Tax and accounting

International tax planning and preparation for corporations

Ensure compliance with international tax rules and simplify cross-border transactions for multinational companies

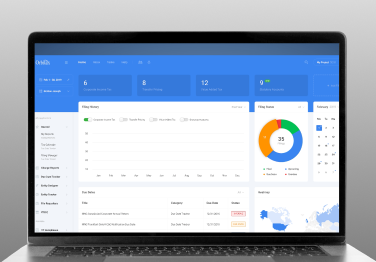

Faster and easier global corporate tax compliance

Stay ahead of constantly changing international tax laws and treaties while streamlining complex international tax calculations and filing processes.

Have complete confidence in every decision with material tax effects with the international tax calculator. Ensure accurate and analyze what-if scenarios under the complexities of the Tax Cuts and Jobs Act’s.

Simplify your nonresident alien tax compliance process with a powerful software solution. Access the most extensive library for nonresident alien tax issues, including a searchable FAQ database.

Simplify research on international tax law and regularly updating regulations to achieve global tax compliance. Save time with easy access to an international tax compliance software and share valuable insights.

Discover more about our tax research and guidance solutions

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us