Tax and accounting

Tax preparation workflow solutions

Automate your tax return preparation workflows with enhanced control and heightened visibility for more strategic decision-making and reduced risk in your corporate tax department

Say goodbye to time-consuming tasks and get ahead of tax preparation workflow

Handle tax data consistently and securely with standard calculation methods that streamline state apportionment, from determining taxable income to e-filing.

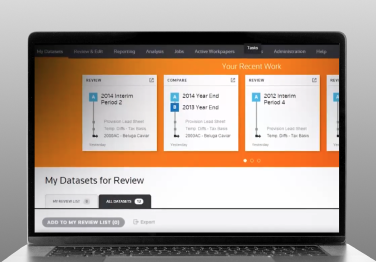

Calculate and track taxable income for multi-state corporations with state tax apportionment software. Streamline tax preparation, audits, and reports and collaborate with teams on a centralized, web-based platform.

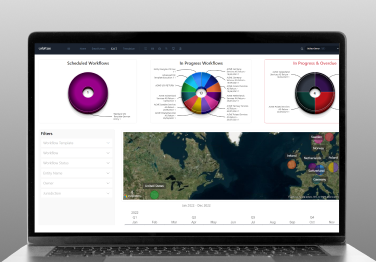

Streamline the tax workflow to produce tax data that's consistent, compliance and ready for submission. Automate manual steps in your workflow, analyze projects at every stage, and easily find information to make quick strategic decisions.

Have confidence in every decision with material tax effects with the international tax calculator. Ensure accurate U.S. international provision calculations, including TCJA GILTI, FDII and BEAT calculations.

Future proof your international tax research and compliance with an international tax workflow software. Automate workflows, adjust with tax code changes, and track progress and share reports with stakeholders.

Discover more about our practice management and growth solutions

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us