International tax workflow automation

Orbitax Executable Actions Tool (E.A.T.)

Why choose Orbitax Executable Actions Tool?

Frequent changes to a company’s geographical footprint bring complex tax implications which organizations must comply with to avoid the risk of penalties and reputational damage. But how do multinational tax departments stay on top of ever-changing tax regulations and avoid messy workflows that are impossible to keep track of manually? The only way to future-proof your company’s tax compliance process is to automate multiple tax relevant workflows and flexibly make adjustments which align with frequent tax rule changes. For stretched tax teams, it’s essential to manage tasks and collaborate with advisors effectively so necessary actions can be implemented and reported in a timely manner.

This is where Orbitax Executable Actions Tool (E.A.T.) changes the game

The analytics dashboard allows you to monitor the progress of your workflows. A visual heat map feature displays any overdue or at-risk tasks with the ability to directly alert stakeholders and bring the workflow back on track.

It builds a layer of intelligent tax optimization workflow into any recurring business process, regardless of complexity. An automated and scalable approach to workflow, E.A.T. reduces reliance upon manual task management and is the solution to cope with ever-changing international tax regulations.

E.A.T. comes preloaded with a series of default templates for typical tax department tasks as well as templates to power all the point solutions built into the Orbitax International Tax Platform.

Example templates include support for tax workflows involving:

- Tracking tax due dates - Notification of tasks due and completion status updates

- Data Collection and calculations for US foreign income calculations, including GILTI, FDII, FTC, Subpart F & GMT

- Generating entity charts and distributing their different views to stakeholders

- Report creation, review, and distribution for Corporate & Withholding tax rates, GILTI, FDII, FTC, Subpart F, DAC6 & MDR, GMT, permanent establishment and anti-avoidance rules for a set of countries, with enacted and proposed tax law changes

What you get with our international tax workflow automation software

Ensure tax workflows are completed correctly and on time with total oversight into task and due date management and the ability to notify stakeholders

Easily review information and share reports with relevant stakeholders and advisors, no matter where they are located and at your chosen frequency

Select templates or design your own customizable workflow steps, which can be easily adjusted to evolve as your company’s requirements change.

Replace manual input across international tax tasks with automated workflows that run independently after a simple drag-and-drop setup process.

Easily upload and share large volumes of complex data across your organization with API connections to other third-party solutions and tax authority e-filing portals

Spot trends and track progress with detailed and customizable visual analytical charts that are available on-demand and easily shared with stakeholders

See Orbitax E.A.T. in action

Due Date Tracker

Allow your tax department to easily automate recurring procedures and assign tasks.

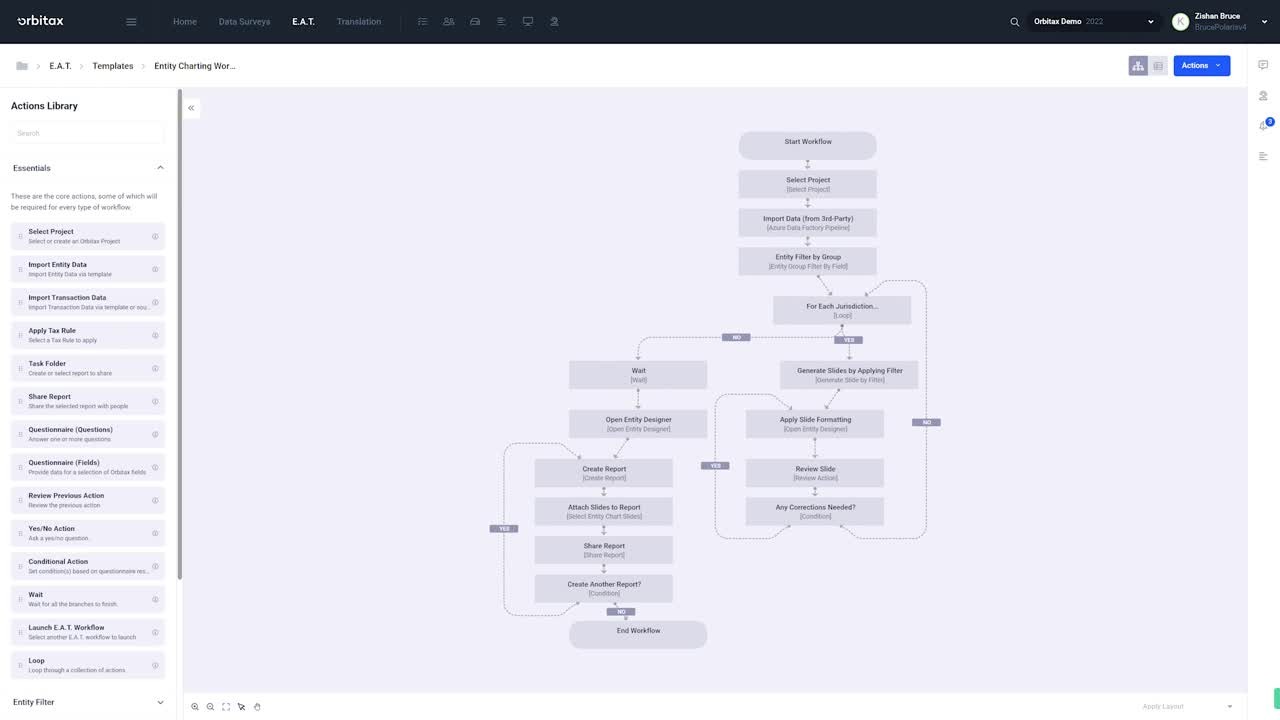

Entity Charting

Optimize your existing workflows tied to the multi-national enterprise footprint.

Ready to start a conversation?

Need more information about how our solutions can work for you? Drop us a line and someone from our sales team will get back to you. Or you can call a representative in your region at +1 800 968 8900.