Tax and accounting

Tax preparation software solutions

Improve tax preparation accuracy and efficiency with automated tax law updates, robust security, and streamlined data management

For tax and accounting firms

Tax workflow and management for small business owners and your accounting teams.

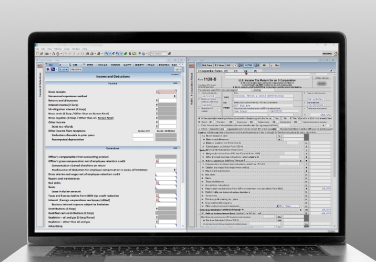

Professional tax software for tax preparers and accountants, including a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

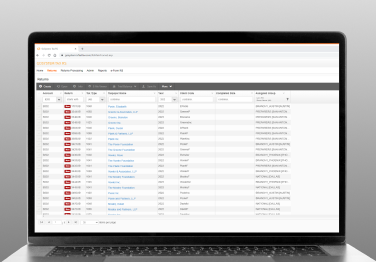

Handle the workflow no matter the size of your firm with industry-leading professional income tax software. Pay less in maintenance costs, face fewer storage issues, and rest easy with business continuance under this online platform.

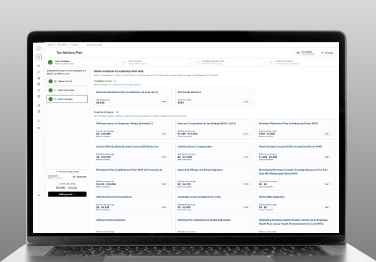

Transform tax compliance work into high-value advisory opportunities with AI-powered strategy identification and guided implementation workflows. Empower staff at all levels to deliver expert tax planning, demonstrate clear value to clients, and create recurring revenue streams.

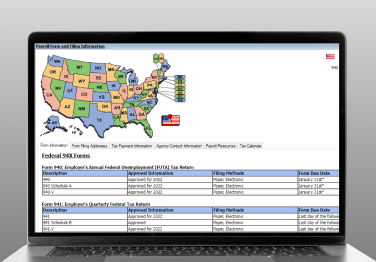

Experience advanced solutions for time entry, paycheck delivery, and more through this payroll software for accountants. Automated features increase accuracy without hiring staff.

Omnichannel tax compliance and management at scale.

File quick and accurate U.S. corporate income tax returns with the most trusted software on the market. Manage every step of the process for federal, state, and international business taxes.

Automate your company's sales and use tax, GST, and VAT compliance and expedite your global indirect tax compliance obligations. Move beyond complicated, country-specific spreadsheets to stay compliant across the globe.

Quickly access on-demand sales and use tax rates through this easy-to-use sales tax software. Identify appropriate product taxability statuses, search sourcing rules, and learn from step-by-step tax guidance.

Have confidence in every decision with material tax effects with the international tax calculator. Ensure accurate U.S. international provision calculations, including TCJA GILTI, FDII and BEAT calculations.

Analyze and report tax treatment of your company’s uncertain tax positions (UTPs). Keep an inventory of UTPs under ASC 740 and IAS 37 and report on them with a full audit trail. Save time with an UTP reporting tool.

Discover more about our tax planning and preparation solutions

For tax and accounting firms

Tax planning

Bring more value to your client relationships and gain the expertise needed to advise clients on everything from new regulations to business expansion.

Tax compliance

Complete more tax returns in less time with a shortened workflow and increased productivity.

Research powered by AI

Tax research tools powered by artificial intelligence and machine learning to get targeted search results in less time.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us