Tax & accounting research tool

Find the right answer faster with Checkpoint Edge

An accounting and tax research tool powered by AI and machine learning to get targeted search results in less time

Looking for AI that doesn’t just assist—but acts?

Explore CoCounsel, the agentic-AI platform redefining productivity for professionals.

Turn your tax research over to Checkpoint Edge

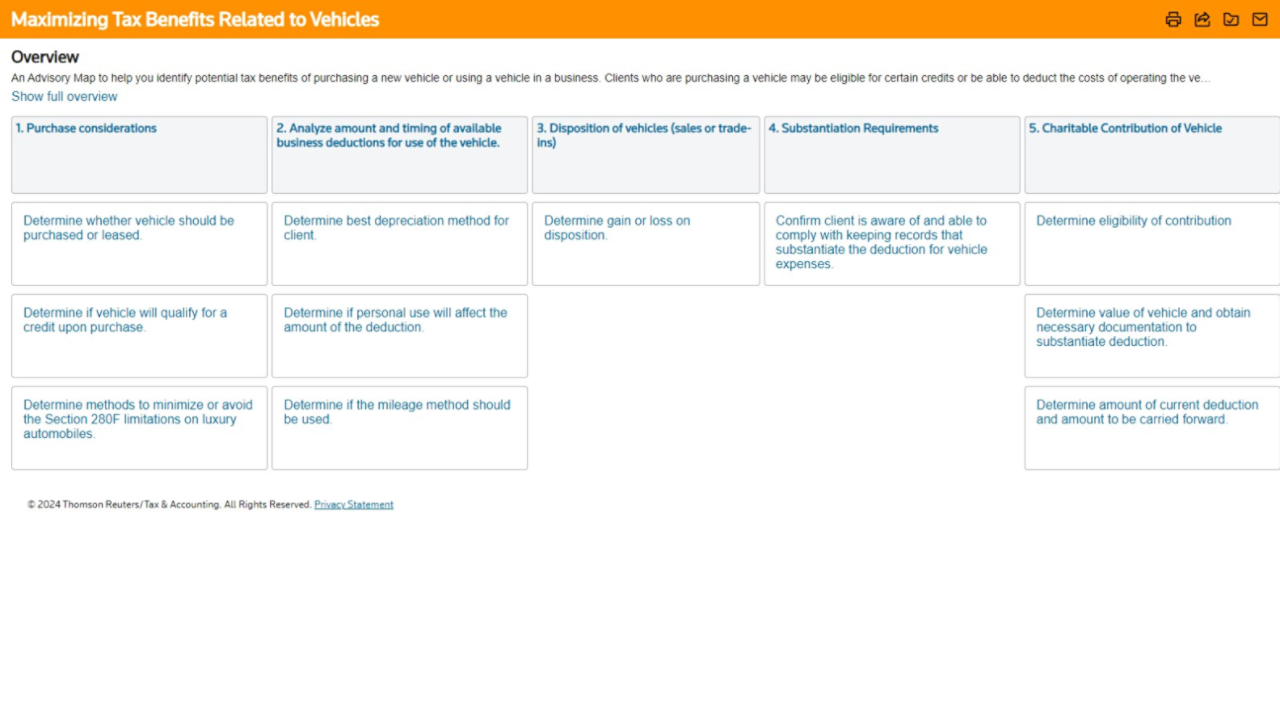

Advisory Maps

Confidently evaluate and determine the best process for delivering specific tax planning and advisory engagements. Planned new release: 2020 Accounting Today Top New Product, Advisory Maps provide step-by-step guidance and information to help you easily work and collaborate on the process.

Explore more features

Have questions?

Contact a representative

Powerful algorithm

Experience Checkpoint Edge, the industry’s most sophisticated AI-powered algorithm, built with larger sources of human-curated data and more diverse sets of features within its machine learning. The typeahead, predictive search feature returns the most targeted results based on full-phrasal, natural-language questions.

Explore more features

Have questions?

Contact a representative

Concept markers

Forward your research momentum with dialogue-based research and get quick, on-point search results with markers. Markers represent related or beneficial concepts in your search; clicking on a marker re-sorts your results to include these chosen concepts.

Explore more features

Have questions?

Contact a representative

State charts

State tax research starts in the charts with Checkpoint Edge. Begin your research with multistate tax comparison charts for quick answers and save valuable time with one-click access to our State Tax Reporters for on-point primary law and editorial explanations.

Explore more features

Have questions?

Contact a representative

The value of Checkpoint Edge

Industry-leading editorial team

- 12 million expert-authored content pieces with integrated primary source documents that are accurate, continuously updated, and offer comprehensive insights you can trust.

- 5,000 combined years of editorial expertise provide reliable and accurate resources to help you navigate the unexpected.

- 680+ highly-qualified editors, outside practitioners, and contributors who have practiced at the world's leading accounting firms, law firms, corporate tax departments, and government agencies.

- Seven on-staff news editors who cover the FASB, SEC, Congress, IRS, and other key regulators are dedicated to keeping you informed as rulemaking happens.

Recognition for a research platform you can rely on

Top New Product for Advisory Maps in Accounting Today's 2024 Top New Products List

Top New Product Award for Smart Research Tools in Accounting Today's 2020 Top New Products List

American Business Awards 2020 Gold Stevie Award

Questions about Checkpoint Edge? We're here to support you.

800-431-9025

Call us or submit your email and a sales representative will contact you within one business day.

Contact us