TAX WORKFLOW

The future of tax automation

How to elevate your firm’s recruiting and retention strategies

56:44

Speakers

Greg Pope

Director, Marketing at Thomson Reuters (Moderator)

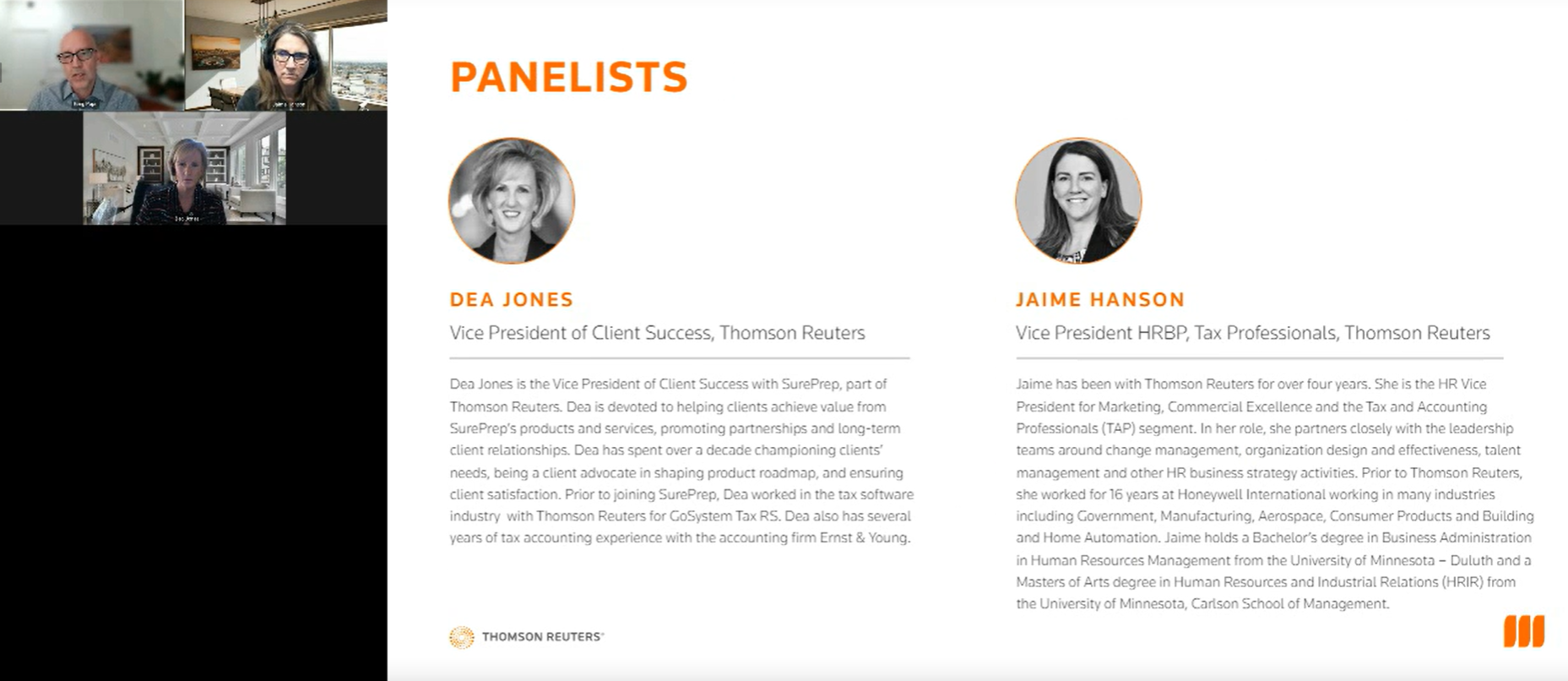

Dea Jones

VP of Client Success, Thomson Reuters

Jaime Hanson

Vice President HRBP, Tax Professionals, Thomson Reuters

Join us as we explore the future of tax automation and gain valuable insight into staying ahead of the curve in recruiting and retention

Finding, developing, and retaining quality talent remains challenging for many tax firms. In this on-demand webcast, discover how automation and technology are transforming the industry and creating new possibilities for firms to elevate their recruitment and retention strategies.

We will discuss:

- The challenges of finding and keeping quality talent.

- How a commitment to automation and technology can help address staffing issues, bridge skill gaps, increase employee satisfaction, and provide personal and professional development opportunities.

- How to help make your firm a more attractive workplace by elevating your standard of work-life balance.

Better tax software with UltraTax CS

Optimize workflow and increase profitability with professional tax software for tax preparers and accountants