Tax and accounting

Tax compliance solutions

Improve your tax workflow time and data management process

Increase productivity with these tax compliance solutions from Thomson Reuters

Professional tax preparation software with a full line of federal, state, and local tax programs that will boost the efficiency of your organization.

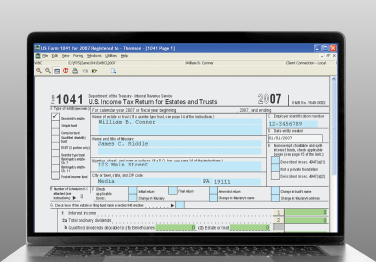

File returns quickly and easily with 1041 income tax software. Experience an automated reporting process for estates and trusts – with real-time calculations as you work.

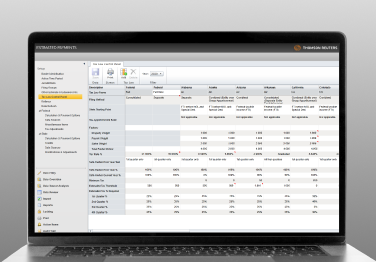

Calculate estimated tax payments with speed and accuracy. Eliminate tedious tasks and streamline estimated payments through automation. Research with a built-in, customizable tax law database.

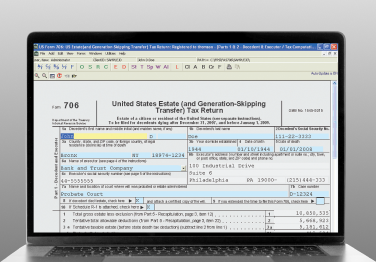

File federal and state returns easily with 706 estate tax software. Choose this simple-to-use program that delivers thorough and accurate returns with real-time calculations as you work.

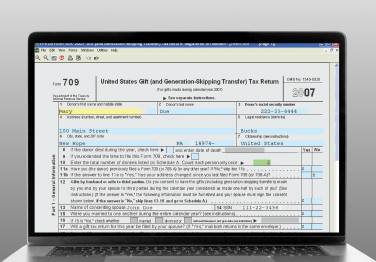

Generate federal returns for trusts and estates with 709 gift tax software. See real-time calculations as you work. Use this module as a standalone product or integrated with the entire suite.

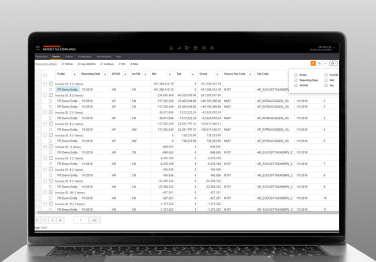

Pull the current and historical reporting data you need, instantly. Implement tax data extraction to support reporting and filing, plus an in-depth picture of your business.

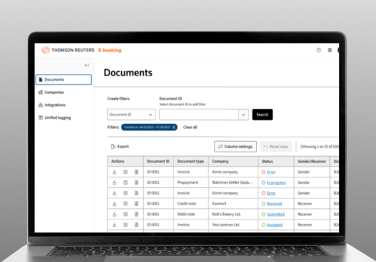

Comply with global e-invoicing mandates by leveraging a fully integrated, electronic invoice compliance solution — one solution spanning the globe, simplifying complexity for tax, e-invoicing, and continuous transaction controls.

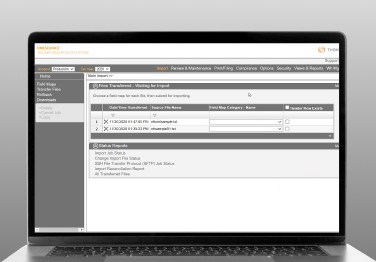

Meet federal and state regulations with e-filing for all U.S. states, Puerto Rico, and Canada. Track withholdings, B-notices, penalty notices, W-8 and W-9 forms, TIN data, and penalty abatements with a tax information reporting software.

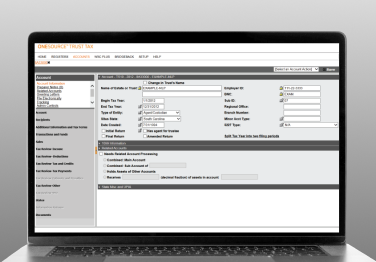

Let administrators and other staff have immediate access to clients’ tax information through this trust tax software. Print K1s, 1099s, and other tax forms and reports.

Meet operational goals and make effective decisions with a fiduciary tax software. Simplify everything from data management, compliance, and filing information in Trust Tax.

Save time by automating B-Notice handling and processing with TIN compliance software. Avoid errors by comparing information in payees’ records and generating deadlines dates.

Automate your company's sales and use tax, GST, and VAT compliance and expedite your global indirect tax compliance obligations. Move beyond complicated, country-specific spreadsheets to stay compliant across the globe.

File quick and accurate U.S. corporate income tax returns with the most trusted software on the market. Manage every step of the process for federal, state, and international business taxes.

Calculate estimated tax payments with speed and accuracy. Eliminate tedious tasks and streamline estimated payments through automation. Research with a built-in, customizable tax law database.

Guide clients through Affordable Care Act (ACA) compliance through this ACA reporting software. Streamline preparation, form distribution, and penalty abatement in one centralized, secure hub.

Stay compliant with a 1095-B software solution that manages the entire tax filing process. Handle the new Affordable Care Act (ACA) tax information reporting and reduce the risk of expensive ACA penalties.

Stay compliant with new Affordable Care Act (ACA) regulations through an intuitive 1095-C software. Large employers can prep, track, and manage all their employees’ forms about the health care coverage and report it to the IRS.

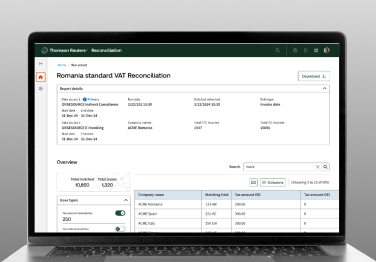

ONESOURCE Reconciliations software automates e-invoice reconciliation, detecting discrepancies, and ensuring full compliance. Request a free demo today.

Discover more about our tax planning and preparation solutions

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us