable transactions, and it can quickly become overwhelming to keep up with these changes and filing requirements. ONESOURCE Determination has the widest coverage of thousands of jurisdictions across the globe, supporting various tax types, so that you’re covered no matter where you expand. And our cloud technology mean that no matter where you do business, ONESOURCE remains a central source of truth, accessible wherever you need it.

ONESOURCE Determination has the widest coverage of product taxability categories, a centralized cloud structure, and the seamless integration to support any new additions to your tech stack.

We took a look at ONESOURCE IDT and saw some interesting characteristics that we could use in an innovative way to put it on the website and calculate taxes in a very fast, reliable, accurate manner.

How ONESOURCE Determination can help you reduce risk & limit tax audit exposure.

ONESOURCE Determination ensures you get indirect tax right the first time, every time, while keeping track of shifting global tax requirements, so that you can reduce the risk of costly penalties and reputational damage. Because calculating taxes correctly isn’t just a matter of getting the math right - it’s vital to the health of your organization. Inaccurate tax calculations can be costly and can inhibit your organization’s ability to plan, grow, and adapt to changing market dynamics. Tax errors can also result in penalties that impact your bottom line and can even affect public perceptions and customer loyalty.

ONESOURCE Determination has the trusted content, reporting, and system connections you need to reduce risk and ensure that your indirect tax calculations are accurate.

We wanted a single set of rules that the tax department could control – not IT, and not the end user – to make sure that our tax liability was accurate.

Are you interested in finding out more about how we can help with the following?

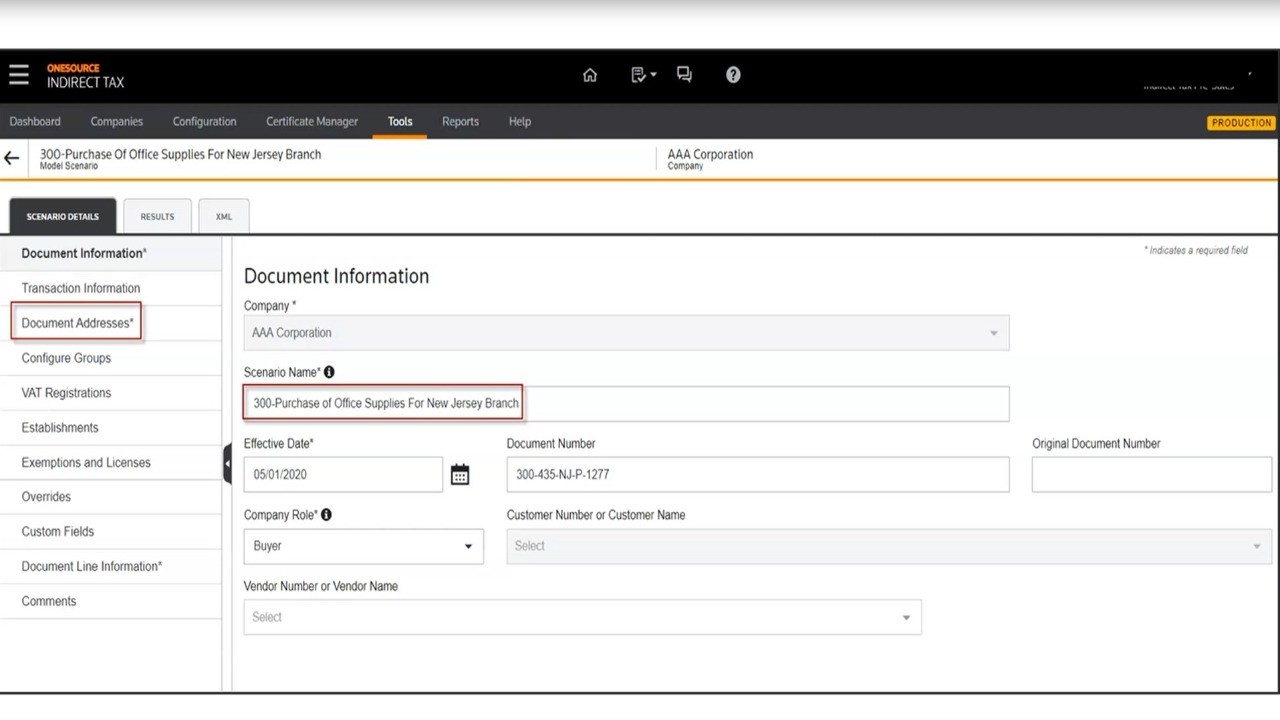

See how it works

Have questions about indirect tax automation? ONESOURCE Determination has answers. Learn how to configure your company structure, set up tax calculation for global jurisdictions, streamline tax returns, and more.